Dear Reader,

Nvidia just hit $5 trillion, and they’re not slowing down.

They obliterated AI with chips that power every major model on Earth.

They seized the data center explosion …

Raking in 2,200% revenue growth in that sector alone.

Now?

They’re charging into two seismic tech frontiers projected to be worth over $24 TRILLION!

And they’re racing to dominate first.

But here’s the dirty secret Nvidia won’t admit …

They can’t do it alone.

Nvidia needs three Silent Partners …

Companies so critical …

Nvidia’s latest trillion-dollar pivot hinges on them.

These aren’t household names …

Combined, they’re worth less than 1% of Nvidia’s $5 trillion market cap …

But Nvidia is depending on them.

Look at what’s happened to past Silent Partners after Nvidia began working with them.

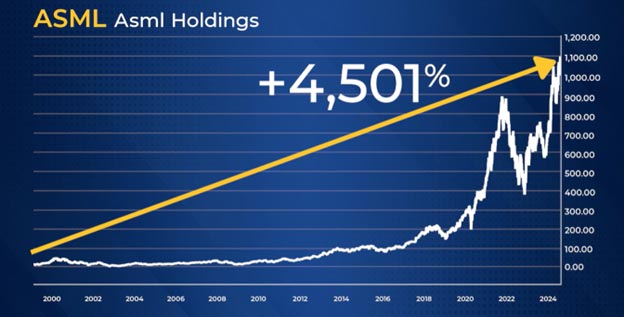

ASML went up 4,501%.

Seagate Technology rose 1,938%.

Synopsys gained 3,745%.

TSMC soared 9,793%.

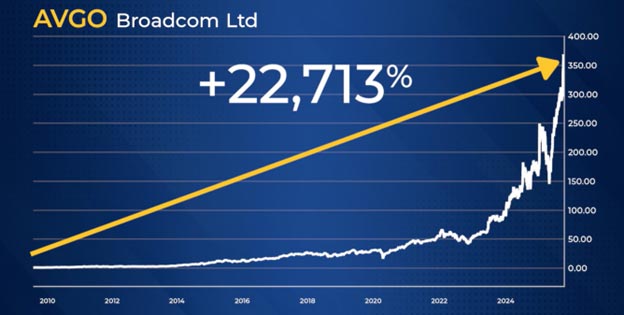

And Broadcom skyrocketed 22,713%.

Yes, 227x!

This wasn’t luck.

These companies are critical …

Often serving as Nvidia’s hidden engines.

Now, three new Silent Partners are stepping into the fire.

Nvidia is betting billions on them.

Wall Street? Clueless.

Even some of the sharpest investors probably don’t know their names.

But I do.

Click below to uncover the three Silent Partners Nvidia needs to conquer the next $24 trillion …

Before the world catches on.Michael Robinson, Editor

Disruptors & Dominators

Wednesday’s Bonus Article

Oil Prices May Fall to $55 by 2026—Bad News for This Energy ETF

Written by Jordan Chussler. Date Posted: 12/9/2025.

What You Need to Know

- The EIA forecasts oil prices will fall over 20% by the end of 2026 due to a sustained global supply surplus.

- The Energy Select Sector SPDR ETF (NYSEARCA: XLE), heavily weighted in ExxonMobil, Chevron, and ConocoPhillips, faces continued underperformance.

- Institutional sentiment is tepid, with high short interest and nearly equal numbers of buyers and sellers over the past year.

After a difficult year for the energy industry, forecasts for the year ahead offer little relief for fossil fuel companies or their shareholders.

According to the U.S. Energy Information Administration (EIA), the industry is facing a supply glut that will carry into 2026. The agency’s short-term forecast, issued last month, expects crude oil prices to finish next year about 20% lower than they are today.

The last gold bull market of our lifetime… (Ad)

A major shift is coming to the gold market — the world’s largest gold buyer is preparing to launch a new way for everyday Americans to invest in gold with a click, and when it goes live in 2026 it could unleash a wave of demand unlike anything we’ve seen. Garrett Goggin believes one $1.60 gold stock is positioned to be a prime beneficiary of this surge — a move where even a small price jump could mean a meaningful gain — along with several other miners set to ride the same trend.Click here to see the $1.60 gold stock and Garrett’s full list of recommendations

That’s particularly bad news for the State Street Energy Select Sector SPDR ETF (NYSEARCA: XLE), which bullish investors had hoped would bounce back in 2026.

Oil’s Bleak 2026 Forecast Means Lower Profits

The energy sector’s uninspiring 7.21% year-to-date (YTD) gain has trailed the broad market, ranking fifth-worst among the S&P 500’s 11 sectors. That follows a 2024 gain of just 5.7% and a 2023 loss of 1.3%.

Zooming out, the highly cyclical energy sector has finished second-to-last or dead last among all sectors seven times in the past 11 years.

When the EIA published its 2026 short-term outlook in November, it indicated the ongoing global surplus is likely to keep prices subdued at least through the first half of 2026, which would in turn pressure oil stocks and exchange-traded funds (ETFs) exposed to the fossil fuel industry.

The price of Brent crude — the benchmark for Europe, Africa, and the Middle East — has fallen more than 16% in 2025. West Texas Intermediate — the U.S. benchmark — has fared worse, down nearly 18% so far this year.

The EIA sees more than 20% downside over the next year, saying it expects “global oil inventories to continue to rise through 2026, putting downward pressure on oil prices in the coming months.”

Compounding matters, the agency’s price target for Brent crude at the end of 2026 is $55 per barrel. That would match a five-year low set in January 2021 and, relative to oil’s June 2022 high of $118.49, represent a nearly 54% decline.

Importantly for investors, the EIA’s 2026 outlook suggests lower crude prices — which are the largest component of retail gasoline and diesel prices — will translate into lower profits for producers and, therefore, smaller returns for shareholders.

The XLE’s Basket of Highly Concentrated Big Oil Stocks

Although the XLE is technically a State Street sector fund, its narrow industry focus and concentrated weightings make it function more like a single-theme ETF.

The XLE, which holds a basket of fossil fuel stocks including the oil majors, is essentially flat over the past year, down 0.04%. At present, there’s little reason to expect a significant shift in performance over the next year.

The fund’s major holdings provide far less diversification than some other sector ETFs. Its singular focus on the oil, gas, and consumable fuels industry has produced extreme concentration: the fund’s top three positions — ExxonMobil (NYSE: XOM), Chevron (NYSE: CVX), and ConocoPhillips (NYSE: COP) — account for an astounding 48.1% of the fund’s allocations. Put another way, nearly half of every dollar invested in the fund is allocated to just three companies.

Over the past year, those three stocks have underperformed relative to their weightings. ExxonMobil has returned 2.73% over that period, while Chevron has lost more than 5% and ConocoPhillips is down nearly 10%.

Some of the XLE’s other holdings have fared better. For example, Williams Companies (NYSE: WMB) and Marathon Petroleum (NYSE: MPC), which round out the top five, have gained nearly 24% and more than 13% over the same period. However, their combined weighting of 8.14% isn’t enough to offset the underperformance of the fund’s top three names.

Wall Street Isn’t Sold on the XLE’s Recovery

Past performance is never indicative of future results, but when you combine the EIA’s 2026 outlook with OPEC+ expecting unchanged demand from 2025 to 2026, more of the same looks likely for oil.

That view is reflected in investor behavior. Over the past 12 months the XLE has seen institutional sellers (1,175) nearly match institutional buyers (1,342).

Meanwhile, current short interest in the fund stands at a significant 12.68% of the float. The ETF’s dividend, which currently yields 6.34% — or $2.88 per share annually — may offer a silver lining to hopeful shareholders.

But given the macro challenges facing the XLE’s largest holdings, even income-focused investors may lose patience with the Big Oil fund.

This email is a sponsored email for Weiss Ratings, a third-party advertiser of MarketBeat. Why was I sent this email content?.

11780 US Highway 1,

Palm Beach Gardens, FL 33408-3080

Would you like to edit your e-mail notification preferences or unsubscribe[/link] from our mailing list?Copyright © 2025 Weiss Ratings. All rights reserved.

If you have questions about your newsletter, feel free to contact MarketBeat’s South Dakota based support team at contact@marketbeat.com.

If you would no longer like to receive promotional emails from MarketBeat advertisers, you can unsubscribe or manage your mailing preferences here.

© 2006-2025 MarketBeat Media, LLC. All rights protected.

345 North Reid Place, Suite 620, Sioux Falls, SD 57103-7078. United States..

Today’s Featured Link: AI Continues to Surge—Here Are 2 Stocks Still Under $15 (Click to Opt-In)