“Once I close for a massive gain, I always check myself to avoid getting greedy and giving it all back on the next trade.”

Nate Bear, Lead Technical Tactician, Monument Traders Alliance

Editor’s Note: Last week, we had a fantastic session with Jon Najarian and Senior Analyst Chris Johnson, and this week Jon is coming back for another event with our own Nate Bear and Ryan Fitzwater.

This free masterclass is a unique opportunity to get FREE trade ideas and perspectives from both a member of the Options Trading Hall of Fame and every day trader who grew his wealth from his home office.

It starts on Wednesday, Jan. 28 at 2 p.m. ETin the MTALive chatroom.

– Stephen Prior, Publisher

Last week was a week.

Between the Greenland situation and the WEF meeting, I was feeling decision fatigue on Friday.

As a trader, when mental power starts slowing down, you have to keep your wits.

Patience becomes key.

And one of the lotto setups I was waiting on was Carvana (CVNA).

The chart looked incredible.

It was nearing all-time highs at $485 with an A+ squeeze.

Given this momentum potential, I took out a lotto trade and 1 butterfly trade targeting $500 on Thursday.

I paid .39 for this butterfly trade on CVNA.

By the end of the trading day, it was closing at $2.13.

So I closed the first lotto for a 400% gain, but I wasn’t done yet.

Although the lotto was closed, I held on to the butterfly trade for a few reasons…

One, I thought CVNA had more room to run.

Two, given that CVNA options were super cheap the next day, I could capture that continued momentum without as much risk.

All I needed was a little push into all-time highs.

So I added to the lotto on Friday.

Then in less than 1 hour, that momentum shift came.

CVNA moved up into all-time highs, and I closed the lotto trade for a 370% winner.

All together – we captured nearly a 1000% gain on CVNA – all in less than 2 trading days.

Freaking awesome.

That’s the power of using patience and building on a lotto trade for a massive gain.

The one thing I caution traders is once you capture that massive gain – there’s a temptation to get back in on a quick dip and try to ride it for more.

Don’t do it.

I can’t tell you the number of times I’ve made a big gain on an options trade only to give it all back by thinking it’ll keep going higher.

Once I get the move into all-time highs, I close the trade and avoid trading that name for the rest of the day (usually).

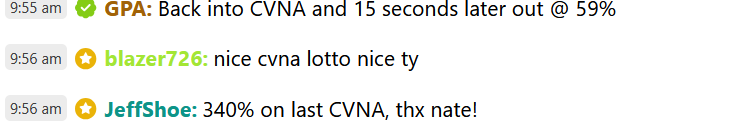

Here’s what a few Daily Profits Live members had to say about the trade.

Carvana has the potential to keep running, so I’ll be looking to position via spreads in this week and next week in Daily Profits Live.

SPONSORED

Elon Musk’s Final Project REVEALED

It’s a secret project … bigger than Tesla … bigger than SpaceX … and bigger than Twitter.

Inside this warehouse in Memphis Tennessee…

Lies a new technology that is 100,000 times more powerful than Nvidia’s most advanced AI chip.

Nvidia’s CEO is even considering investing in this project directly.

Get the full details on Elon’s secret new AI project now.

Action Plan: If you want to see more charts I’m targeting, I’ll be joining CNBC/Fox Business superstar trader Jon Najarian on Wednesday for a special Unusually Bullish Charts: Technical Analysis Masterclass.

We’ll be going over our TOP 6 Favorite stock charts we’re watching.

The event is completely free.

SPONSORED

Crazy New Tech Stuns Scientists with World Record

A groundbreaking new tech just fully charged a laptop from 1% to 100%… in a world record NINE minutes.

Here’s why the tiny company that patented this tech could become the #1 stock by next year.![]()

Monument Traders Alliance, LLC

You are receiving this email because you subscribed to Trade of the Day Wake-Up Watchlist.

To unsubscribe from Trade of the Day Wake-Up Watchlist, click here.

Questions? Check out our FAQs. Trying to reach us? Contact us here.

Please do not reply to this email as it goes to an unmonitored inbox.

To cancel by mail or for any other subscription issues, write us at:

Trade of the Day | 14 West Mount Vernon Place | Baltimore, MD 21201

North America: 800.507.1399 | International: +1.443.353.4977

Website | Privacy Policy

Keep the emails you value from falling into your spam folder. Whitelist Trade of the Day.

© 2026 Monument Traders Alliance, LLC | All Rights Reserved

Nothing published by Monument Traders Alliance should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by Monument Traders Alliance should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Monument Traders Alliance, LLC, 14 West Mount Vernon Place, Baltimore, MD 21201.

REF: 000142349377