EARN WHILE YOU LEARN! JOIN OUR FREE LIVE TRADING SESSION!

Hello Peter Anthony Hovis,

The Changing of the Guard

The air in the financial districts turned heavy today as a months-long game of political musical chairs appeared to reach its crescendo.

Investors, who had spent the better part of the year trying to decipher the future of U.S. monetary policy, found themselves reacting to a sudden shift in the winds blowing from the White House.

The day began with a flurry of speculation that Kevin Warsh, a former Federal Reserve governor known for his historically disciplined stance on inflation, had become the frontrunner to succeed Jerome Powell.

This wasn’t just idle chatter; the rumor mill kicked into high gear following reports that Warsh had visited the White House on Thursday.

Kevin Warsh (Photo: Tierney L. Cross/Bloomberg)

As the news spread, the bond market—the often-sober sibling to the more excitable stock market—suffered a sudden bout of nerves.

Treasury yields pushed higher as traders began to price in the possibility of a “Warsh Fed.” While President Trump has openly signaled his desire for a leader who will cut rates “further and faster,” the market’s memory of Warsh is one of a hawk who prioritizes policy discipline over easy money. Sean Callow, a senior analyst at ITC Markets, summed up the tension perfectly, noting that whatever may be said now, Warsh has a long hawkish history that markets haven’t forgotten, which pushed the dollar and yields upward.

The equity markets didn’t escape the turbulence.

The S&P 500 and the tech-heavy Nasdaq were already under pressure following a disappointing earnings signal from Microsoft, which suffered its worst drop in years. The added uncertainty of a leadership transition at the world’s most powerful central bank provided little comfort. President Trump, speaking at a premiere for the documentary “Melania,” confirmed he would make his formal announcement on Friday morning.

The weight of that looming decision felt palpable across trading floors, especially as betting markets like Polymarket saw the odds of a Warsh nomination leap to over 85%.

In the world of alternative assets, the narrative of “digital gold” faced a brutal reality check.

While traditional gold reached staggering heights near $5,600 earlier in the day before experiencing a “flash crash” and settling lower, Bitcoin suffered a far more consistent rout. The leading cryptocurrency slumped to fresh two-month lows, sliding toward $81,000.

For many, the breakdown in Bitcoin’s correlation with gold during a period of geopolitical upheaval was telling. Alex Kuptsikevich, chief market analyst at FxPro, observed that cryptocurrencies no longer appeared to be the alternative to fiat money or the hedge they were once claimed to be.

As the sun set on today’s session, the financial world remained in a defensive crouch, waiting for the President’s Friday morning reveal.

The shift in sentiment was underscored by $4.8 billion in outflows from Bitcoin ETFs over the last three months, a streak that suggests the appetite for high-risk “digital havens” is being eclipsed by a return to traditional safety—or simply the safety of cash.

With liquidity expected to be lower over the weekend, analysts like Adam McCarthy at Kaiko are warning that the slide could continue, with a break below $80,000 looking increasingly likely if the bearish mood persists.

The Digital Backbone of China’s Industrial Heartland

Today’s Stock Pick: Full Truck Alliance (YMM)

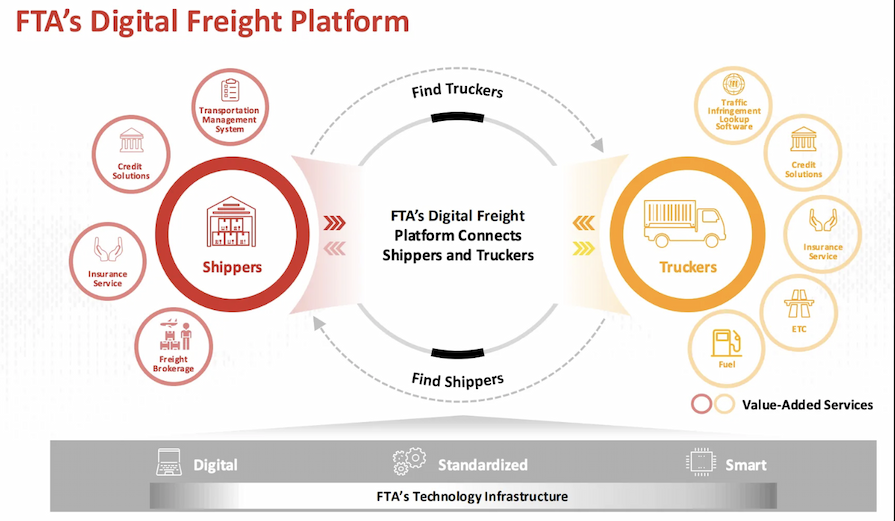

In the sprawling industrial heartland of China, where over 30 million trucks crisscross highways carrying everything from fresh produce to factory components, Full Truck Alliance is powering the marketplace.

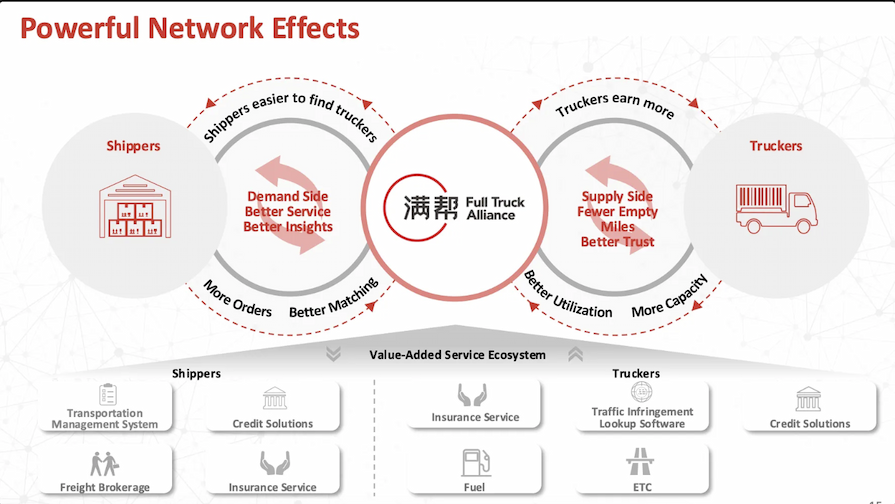

It is the digital freight platform that connects shippers with truckers to keep the logistics industry humming.

(Source: Full Truck Alliance)

Besides matching orders, truckers can buy fuel, purchase trucks, secure insurance, and even access credit without ever leaving the app. Gas station operators pay to be featured. Truck manufacturers get sales leads. Highway toll operators tap into the network. Each of these revenue streams compounds the platform’s profitability while deepening user lock-in.

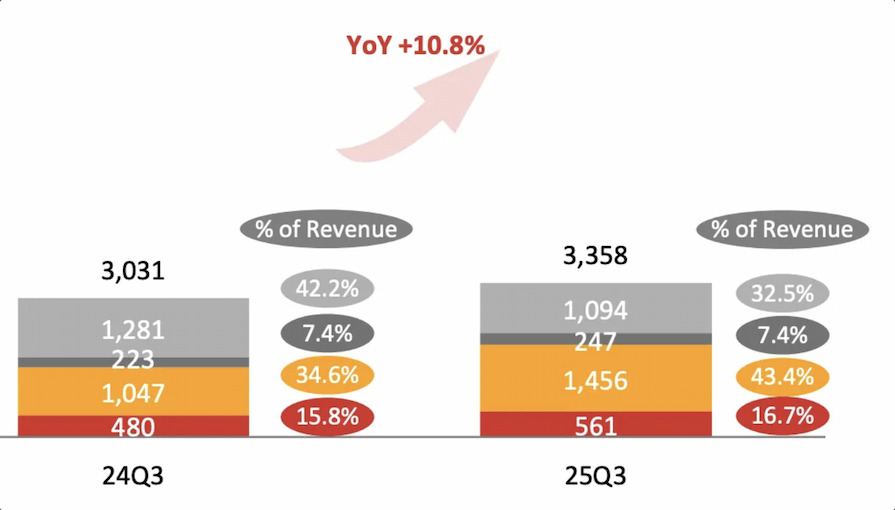

(Source: Bloomberg)

The business was good in the second quarter. Revenue climbed 10.8% year-over-year to RMB 3.36 billion (roughly $450 million), while net income surged 64.2%.

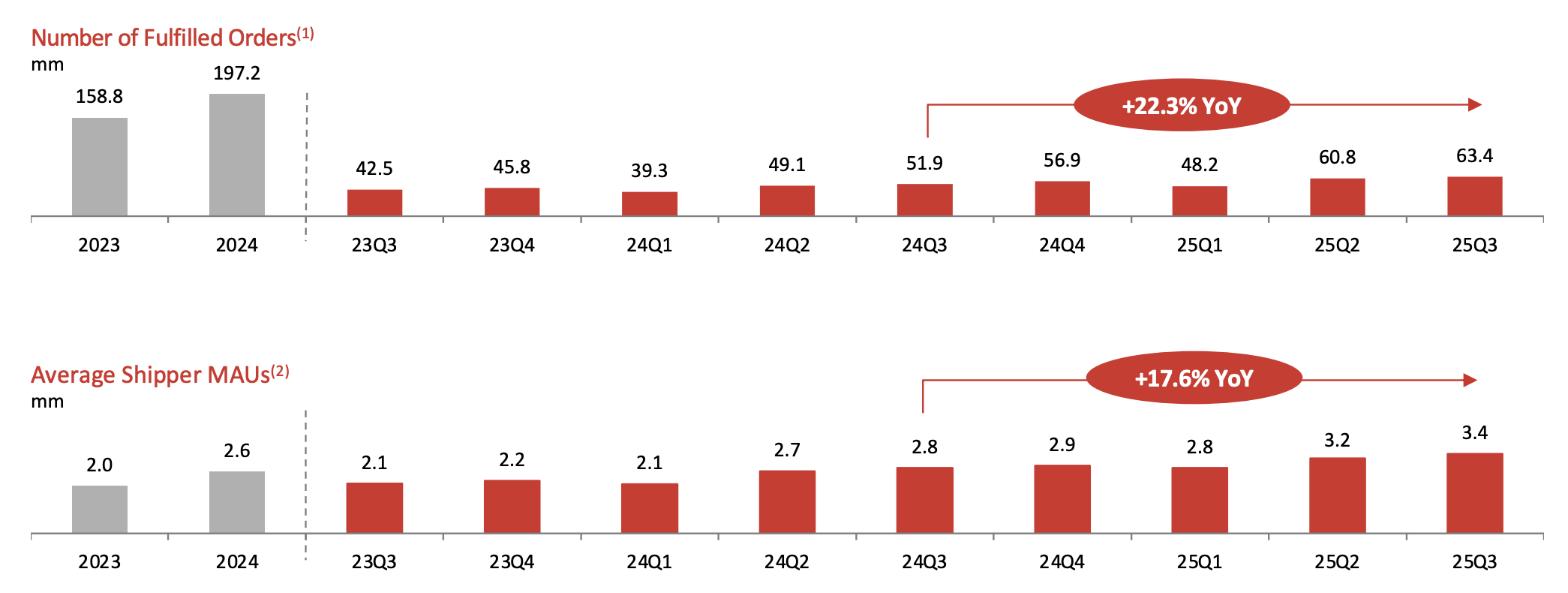

(Source: Full Truck Alliance)

The platform is large and growing: Full Truck Alliance is a big player. Just look at the second quarter’s volume numbers. An average of 3.16 million shippers posted orders on the FTA platform each month, matched with 4.34 million active truckers who fulfilled shipping orders over the trailing twelve months.

All in all, the platform facilitated 60.8 million fulfilled orders during the quarter alone, representing a 22.3% jump from the previous year.

(Source: Full Truck Alliance)

However, this is NOT just about volume.

It’s about network effects, which is a classic Silicon Valley playbook.

As more shippers join the platform seeking trucks, more truckers sign up seeking loads. As the trucker base expands, the platform becomes even more attractive to shippers who need reliable, quick matches.

It’s a virtuous cycle that’s extraordinarily difficult for competitors to replicate.

(Source: Full Truck Alliance)

More importantly, some estimates suggest Full Truck Alliance controls approximately 60% of the digital freight matching market in China.In a country where the road transportation market was worth an estimated $1.5 trillion in 2023, even a modest slice represents enormous opportunity.Best of all, the company’s gross profit margins hover near 90%, a testament to the capital-light nature of the business model. Unlike traditional logistics companies weighed down by trucks, warehouses, and fuel costs, Full Truck Alliance simply facilitates matches and takes a cut. It may create a strong operating leverage for the company.Bottom line: Full Truck Alliance is trading at a forward P/E ratio around 14. The valuation is solid when we consider that analysts have set average price targets around $10 per share.

EARN WHILE YOU LEARN! JOIN OUR FREE LIVE TRADING SESSION!

© All Rights Reserved, Trade Alliance