The Cuban foreign minister is visiting Moscow on Wednesday as the island faces blackouts and severe fuel shortages worsened by a U.S oil embargo.

— Read on apnews.com/article/russia-cuba-putin-rodriguez-lavrov-oil-embargo-80ed0a0ae6c50935e90f56feb15f7291

Author Archives: RJ Hamster

The RJ Hamster morning Show

The RJ Hamster morning Show

The RJ Hamster morning Show

The RJ Hamster Morning Show

The RJ Hamster Morning Show

The RJ Hamster morning Show

The RJ Hamster morning Show

Guthrie Person of Interest; 6 Unredacted Epstein Names; GOP: Probe Bad Bunny Show

Breaking News from Newsmax.com

• Person Detained in Nancy Guthrie Abduction Case

Special: Wall Street’s ‘Fear Gauge’ Is Soaring

• Khanna Reveals 6 Names Unredacted in Epstein Files

• Republicans Seek Probe of Bad Bunny Halftime Show

SPONSOR

Wall Street’s “Fear Gauge” Is Soaring

WSJ MarketWatch: U.S. Stocks Down Sharply On AI Jitters… Wall Street’s “Fear Gauge” Is Soaring

02/05/2026

The S&P 500 is currently negative for the year

Today’s losses wiped away the S&P 500’s gains for 2026. The index is currently down about 0.5% this year to date.

If this level holds through market close, it will be the second time the S&P 500 has dipped into the red for 2026, with the first-time being Jan. 20.

Market volatility has been elevated recently, with the Cboe Volatility Index jumping to almost 23 today.

Ben Fulton, the chief executive of WEBs Investments, said that this volatility could be here to stay for the near term, and that investors should be paying attention.

** Information contained within this email should not be construed as Legal, Accounting, Tax or Investment advice. Patriot Gold Group is a Gold & Silver Dealer, representatives are NOT Licensed Financial Planners and do NOT give investing or tax advice.THE BEST OFFER IN PRECIOUS METALS INVESTING! Request Your FREE Report Is The Perfect Guide For Americans Looking To Precious Metals As Inflation Soars. Patriot Gold Group is America’s #1 Gold IRA Specialist. Ready to Learn Why Gold and Silver Typically Surges During High Inflation and Market Volatility?Call: 1-888-309-9181Get Free New Buyer’s Guide

It’s Not Too Late To Take Advantage Of Our Exclusive ‘Recession Protection’ Gold And Silver IRA Offer.Call Patriot Gold Group at 888-309-9181 to Request Your Free Stagflation Protection Precious Metals Investor Guide

Learn Why Americans Investing in Precious Metals Historically Have Not Feared Inflation. Patriot Gold Group is America’s #1 Precious Metals IRA Specialist. or Call the Patriot Gold Group at 888-309-9181

BMO Bullish Scenario Sees Gold At $8,650 And Silver At $220 By 2027

01/27/2026

Surging momentum in gold and silver reflects a shifting order in the global marketplace, as uncertainty over the future of government balance sheets and fiat currency resilience dominates investor sentiment, according to one Canadian bank.

In their latest precious metals note, commodity analysts at BMO Capital Markets embarked on a bullish thought experiment, examining the current drivers for gold and what they mean for prices through the rest of the year.

The analysts note that gold’s push above $5,000 an ounce in the first month of the year puts prices above their first-quarter forecasts from December.

“The world has changed. A call on gold and precious metals is a call on the future state of the world and the nature of the transition that gets us there,” the analysts said. “This calls us to consider bull case scenario for prices over the years in which a new world order is established, with potentially two more dominant spheres of influence, where nations in between are pushed to choose sides.”

While gold has been driven to new all-time highs as investors once again embrace the “Sell America” trade, with the U.S. dollar and bond market struggling, BMO analysts noted that this is a global issue supporting broad-based demand for gold.

“Last week saw a huge sell-off Japanese bonds with accompanying dramatic swings in the yen, further raising concerns about traditional safe haven assets,” the analysts said. “For this bull case scenario, we stretch our model input assumptions to reflect a world where investors of all forms continue to add gold at a rate similar to, or even above, the rate seen over the first year of Trump’s second term. If we assume average quarterly central bank purchases of ~8Moz, quarterly ETF flows of ~4-5Moz, and ongoing erosion in real yields and the US dollar, this brings us to a bull case scenario for gold prices of ~$6,350/oz by Q4 2026 and ~$8,650/oz by Q4 2027.”

While BMO sees potential for higher gold prices, the analysts have not yet officially adjusted their December price forecasts. They said the current problem in the gold market is that forecast models are outdated, as the global order and financial system may be undergoing a scale of disruption not seen since after WWII.

BMO analysts are also shifting their assumptions regarding other precious metals. Silver’s solid move above $100 an ounce has pushed the gold-silver ratio to fresh multi-year lows below 50 points.

In December, BMO was expecting gold to outperform silver because of its role as a safe-haven monetary asset; however, the analysts now see a scenario where silver could continue to outshine the yellow metal.

“This would capture a scenario where this new global risk environment further ignites safe haven status in the non-gold precious metals too, amplified by retail participation, even though these metals have traditionally been more governed by their industrial metal characteristics,” the analysts said.

“As an anchor point for a bull case, we could assume that the gold:silver ratio occupies the ~40-50 mark (the bottom end of 30-year range) for a more extended period of time, suggesting silver prices of ~$160/oz by Q4 2026 and ~$220/oz by Q4 2027.”

** Information contained within this email should not be construed as Legal, Accounting, Tax or Investment advice. Patriot Gold Group is a Gold & Silver Dealer, representatives are NOT Licensed Financial Planners and do NOT give investing or tax advice.Our Popular Investment Guide Will Show You How To Fortify Your Retirement in Physical Gold; Silver and Pay No Fees for the Life of Your Precious Metals Self Directed IRACall: 1-888-309-9181Get Free New Buyer’s Guide

About Patriot Gold Group CEO Jack Hanney

Jack Hanney is the CEO & Co-Founder of Patriot Gold Group, and a nationally sought after financial speaker and guest. Recently featured on Fox Los Angeles “Good Day LA”, he was interviewed on his insights on the global health crisis and its impact on the economy, and he accurately predicted the catastrophic 17% pullback we saw last week. His interview can be viewed here: Fox Interview

Jack Hanney is the CEO & Co-Founder of Patriot Gold Group, and a nationally sought after financial speaker and guest. Recently featured on Fox Los Angeles “Good Day LA”, he was interviewed on his insights on the global health crisis and its impact on the economy, and he accurately predicted the catastrophic 17% pullback we saw last week. His interview can be viewed here: Fox Interview

Learn Why Smart Money is Moving to Precious Metals in Today’s Market

**Information contained within this email should not be construed as Legal, Accounting, Tax or Investment advice. Patriot Gold Group is a Gold & Silver Dealer, representatives are NOT Licensed Financial Planners and do NOT give investing or tax advice. Learn How To Protect Your Retirement in Physical Gold & Silver and Pay No Fees for the Life of Your Precious Metals Self Directed IRACall: 1-888-309-9181Get Free New Buyer’s GuideFinally: All investment guide requests are automatically offered free of charge, with my personal video newsletter, The Hanney Report, found on Youtube.com. See my news interview on Fox here:Call: 1-888-309-9181Get Free New Buyer’s GuidePGG is not providing investment, legal or tax advice. The reports provided are for general information purposes only. Please consult a qualified tax professional for strategies. “All investments carry some degree of risk. Stocks, bonds, [precious metals, crypto currencies], mutual funds and exchange-traded funds can lose value if market conditions sour. Even conservative, insured investments, such as certificates of deposit (CDs) issued by a bank or credit union, come with inflation risk. That is, they may not earn enough over time to keep pace with the increasing cost of living.” (FINRA 11/2022)© 2026 Patriot Gold Group. All rights reserved.

This email is never sent unsolicited. You have received this Newsmax email because you subscribed to it or someone forwarded it to you. To opt out, see the links below.

Remove your email address from our list or modify your profile. We respect your right to privacy. View our policy.

This email was sent by:

Newsmax.com

362 N. Haverhill Road

West Palm Beach, FL 33415 USA

DM919584

0105044kruh3

When Hand Numbness Signals Something More; Person Detained in Connection to Nancy Guthrie’s Disappearance

February 11, 2026

WORDS OF WISDOM “The second half of a man’s life is made up of nothing but the habits he has acquired during the first half.” — Fyodor Dostoyevsky, “The Possessed”

🎧 Prefer to listen? Get the podcast. TOP STORIES When Hand Numbness Signals Something More

Hand numbness often isn’t a hand problem—it usually comes from…

One Dollar for Six Months. Two Days Only.

In a world where partisan and biased reporting has become commonplace, you can always count on The Epoch Times for a refreshing dose of factual, honest journalism without spin. When you don’t feel like reading the news, pick up a daily tip from us. From how to make honey-fermented garlic for a healthier gut to what elevated vitamin B12 levels might say about your body, our health coverage is deep and extensive. You will find your kind of healthy changes to make right away. Yet what makes you truly love The Epoch Times may be none of the above. It is our talks on art, culture, and history that move hearts. At nighttime or on an indolent Sunday afternoon, find yourself indulging in a fascinating read on stories you have been longing for: a trip to the Allegheny Mountains for America’s oldest retreat for healing; see the restoration of the Sistine Chapel where Michelangelo’s true colors were revealed; a young lady struggling to find peace after the loss of her father finally found healing—through a hawk… The list is endless. The inspiration is infinite.

Subscribe to The Epoch Times with our Flash Sale Rate

: $1 for a full 6 months. Seize the day. Subscribe Now

Person Detained in Connection to Nancy Guthrie’s Disappearance

10 Dead, Including Suspect, After Active School Shooting Incident in BC

Walz Optimistic Federal Immigration Crackdown in Minnesota to End Within Days

FDA Refuses to Review Moderna’s Application of Experimental Flu Shot

Democratic Governors Threaten Boycott of White House Gathering PREMIUM

‘They Shouldn’t Be a Political Prop’: Parents Raise Concerns Over Student Anti-ICE Walkouts INSPIRED

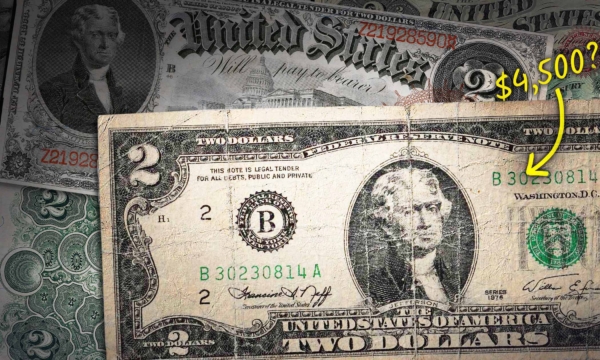

This $2 Bill in Your Pocket Could Be Worth Way More—Over $4,000 More—Than Face Value EPOCH TV

3 Years After East Palestine Train Derailment, NIH Gives $10 Million to Study Health Effects OPINION JEFF MINICK ‘Of Those to Whom Much Is Given, Much Is Required’: Is This What’s Missing in America? MOLLIE ENGELHART Stop Asking How to Make Regenerative Food Cheap EPOCH FUN Freecell SolitaireArrange cards by suit in ascending order to win.PLAYSpot the DifferenceFind the differences between 2 images.PLAYWord WipeCreate words to eliminate tiles.PLAY

Share this email with a friend.

Received this email from a friend?

Trouble viewing this email?

View in browser Copyright © 2026 The Epoch Times, All rights reserved. The Epoch Times. 229 W. 28 St. Fl. 7 New York, NY 10001 | Contact Us * When sharing an article, giftaccess@TheEpochTimes.com is added to the list of recipients. If your friend is not already a subscriber, we will send them a special link for free access to the article.

Our Morning Brief newsletter is one of the best ways to receive the most up-to-date information. Manage your email preferences hereor unsubscribe from Morning Brief here.