EARN WHILE YOU LEARN! JOIN OUR FREE LIVE TRADING SESSION!

Hello Peter Anthony Hovis,

The Great Migration: Wall Street Swaps Big Tech for Broader Growth

The story of today’s trading session was not one of total retreat, but of a calculated migration. As the closing bell echoed across Wall Street, the narrative was clear: the “all-weather” tech giants are no longer the only game in town.

Once again, investors spent yesterday’s trading session aggressively rotating capital out of the mega-cap technology stars and into a broader, more diverse landscape of companies poised to catch the tailwinds of improving economic growth.

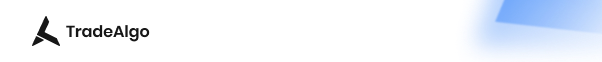

While the Nasdaq 100 endured a sharp 1.8% slide (its steepest two-day rout since last October), the broader market showed a resilient, hidden strength. Under the surface of a mildly lower S&P 500, which fell 0.5%, the majority of individual shares actually trended upward.

It was a huge signal of a healthy broadening of market leadership.

The day’s center stage belonged to Alphabet, which delivered a financial blockbuster that simultaneously wowed and worried the Street.

The Google parent shattered expectations by reporting fourth-quarter revenue of $97.23 billion, comfortably ahead of the $95.2 billion analysts had penciled in. The engine behind this growth was a surge in Google Cloud revenue, which hit $17.7 billion, and an “expansionary moment” in search driven by generative AI.

(Photo: Camille Cohen | Afp | Getty Images)

However, the price of staying at the top is steep; Alphabet revealed a staggering capital expenditure plan of up to $185 billion for the year to build out the necessary AI infrastructure.

- “We’re seeing our AI investments and infrastructure drive revenue and growth across the board,” remarked CEO Sundar Pichai. “Search saw more usage than ever before, with AI continuing to drive an expansionary moment.”

Despite the stellar numbers, Alphabet’s shares initially tumbled over 7.5% in after-market trading as investors grappled with the sheer scale of the spending required to fend off rivals like OpenAI.

This anxiety bled into the broader software sector, which has been “decimated” recently by fears that AI will cannibalize traditional business models. The iShares Expanded Tech-Software Sector ETF slid 1.8% yesterday, bringing its total decline to over 25% since its October peak.

The semiconductor space proved to be the most volatile theater of the day.

Arm Holdings Plc saw its shares crater by more than 8% after a disappointing sales forecast for the upcoming quarter. While Arm’s current royalty revenue hit a record $737 million thanks to its pivot toward data centers, the ghost of a slowing smartphone market continues to haunt its outlook.

Licensing revenue—a key indicator of future demand—fell short of projections at $505 million, fueling concerns that the mobile-heavy past is still tethering the company’s AI-heavy future.

The pessimism was infectious.

Advanced Micro Devices suffered its worst rout in nearly nine years, plunging 17% on a forecast that failed to satisfy high-flying expectations. Even Qualcomm, despite beating earnings with a record $12.25 billion in revenue, offered a tepid forecast that underscored a “shaky” phone market.

- “Software stocks are being decimated as worries permeate over whether AI will cannibalize their businesses,” noted Bret Kenwell at eToro.

- “Right now, investors are not asking themselves where the value is. Instead, they’re throwing out all software stocks—even as many top firms within this space are doing just fine.”

Bret Kenwell at eToro (Photo: CoinDesk)

Beyond the tech volatility, the broader economic and geopolitical picture offered moments of calm. Oil prices ticked higher amidst conflicting reports on U.S.-Iran nuclear talks, which briefly hit a snag before appearing to get back on track. This development helped stocks pare their earlier, deeper losses.

On the domestic front, U.S. service providers reported their strongest back-to-back growth since 2024, a “Goldilocks” signal suggesting the economy remains solid despite a cooling labor market.

The day ended with a clear message: the market is not breaking, it is rebalancing.

As quantitative momentum strategies took a 3.7% hit and Bitcoin slumped 4.6% to $72,627, the “equal-weighted” S&P 500 actually rose 0.9%. This shift from tech-heavy concentration toward financials, healthcare, and small caps suggests that while the AI hype is being “priced more carefully,” the underlying economic engine is still humming.

- “This is a rotation, not a rupture,” concluded Mark Hackett at Nationwide. “Seeing that shift near record highs highlights the market’s underlying strength.”

At the same time, the Nasdaq 100 recently breached a key technical level of the 100-da moving average. It has served as the support line for the last three dips. Investors will watch if it breaks down further or not.

(Source: Bloomberg)

The Free Cash Flow Machine Hitting a 24-Quarter Streak

Today’s Stock Pick: CNX Resources Corporation (CNX)

CNX Resources has been around for over 160 years, but today they operate as a pure-play natural gas company.

What they actually do is pull gas out of the ground from the Marcellus and Utica shales—two of the biggest gas fields in the world—and then use their own massive network of pipelines and processing plants to move that gas to market.

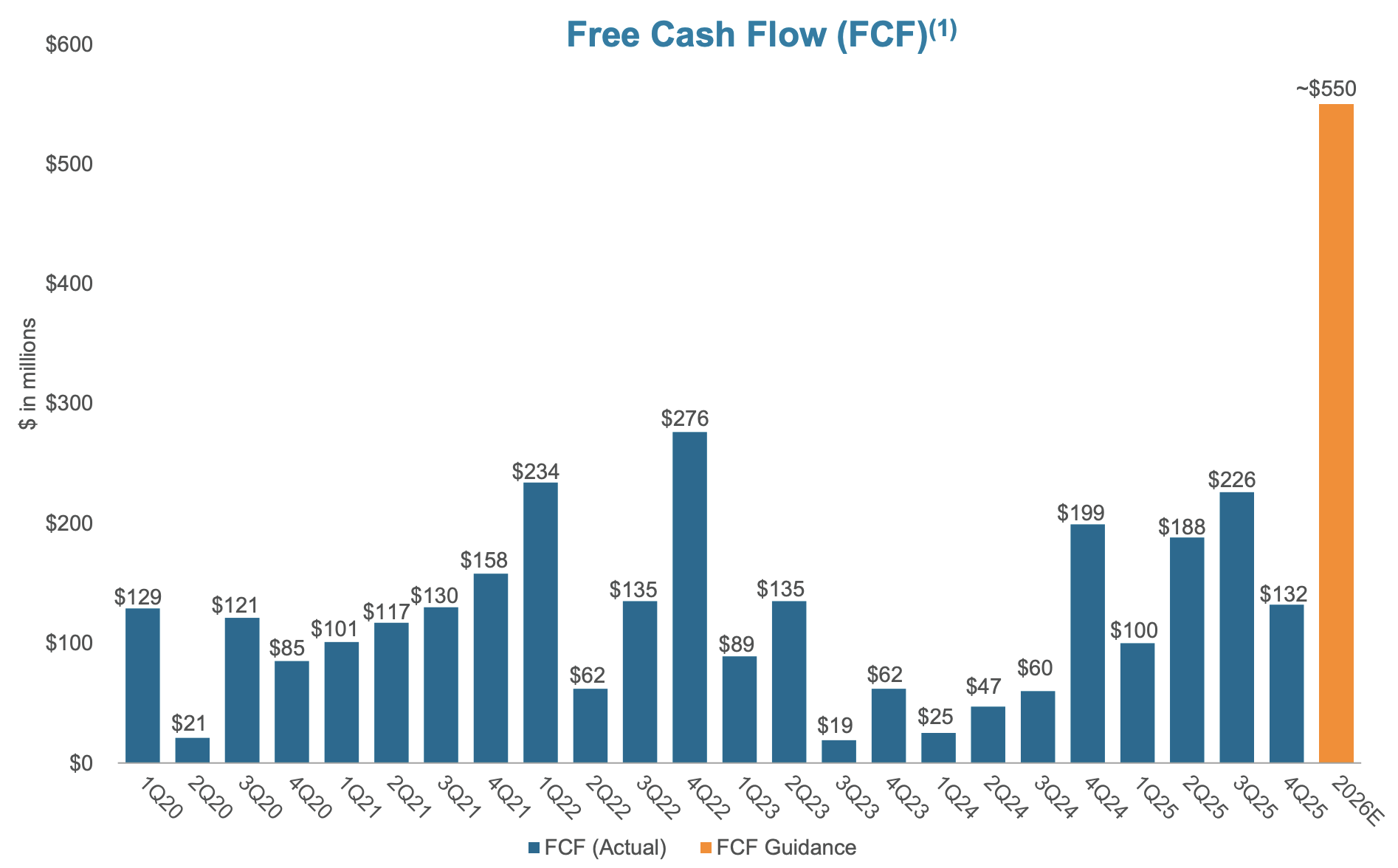

CNX has built a bit of a reputation for being obsessed with “free cash flow” and “per-share value.”

(Source: Paul J. Gough/PBT)

Instead of just drilling as many wells as possible to grow for growth’s sake, they focus on being the low-cost leader in their region. They’ve managed to string together 24 consecutive quarters of positive free cash flow as of early 2026, which is a massive feat in a commodity business where prices can be all over the place.

Sure enough, the company is a Free Cash Flow beast. How much are we talking about? The company expects to a whopping 11% in FCF yield this year! And it has a share repurchase authorization that would be capable of buying about 45% of its current market cap.

- “The fourth quarter represented our 24th consecutive quarter of free cash flow generation, highlighting our Sustainable Business Model and consistent execution that are the cornerstones of growing our long-term per share value,” commented Alan Shepard, President & CEO.

- “We continue to believe that our share repurchase program represents a compelling capital allocation opportunity, and as such, we are announcing an additional $2 billion share repurchase authorization, with no expiration. This new authorization increases our total authorized repurchase capacity to $2.4 billion, which represents approximately 45% of our current equity capitalization.”

(Source: CNX Resources)

The company projected a big 32% CAGR for FCF per share from 2020 to 2026. What’s more, the FCF per share is expected to double in 2026 from 2022. Will the company achieve this ambitious goal?

We don’t know, but the margin of safety is massive with this stock.

Disciplined production: In the past, shale operators would chase growth at all costs. Not anymore. Many of them become disciplined and maintain stable production levels during the boom year in 2022. That’s difficult to resist – it’d be a quick buck to boost production and earn profits on these elevated prices.

But with the production level being stable, CNX Resources will have ample room to generate high FCF since it didn’t take on too much of fixed costs, even with natural gas prices coming back to Earth.

Not only that, its TTM leverage ratio is safe at 1.9x.

Bottom line: CNX Resources is all about free cash flow, and its yield is expected to post ~13% this year. Many of them would go to shareholders, so it would represent a double-digit return if we combine revenue growth and share buybacks. It is a good stock to own for reliable returns.

EARN WHILE YOU LEARN! JOIN OUR FREE LIVE TRADING SESSION!

© All Rights Reserved, Trade Alliance