EARN WHILE YOU LEARN! JOIN OUR FREE LIVE TRADING SESSION!

Hello Peter Anthony Hovis,

2026 = Growth + Faster Disinflation

The year of 2026 is looking extremely bullish.

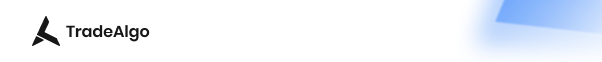

Yes, the Federal Reserve hinted at pausing its rate-cutting cycle. It could have been viewed as a bearish catalyst, but the central bank shared its 2026 outlook which looked strong for the market.

First, officials boosted their median outlook for economic growth in 2026 to 2.3% from 1.8% they projected in September. That’s a big boost. Not only that, but they also saw inflation declining to 2.4% next year, from the 2.6% in the previous projection.

In other words, the Fed sees faster growth and slower inflation.

That’s a “dream” scenario for most investors.

- “The Fed’s ‘hawkish-but-bullish’ cut last night reinforces this: stronger 2026 growth, faster disinflation,” said Florian Ielpo, head of macro at Lombard Odier Investment Managers. “Cuts are continuing, but they’re no longer automatic — and that’s usually a constructive backdrop for equities.”

Florian Ielpo, head of macro at Lombard Odier Investment Managers (Photo: EQD)

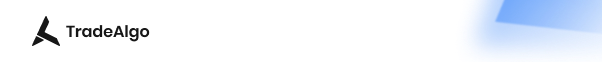

Sure enough, global stocks hit a new record high after yesterday’s trading session. The MSCI All Country World Index is on track to deliver its best year since 2019.

There are even more positive catalysts for next year. President Trump’s stimulus package is set to kick in. The new Fed chair will begin their tenure, and more rate cuts are expected. Earnings growth is projected to accelerate.

- “The momentum should continue into year-end. With rate cuts underway, a new Fed chair on deck, and earnings trending higher, the bull market looks positioned to extend into 2026,” said Gina Bolvin, President of Bolvin Wealth Management Group.

- “As more companies adopt AI, participation should broaden and sectors beyond the Magnificent Seven may start to show strength.”

(Source: Bloomberg)

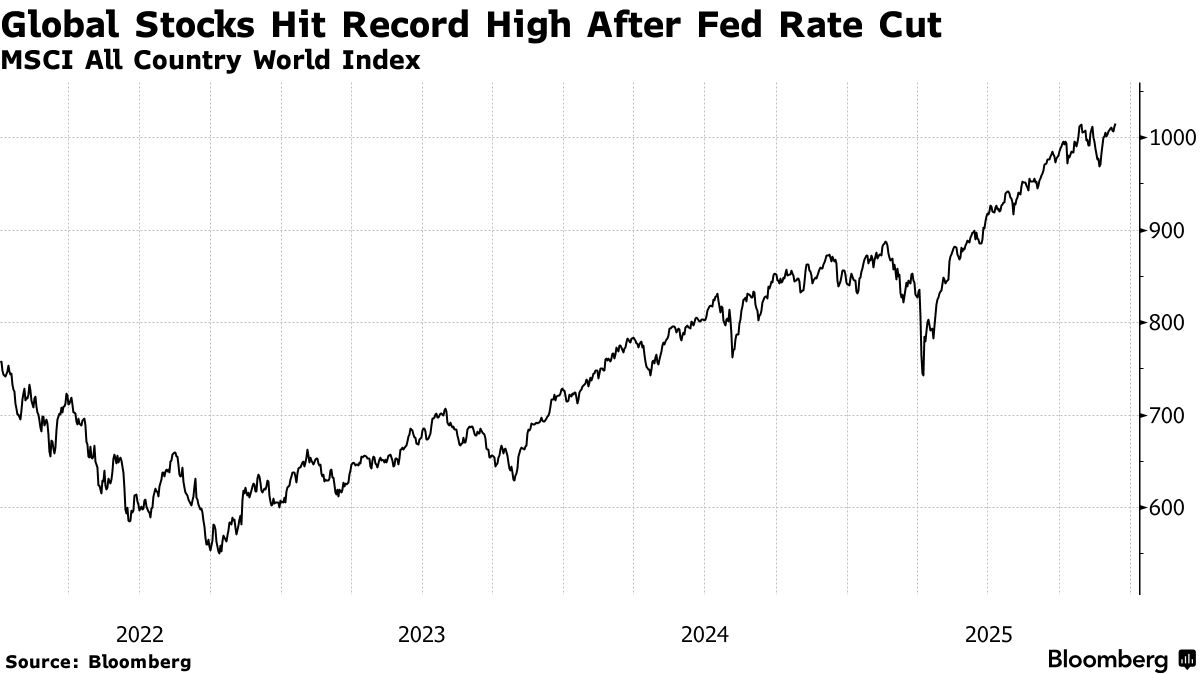

Applications for US employment benefits rose last week by the most since the start of the pandemic. Initial claims increased by 44,000 to 236,000 in the week ended Dec. 6. However, Wall Street isn’t reading too much into it because of volatility surrounding the holiday week of Thanksgiving.

- “Don’t read too much into the jump in jobless claims,” Heather Long, chief economist at Navy Federal Credit Union, said in a note. “Smoothing it out, this still looks like an economy averaging 215,000 to 220,000 new jobless claims a week. That’s not a cause for concern.”

(Source: Bloomberg)

Notably, the tech sector struggled yesterday. Oracle’s disappointing earnings report crushed the stock. Nvidia fell 1.6% while the Magnificent Seven index of tech giants declined 0.6%.

This shows how investors are bullish on the overall economy but have become anxious about those companies that spend billions of dollars on AI infrastructure projects.

- “Markets have grown far more wary of AI-related spending, which is a sharp contrast with mid-2025 when anything hinting at higher capex sparked excitement,” said Susana Cruz, a strategist at Panmure Liberum. “Oracle has been the weakest link in all this, largely because it’s funding a big chunk of its investment with debt.”

With the catalysts winding down (the earnings season and the Fed’s FOMC meeting), the market looks poised to establish a new trend in either direction.

Couchbase: 20% Growth, Positive Free Cash Flow, and a Massive TAM.

Today’s Stock Pick: Couchbase (BASE)

Salesforce pioneered the SaaS industry with a tagline of “No Software.”

Users no longer needed to download software on the desktop computer. Rather, they can easily access it on the cloud by typing in the website address.

The concept is obvious now, but it was revolutionary back then.

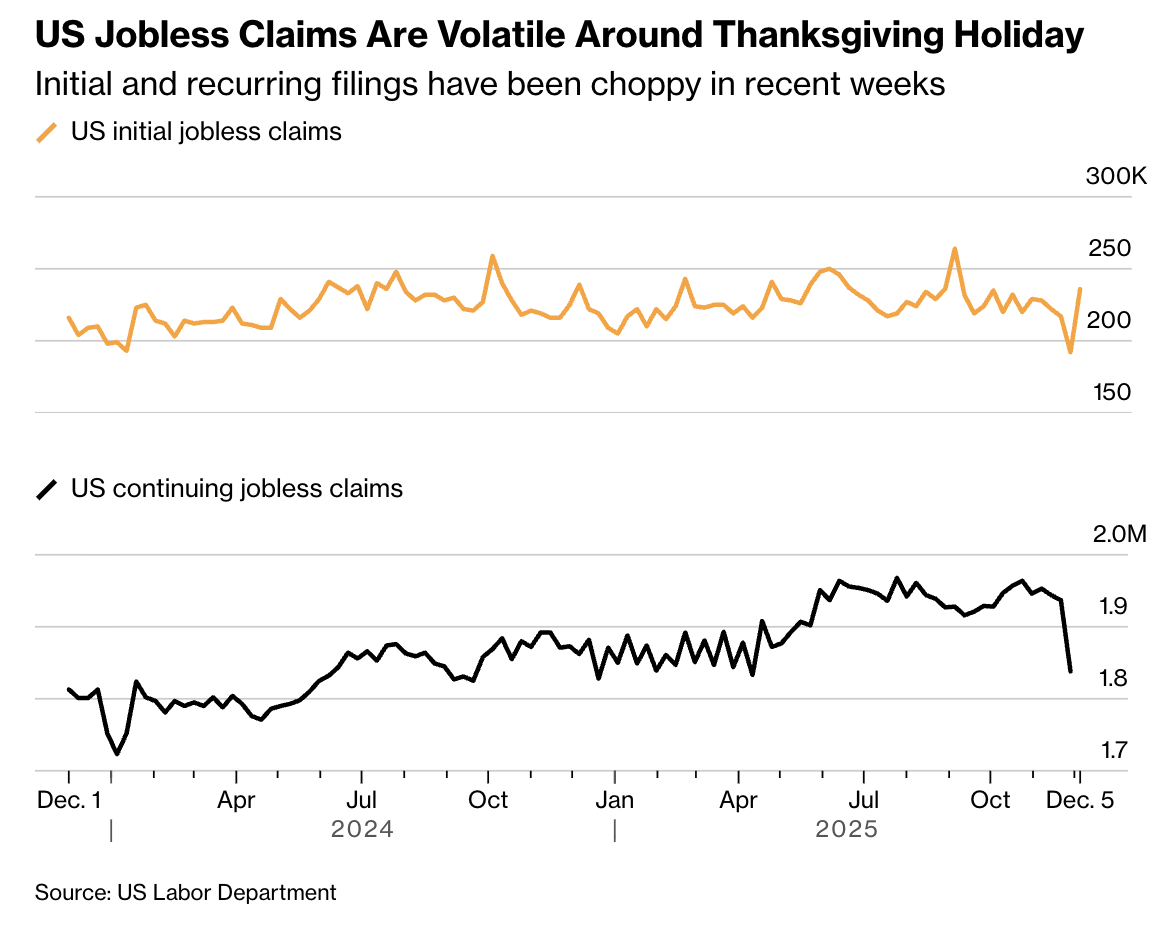

Couchbase is attempting to do the same thing with the SQL database, with the motto of “NoSQL.”

Let’s compare the difference between SQL and NoSQL.

Imagine you have a giant filing cabinet where everything is neatly organized in folders and labeled in a strict, structured way—that’s like a SQL database (relational database).

Everything has to follow a set format, like rows and columns in a spreadsheet.

Now, imagine instead of that rigid filing system, you have a big box where you can toss in notes, photos, lists, or whatever you want, without worrying about strict organization—that’s like a NoSQL database.

It gives you more flexibility, making it easier to store and retrieve data, especially when dealing with huge amounts of information (like social media posts or product recommendations).

NoSQL is great for speed, scalability, and handling messy, ever-changing data—perfect for modern apps, big data, and real-time updates.

(Source: ScyllaDB)

Among many benefits, NoSQL is especially important in the cloud era. Companies rely on data more than ever to offer world-class customer service, but more data means higher cloud computing costs.

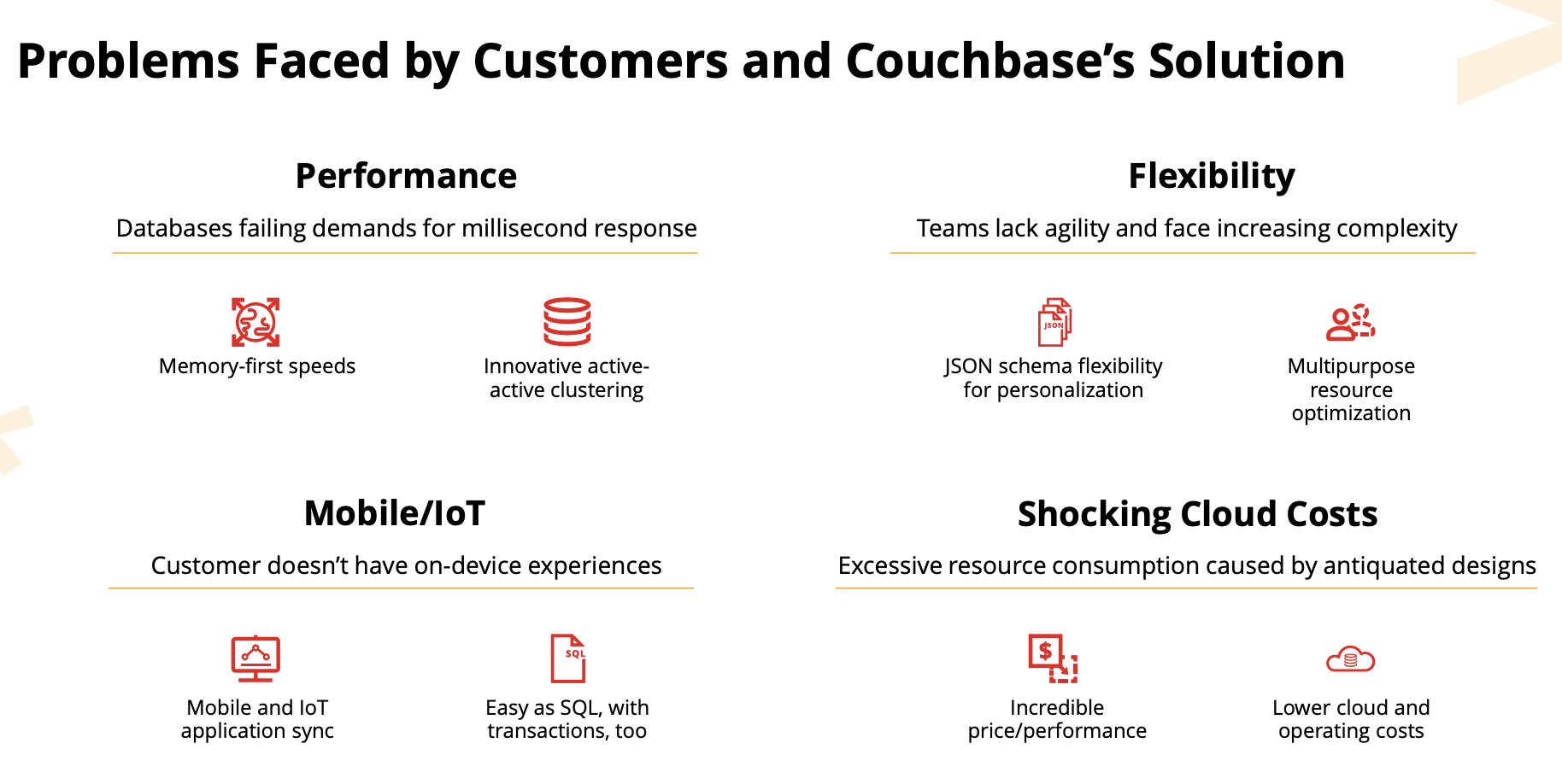

Antiquated database designs lead to excessive resource consumption and Couchbase’s products lower costs with modern designs.

(Source: Couchbase)

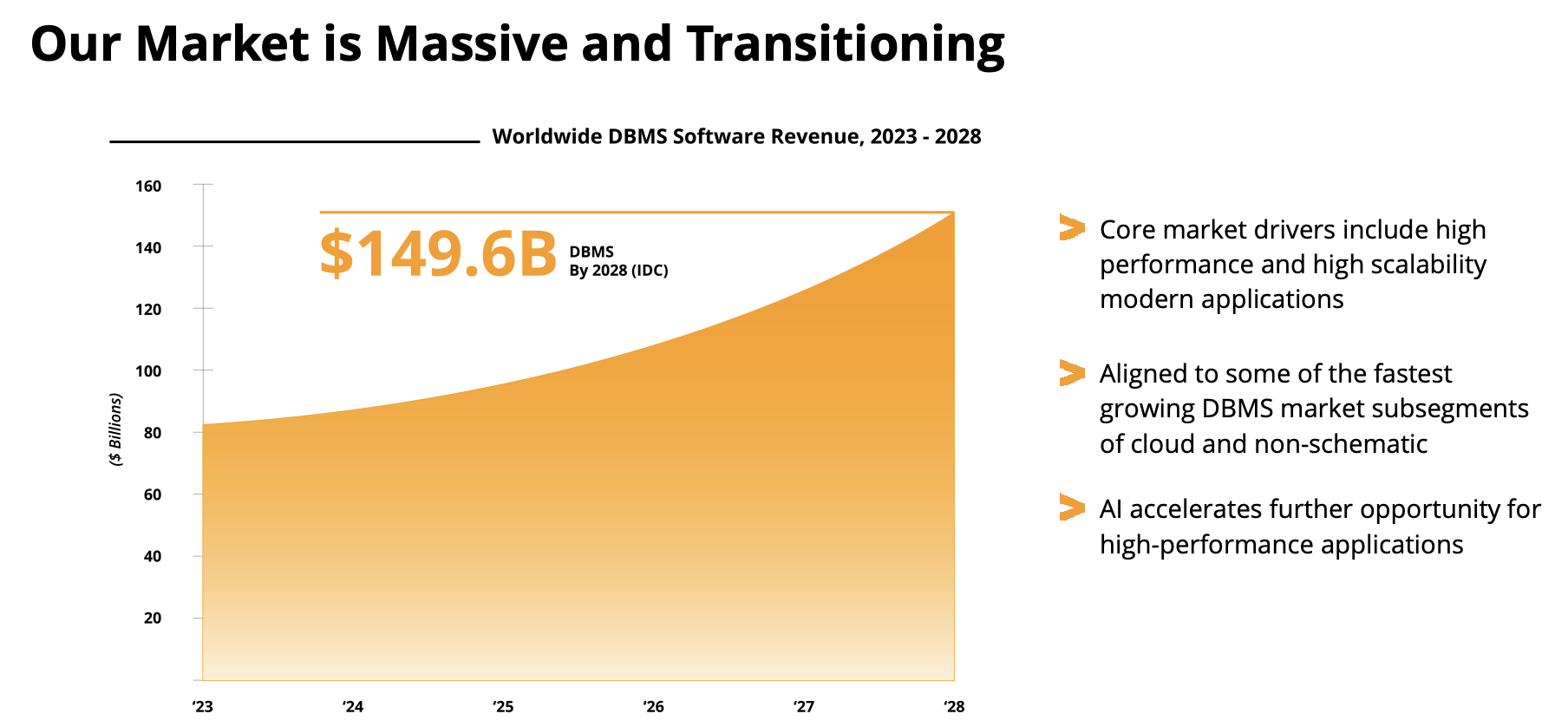

The market for Couchbase’s solutions is immense.

The company estimates its TAM to be at $149.6 billion by 2028. Why? AI will likely accelerate the trend for high-performance applications because companies need innovative ways to run AI models at lower costs.

(Source: Couchbase)

Couchbase has an enviable roster of corporate clients, including Verizon, GE, Zynga, Carnival, Domino’s Pizza, PEPSICO, United Airlines, and Marriott.

(Source: Couchbase)

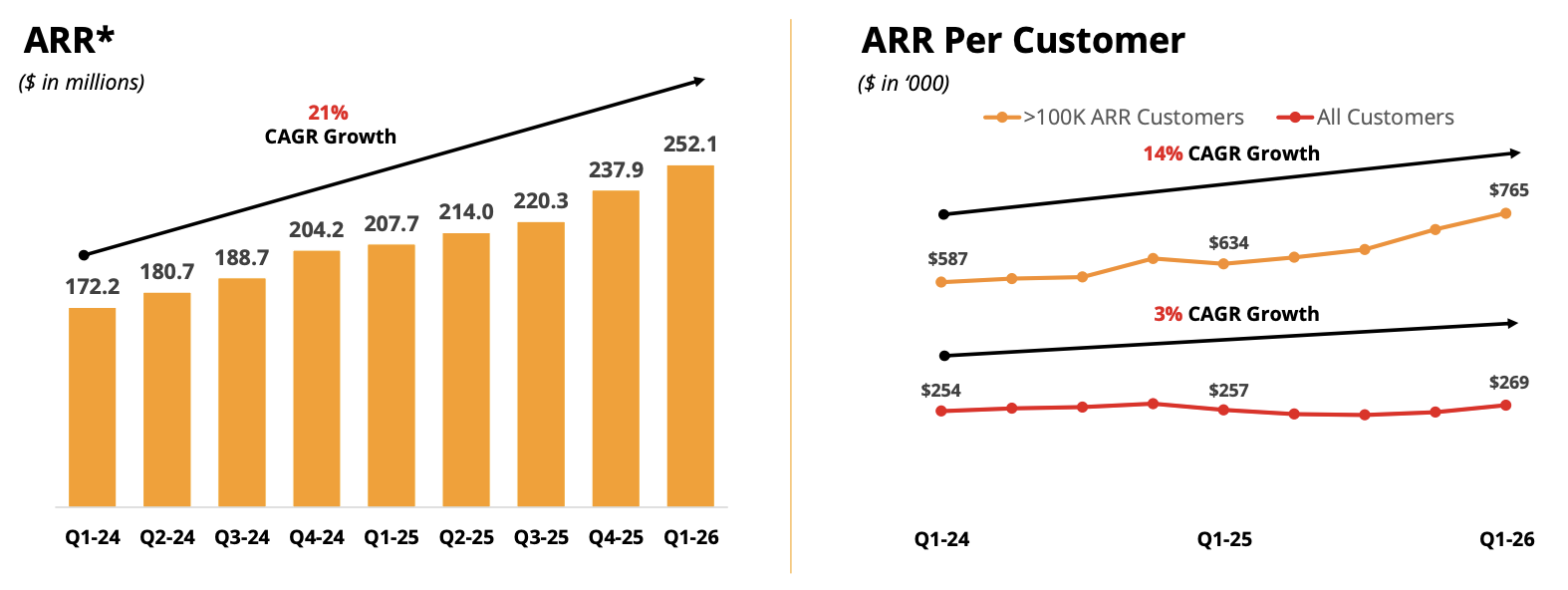

Sure enough, Couchbase delivered a 21% ARR CAGR growth since the first quarter of FY’24. The total customer base is 937, and it has penetrated 29% of Fortune 100 companies.

(Source: Couchbase)

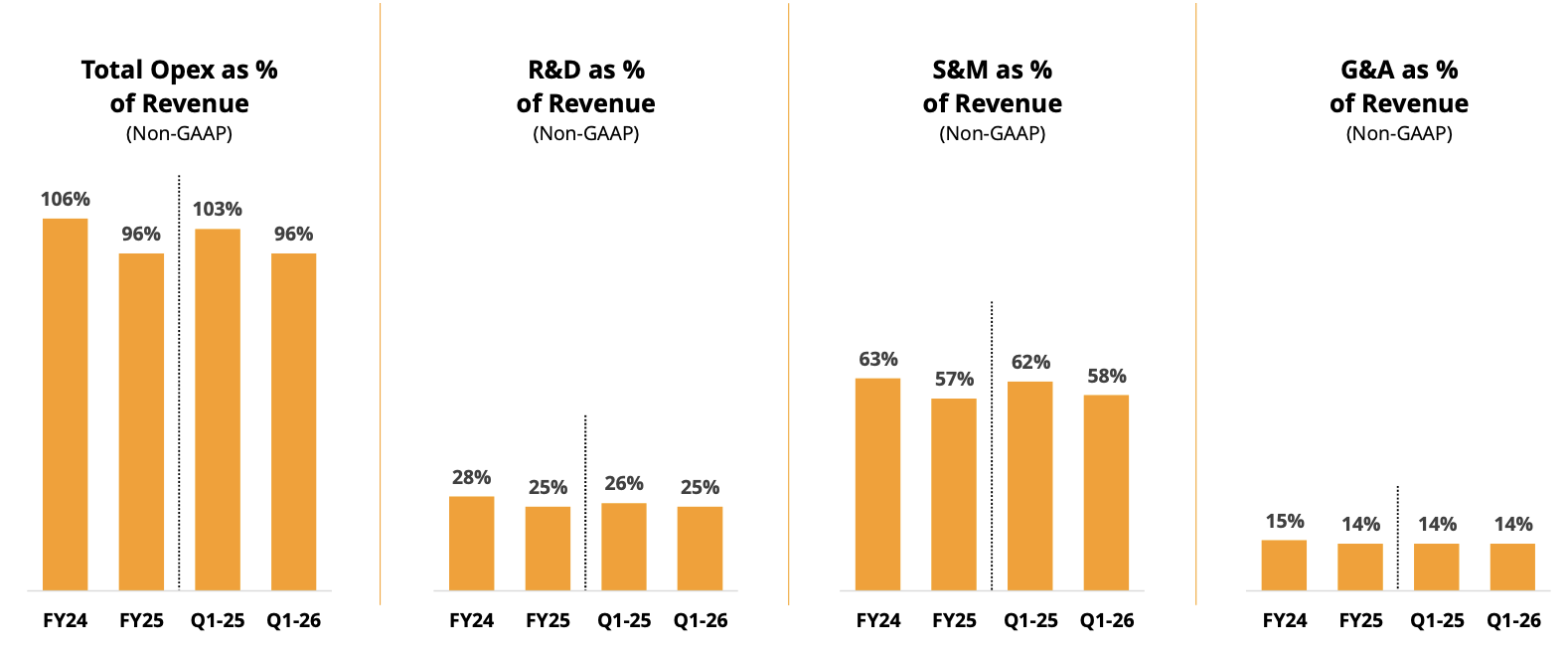

At the same time, costs are falling. Total operating expenses as % of revenue plunged from 106% (FY’24) to 96% (Q1-26). Meaning? Couchbase is poised to generate bigger cash flows down the road.

(Source: Couchbase)

Bottom line: Couchbase expects to deliver 20%+ revenue growth and positive FCF in FY’26. These are strong forecasts, so the stock looks like an elite play during the artificial intelligence era.

EARN WHILE YOU LEARN! JOIN OUR FREE LIVE TRADING SESSION!

© All Rights Reserved, Trade Alliance

You’ve probably never heard of Kingsway Financial Services (KFS).

You’ve probably never heard of Kingsway Financial Services (KFS).