Author Archives: RJ Hamster

The RJ Hamster morning Show

T he RJ Hamster morning Show

Score the best of Black Friday with Xbox!

Wrap up your holiday shopping now and save time to playGAMESGAME PASSACCESSORIESDEALS

![]() 0WRAP UP THE JOY

0WRAP UP THE JOY

OF GAMINGSHOP NOW ❯

The wait is over! Light up the holidays with Xbox and save on your favorite ways to play with the best deals of the season.

Unwrap savings on Xbox accessories

Save now on select Xbox accessories. Add color, style, and immersive gaming to any setup now.SHOP NOW ❯

Make it personal with free engraving

Make it yours or theirs. Get free engraving and save on select components and top cases with Xbox Design Lab.DESIGN YOURS ❯

The gift for any Xbox gamer

Start your shopping with an easy win! With an Xbox Gift Card, you can give the freedom of choice, whether they’re looking for games, add-ons, consoles, accessories, or more.GET A GIFT CARD NOW ❯

Xbox Mastercard

Apply now and for a limited time only, enjoy a bonus of 10,000 card points (a $100 value!) after qualifying account activity. Terms apply.APPLY NOW ❯

Save on select Xbox games

Get up to 75% off when you shop these games and bring a smile to yourself or someone special.SHOP NOW ❯

Call of Duty®: Black Ops 7

Don’t miss out! Save 15% on the biggest Black Ops ever for a limited time.GET IT NOW ❯

Enjoy Xbox Game Pass

This season, stream and play hundreds of games on any device, including more day-one games than ever before!2 Plus, in-game benefits, faster rewards, and much more.1,3JOIN GAME PASS ❯

Earn more with Rewards

As you play the games you love and shop the Store for everyone on your list, earn Rewards points you can turn into Xbox Gift Cards for more fun and games.3EARN WITH XBOX ON MOBILE ❯ EARN WITH XBOX ON PC ❯

The best deals of the year

Discover more Black Friday deals to shop and save with Xbox for the holidays.SHOP DEALS ❯ FOLLOW XBOXMY ACCOUNTMY GAMER PROFILEXBOX PC APPXBOX MOBILE APPSUPPORT

1. Benefits vary by Xbox Game Pass plan. Game library varies over time, by region, device, and Xbox Game Pass plan. xbox.com/gamepass. https://www.ea.com/ea-play/.

2. Xbox Cloud Gaming: Xbox Cloud Gaming requires an Xbox Game Pass subscription and supported device (both sold separately). Cloud playable games not included with Xbox Game Pass are sold separately, and may be made available with Xbox Game Pass in the future. Game library varies. Stream directly on Xbox consoles, or with the Xbox app or at xbox.com/play on supported devices. Select regions (xbox.com/regions) and devices at xbox.com/cloud-devices. See cloud gaming library (xbox.com/play).

3. Rewards: Terms apply. Microsoft Account required. Select markets only. Rewards vary by Game Pass Plan and Rewards level. Point values vary by local market currency, Rewards level, and the number of points redeemed. Point multipliers compared to Game Pass Essential earning potential. Gameplay rewards for 18+. Exclusive quests with Premium and Ultimate plans only, for titles in the Game Pass library. Excludes PC Games that require 3rd party launchers or are played on Battle.net. Playtime required for all quests. Qualifying purchases at Microsoft Store (online, or on Windows or console) at Rewards with Xbox.Unsubscribe | Privacy Statement

Microsoft Corporation

One Microsoft Way

Redmond, WA 98052

© 2025 Microsoft Corporation. All Rights Reserved. All trademarks are the property of their respective owners.

Amazon Enters Correction Zone—Time to Panic, or to Load Up?

Arizona-made nanochips the new millionaire maker? (From Banyan Hill Publishing)

Amazon Enters Correction Zone—Time to Panic, or to Load Up?

Written by Sam Quirke on November 27, 2025

Key Points

- Amazon has fallen into correction territory after dropping more than 15% from its all-time high earlier this month.

- Yet buyers are already stepping back in, with shares up more than 6% from last week’s lows.

- Analysts remain almost universally confident, calling the move a reset rather than the start of a reversal.

Shares of Amazon.com Inc. (NASDAQ: AMZN)have spent the past two weeks under pressure, sliding from record highs near $260 at the start of the month to almost $215 last week. The good news for investors is that despite that sharp move, the stock hasn’t broken any key technical levels, and momentum is already improving.

It appears that much of the selling was driven by a broader souring of sentiment, especially in tech stocks. However, giving up more than 15% of gains without much defense from the bulls is never a good look. The big question now as we head into Thanksgiving weekend is whether this pullback marks the start of something deeper or a rare opportunity to buy one of 2025’s best-performing mega-caps at a discount.

Lock In 7%–9% Yields Before Everyone Else Does (Ad)

Here’s what income-focused investors are discovering fast:

The biggest payouts in are NOT coming from trendy tech…

But from a powerful wave of high-yield dividend stocks quietly dominating the market.

Our newest research reveals three of the strongest cash machines in today’s income landscape[Download Your Free Report Before It Goes Public]

A Healthy Correction

Before the selloff, Amazon had rallied as much as 60% from April, a run that was bound to attract profit-taking, especially after the earnings inspired a gap-up in late October.

The current drop officially puts the stock in correction territory, but it hasn’t come close to testing, let alone breaking any lows.

Technically, the setup looks more like a cooling phase than a collapse, and all the major moving averages and trend lines are intact.

Notably, trading volume during the decline has stayed moderate, with the most volume in recent weeks on green days, and no signs of panic selling.

The Fundamentals Remain Strong

Much of this strength stems from Amazon’s latest earnings report at the end of October, which confirmed that its growth story is alive and kicking. As MarketBeat highlighted at the time, all of the company’s major revenue engines are firing on all cylinders, and the outlook is bright heading into 2026.

Margins are trending higher, helped by cost discipline and automation, and cash flow continues to grow. The broader narrative hasn’t changed: Amazon is still a $2.5 trillion growth story that dominates every market it operates in and has ample room to grow. From a valuation standpoint, the recent pullback also made it more attractive to investors on the sidelines, and it’s perhaps no surprise that shares have been snapped up quickly so far this week.

My research tells me this gold stock will rise 400% in Q1 2026 (Ad)

“Like buying gold for $1,000/oz”

If you could go back in time to 10+ years ago and buy gold for $1,000 an ounce, it would be one of the biggest no-brainer decisions and an easy 4X gain. But you can’t go back…

Gold analyst Garrett Goggin believes there’s a similar opportunity right now in his #1 favorite gold stock.Own Garrett’s #1 Gold Stock Now: Click here to see the details

Analysts Back the Rebound

It’s also no surprise that Wall Street is treating this correction as a buying opportunity as well.

Rosenblatt Securities, for example, reiterated its Buy rating on Tuesday along with its $305 price target, implying more than 30% upside from current levels.

This echoed the move by BNP Paribas on Monday, which upgraded the stock to Outperform, and dozens of other analysts who’ve been calling the stock a red-hot buy for months.

With a street-high analyst price target of $360, the consensus on Amazon underscores widespread confidence that this is a temporary pause, not the beginning of a breakdown.

Technical Setup Looks Constructive

Recent selling has also improved the technical setup. Having been in overbought territory earlier in November, Amazon’s Relative Strength Index (RSI) has cooled nicely towards the low 40s, helping to reset momentum without causing cracks in the broader trend.

Support around the $210-215 mark has been tested multiple times in recent months without breaking, suggesting a firm base has formed. A close above $240 in the coming sessions would confirm that buyers are back in control and could pave the way for a retest of $260 highs before year-end.

Broader macro sentiment will play a big part in that happening, and for now, at least, it’s looking good. The S&P 500 has been rallying hard since Monday morning, risk appetite is opening up once again, and rate-cut expectations are growing.

Even if volatility persists in the near term, it’s hard to bet against Amazon’s long-term trajectory. Few companies have such a combination of scale, innovation, and operational discipline. This correction may look sharp on paper, but it seems likely that future investors will look back on it as a golden entry opportunity ahead of fresh highs into 2026.

Featured Stories:

- SanDisk Joins the S&P 500: Inside the Index Effect Rally

- Buffett, Gates and Bezos Dumping Stocks (From Banyan Hill Publishing)

- Tesla Just Got Called a “Must Own” Stock—Here’s Why

- Larry’s Unexpected Black Friday Move(From Brownstone Research)

- Why Gold Loves Trump as Much as Trump Loves Gold

- Google’s Gemini 3 Sends Broadcom Soaring: TPUs Take Center Stage

- Palantir Isn’t Just Riding the AI Boom—It’s Orchestrating It

Did you like this article?

Thank you for subscribing to MarketBeat!

MarketBeat empowers investors to make better financial decisions by delivering up-to-the-minute financial information and unbiased market analysis.

If you have questions about your account, please don’t hesitate to email our South Dakota based support team at contact@marketbeat.com.

If you would like to unsubscribe or change which emails you receive, you can manage your mailing preferences or unsubscribefrom these emails.

© 2006-2025 MarketBeat Media, LLC. All rights protected.

345 N Reid Pl. #620, Sioux Falls, SD 57103-7078. USA..

TSee Also: Claim Your Share of $5.39 BILLION in AI Equity Checks(From Angel Publishing)

Former CIA to Trump – Will you shut down this secret lab?

![]()

AN OXFORD CLUB PUBLICATION

Loyal reader since August 2025

Editor’s Note: Did you miss this?

Jim Rickards at Paradigm Press says he recently visited a lab that’s even more secretive than Area 51…

He shares some of his findings here.

– James Ogletree, Senior Managing Editor

Former CIA to Trump – Will You Shut Down This Secret Lab?

Dear Reader,

Deep in the sands of New Mexico lies a government lab so secret it makes Area 51 look like a tourist spot…

The scientists here aren’t toying with viruses or weather manipulation technology…

No, they’re into something far more alien…

A technology with the power to completely flip how wars are waged — on soldiers and civilians.

And nothing will keep them from unleashing their creation on America.

I know, because I recently visited this lab.

And the dangerous thing I saw could be released as soon as January 13th…

In my gut, I know there’s no stopping it.

That’s why I’ve already prepared my finances…

So that instead of losing money when this thing is unleashed…

My money will be backed by a strategy with an 88% win rate over 10 years straight.

Click here for my full analysis before it’s taken offline.

Sincerely,

You are receiving this email because you subscribed to Wealthy Retirement.

Wealthy Retirement is published by The Oxford Club.

To stop receiving special invitations and offers from Wealthy Retirement, please click here.

Please note: This will not impact the fulfillment of your subscription in any way.

Questions? Check out our FAQs. Trying to reach us? Contact us here.

Please do not reply to this email as it goes to an unmonitored inbox.

Privacy Policy | Whitelist Wealthy Retirement

© 2025 The Oxford Club, LLC All Rights Reserved

The Oxford Club | 105 West Monument Street | Baltimore, MD 21201

North America: 866.237.0436 | International: 443.353.4540

Oxfordclub.com

Nothing published by The Oxford Club should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by The Oxford Club should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of The Oxford Club, LLC, 105 West Monument Street, Baltimore, MD 21201.

REF: 000142349377

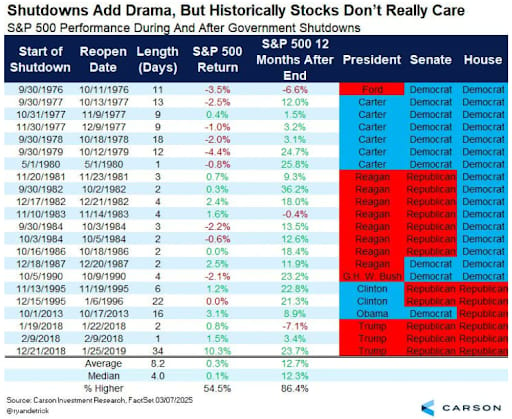

Another Reason Why You Shouldn’t Trade On The Mainstream News

November 28, 2025

Contrary to the mainstream’s talking points…

The government shutdown didn’t shake the market.

In fact, it went on to set new all-time highs.

And here’s the part no one on TV will admit…

Markets have done the same thing during past shutdowns, too.

And that’s why I don’t get distracted by the headlines. Because there will always be noise…

The only thing that matters is the data.

If you can focus on the right information… you’ll be way ahead of most traders.

The good news is…

You don’t have to dig through endless tickers. I’ve already done the heavy lifting.

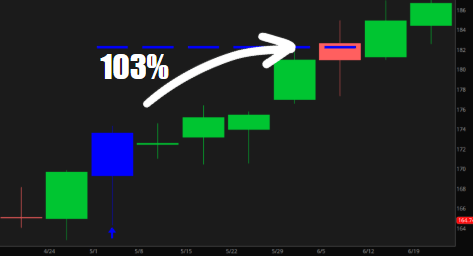

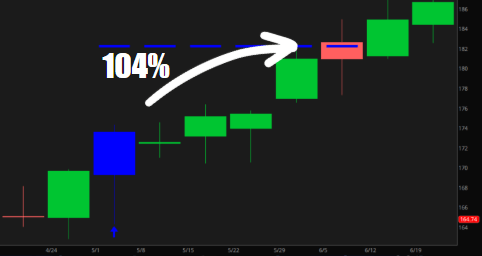

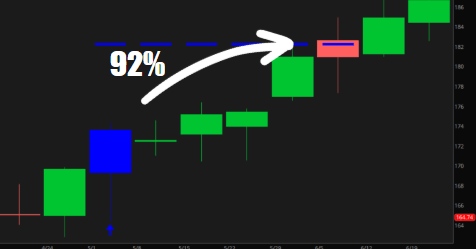

And right now, the chart data I’m tracking has already highlighted 10 trades with the highest probability of surging.

I’m talking about the same data that caught winners like 103% on TSLA…

104% on GM…

And 92% on MU…

Now, there were smaller wins and those that didn’t work out. There are bound to be winners and losers in trading.

But if you want to tune out the mainstream and focus on what’s actually moving the market…

I recently held a session where I gave the full details…

With the important charts backing each setup…

You’ll find the full breakdown in the replay here.

-Investimonials

We develop tools and strategies to the best of our ability, but no one can guarantee the future. There is always a risk of loss when trading. Past performance is not indicative of future results. From 11/30/23 to 9/26/25, the win rate on live published alerts was 58.1%, and the average return was 16.28% over an 18-day hold time

Update your email preferences or unsubscribe here

© 2025 Millionaire Publishing

66 W Flagler St. Ste. 900

Miami, FL 33130, United States of AmericaTerms of Service

The RJ Hamster morning Show

The RJ Hamster morning Show

$1 Deal: Closest thing to a ‘win/win’ trade plan

In 2026, Big Tech is set to pay $900 billion in what I call ‘AI Tolls.’

Every tech company that wants access to AI has no choice but to pay them.

That’s why I’m convinced AI Tolls is the closest thing to a ‘win/win’ trade plan I have seen in this hypergrowth sector. But you don’t need to be rich or connected to get in on it…

For the first time ever, you can unlock my entire trade plan for only $1. Previously, you would’ve had to pay many times this amount to access it.

But the moment the Black Friday–Cyber Monday window closes, this offer disappears — and won’t return until next year.

Here’s everything you’ll get for just $1.

Sincerely,

Tim Bohen

P.S. Every major tech company racing to scale AI must buy the same key technology at the center of my trade plan. You can unlock its ticker and analysis for just $1 — but only during this Black Friday/Cyber Monday deal.

Today’s Featured Story

If You Wait for the Dip, Micron Technology Could Leave You Behind

Written by Thomas Hughes. Published 11/14/2025.

Key Points

- Micron Technology is on the brink of a major demand ramp that will last for years as AI demand and data center growth fuel the business.

- As DRAM prices surge, Analysts are lifting their targets—but not fast enough.

- While MU stock is poised to correct in mid-November, robust trends and forecasts pointing to the $300 level might prevent it.

While concerns that the AI demand outlook is overblown and that players like OpenAI may struggle to meet GPU commitments are valid, these are bricks in a Wall of Worry built on a robust demand spike and the foundations of a multi-year memory chip supercycle.

Evidence of that supercycle appears in moves by DRAM chipmakers — notably Samsung (OTCMKTS: SSNLF) — to raise prices, and in Morgan Stanley’s decision to lift its price target. More upward revisions are likely in the coming quarters.

Market uncertainty is high — but this memecoin is gaining momentum (Ad)

Something with massive upside potential is still flying under the radar…

Discover the brand-new memecoin that is poised to soar next.Discover the #1 Memecoin to Own Right Now

Those macro signals underscore a rising tide that directly benefits Micron (NASDAQ: MU), one of the few companies positioned to capitalize on surging DRAM demand. Micron’s price action peaked in November and could see a pullback — but for long-term investors that pullback would be a bullish buying opportunity.

Analysts Can’t Keep Up With Micron’s Rapidly Rising Growth Trajectory

Morgan Stanley analyst Joseph Moore and his team raised their price target for MU to $325, roughly 50% above their prior target.

The new target implies about 40% upside from mid-November highs and is likely conservative.

In Morgan Stanley’s view, the demand-driven price surge supports an earnings outlook that takes Micron into “uncharted territory” from a profit standpoint. “We think the stock has yet to fully price in the upside that’s coming,” they said. Their model assumes DRAM prices could rise by as much as 50% in some scenarios — and even that projection has shown signs of being cautious.

That thesis was reinforced almost immediately when Samsung raised prices by about 60%, citing a global shortage of AI-capable HBM3E (or better) memory units that are critical to the AI industry. Each GPU — whether from NVIDIA (NASDAQ: NVDA) or Advanced Micro Devices (NASDAQ: AMD) — is built with clusters of HBM stacks, each containing up to 12 DRAM dies. That architecture has driven an exponential increase in demand for Micron’s products relative to what we’ve seen so far from NVIDIA and what we expect when AMD launches the MI450 line.

The takeaway for investors is straightforward: Micron is experiencing an unprecedented surge in revenue and earnings potential that the stock price has not yet fully reflected.

Micron Is a Deep Value, But the Market Isn’t Sure How Deep

Analysts will need to raise near- and long-term estimates to reflect the strength in demand and pricing. Consensus forecasts currently show some strength for 2026–2028, but they do not yet capture the surge implied by recent trends, nor have many forecasters extended their targets further out.

As of mid-November 2025, Micron was trading at roughly 14x trailing earnings and about 12x on its 2028 forecast. If the valuation multiple expands materially — for example, by 50% over the coming years — the stock could appreciate significantly even without dramatic additional earnings outperformance.

With those factors in play, Micron’s share price could plausibly reach triple-digit gains relative to November highs over the next few years.

Analyst coverage has increased to 38 firms, sentiment has firmed (with a Buy bias around 88%), and price targets are trending higher.

The consensus lagged the market in November, which helped create a short-term correction outlook, but Micron is still up more than 45% over the prior 12 months. Morgan Stanley’s high-end target of $325 and the series of recent upward revisions are all above the prior consensus.

Micron Is at a Peak and Poised to Pull Back… But It Might Not

Micron’s stock price reached a peak in November and could see limited gains over the next few weeks to months. Headwinds include elevated short interest, which is near long-term highs, and institutional activity: many institutions reduced their holdings in the first half of Q4.

If a correction occurs, the stock could fall into the $185–$200 range before finding support. The caveat is that positive analyst sentiment and steady retail interest may provide enough backing to hold prices near current highs. In that case, Micron could consolidate at or near these levels and potentially move to new highs later this year or in early 2026.

Thank you for subscribing to Insider Trades Daily, which covers the most recent insider buying and selling activity from Wall Street CEO’s, CFO’s, COO’s and other insiders.

This message is a sponsored email for Timothy Sykes, a third-party advertiser of InsiderTrades.com and MarketBeat.

If you need assistance with your account, feel free to email our South Dakota based support team at contact@marketbeat.com.

If you no longer wish to receive email from InsiderTrades.com, you can unsubscribe.

© 2006-2025 MarketBeat Media, LLC. All rights reserved.

345 N Reid Place, Suite 620, Sioux Falls, S.D. 57103-7078. United States of America..

Link of the Day: AI Continues to Surge—Here Are 2 Stocks Still Under $15 (Click to Opt-In)