Here’s What Happens When Washington Decides It Can’t Lose

For the first time in decades, the U.S. government is no longer standing on the sidelines of innovation – it’s actively directing it.

In today’s Friday Digest takeover, our technology expert Luke Lango explains why 2026 may look like a national mobilization, with Washington actively funding, fast-tracking, and steering the buildout needed to win the AI race.

This shift goes far beyond regulation. The government is now shaping outcomes – backing critical supply chains, clearing bottlenecks, and accelerating infrastructure tied to AI dominance.

In his essay below, Luke introduces the framework he’s using to track this transition, and highlights where the most compelling opportunities are emerging.

But today’s essay is just the start. For Luke’s full deep dive – including more detail on the specific stocks he believes could benefit most – you can watch his free Genesis Mission broadcast right here.

Enough introduction. I’ll let Luke take it from here.

Have a good evening,

Jeff Remsburg

In the early 1940s, Americans couldn’t explain why obscure chemical firms were suddenly flush with cash or why Washington cared about desert towns in New Mexico.

And in the early 1960s, few investors understood why the government was pouring billions into rockets, primitive computers, and aerospace firms most people had never heard of.

But a small group did understand. They recognized the signs of a national mobilization, positioned early, and reshaped their wealth.

That same pattern is unfolding again today.

Most investors are trying to play 2026 with a 2019 rulebook. That world is gone. The era of frictionless globalism is over.

We’ve entered a new phase where the U.S. government isn’t just regulating markets… it’s fast-tracking permits, steering contracts, and funding critical buildouts toward winning the AI race against China.

When Washington decides it can’t afford to lose, it stops debating… and starts building.

That’s how we built the atomic bomb first.

That’s how we beat the Soviets to the moon.

And that’s how we’re now responding to China’s push for AI dominance.

That’s why my team and I just released a free broadcast focused on what I believe is the most important government-backed investment opportunity of our lifetime… and the narrow window opening beforeWall Street fully connects the dots.

Below, I’ll show you the framework — and the six bottlenecks investors should be watching right now.

Because events like this don’t feel obvious until after the opportunity has passed.

Recommended Link

Investing Legend Hints the End May be Near for These 3 Iconic Stocks

Futurist Eric Fry says Amazon, Tesla and Nvidia are all on the verge of major disruption. To help protect anyone with money invested in them, he’s sharing three exciting stocks to replace them with. He gives away the names and tickers completely free in his “Sell This, Buy That” broadcast. Click to stream now…

From Free Markets to National Mobilization

For decades, when it came to the private sector, the prevailing belief in Washington was simple: Set fair rules, then get out of the way. The “invisible hand” would take care of the rest.

That invisible hand optimized for cheap labor, global efficiency, and short-term profits – but not national resilience. The result was a hollowed-out manufacturing base and a growing dependence on foreign rivals for the materials and technologies that now define economic and military power.

For a while, it looked like a win. Cheap goods. Higher margins. Faster growth.

That illusion has collapsed.

The U.S. has entered a new era of national mobilization. The government is setting the priorities, clearing obstacles, and backing companies that advance American AI dominance.

If a company helps achieve that goal, it gets fast-tracked approvals, government cash, and policy support.

That’s the new reality.

Over the past year, Silicon Valley has accepted that the next era is about building the modern equivalent of the Manhattan Project or Apollo Program.

In return, Washington has stopped pretending that decade-long approval processes and fragmented regulation are compatible with winning the race that will shape the next era.

This also explains why geopolitics suddenly feels louder: Supply chains are now strategy.

America has three nonnegotiable needs: massive energy, enormous quantities of raw materials, and unprecedented computing power.

And it doesn’t have enough of any of them.

So the government is acting accordingly… using diplomacy, industrial policy, and national security tools to secure energy supplies, stabilize material flows, and accelerate infrastructure buildouts. In effect, the U.S. government is helping secure the inputs AI needs: power, materials, and compute.

The 2010s investor playbook — capital-light, consumer-first growth — doesn’t fit this market. We are entering a period defined by heavy capital spending, physical constraints, and state-backed demand.

The strategy now is to own the choke points — the materials, power systems, infrastructure, and technologies that this new system cannot function without, and cannot scale fast enough on its own.

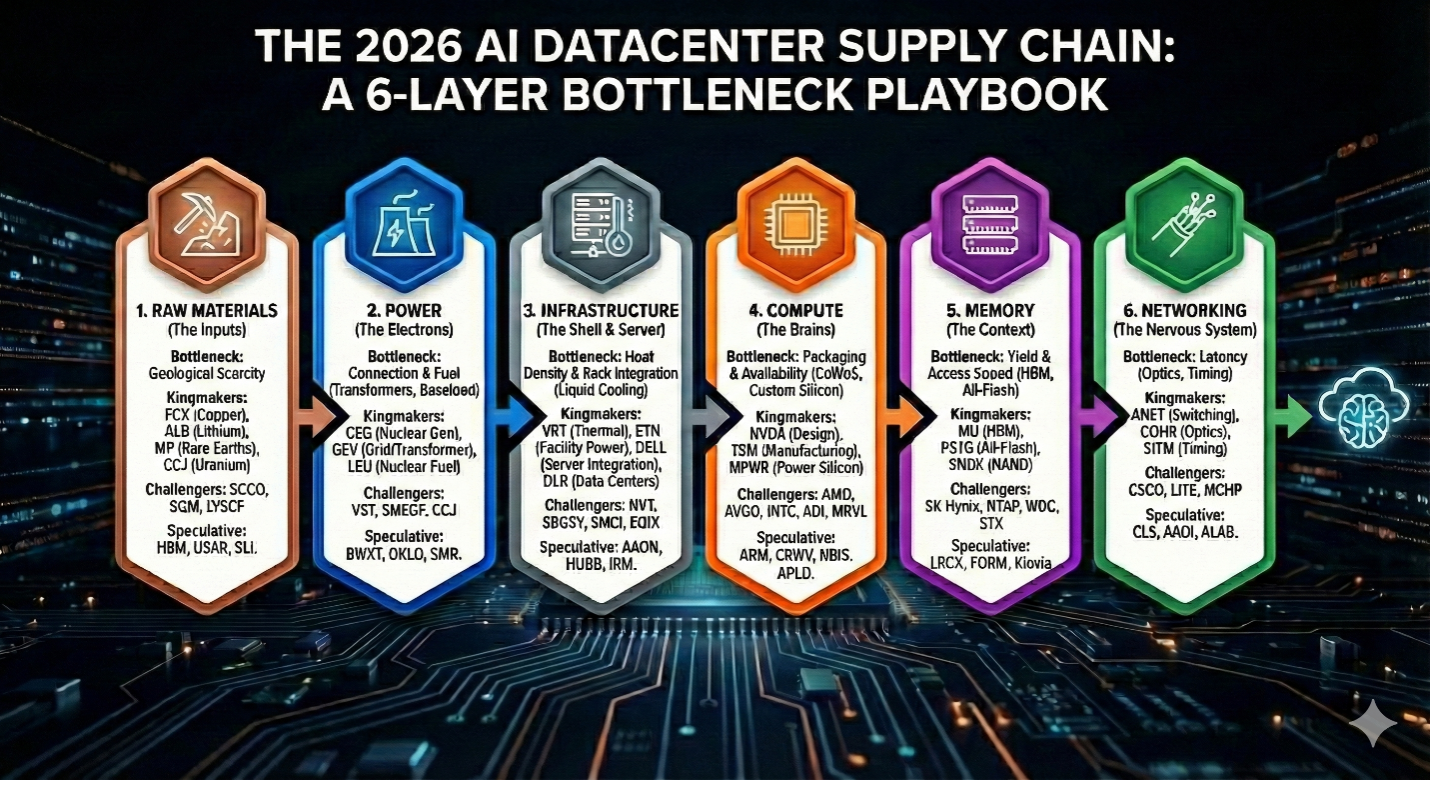

To that end, I have identified the 6-Layer AI Bottleneck Playbook.

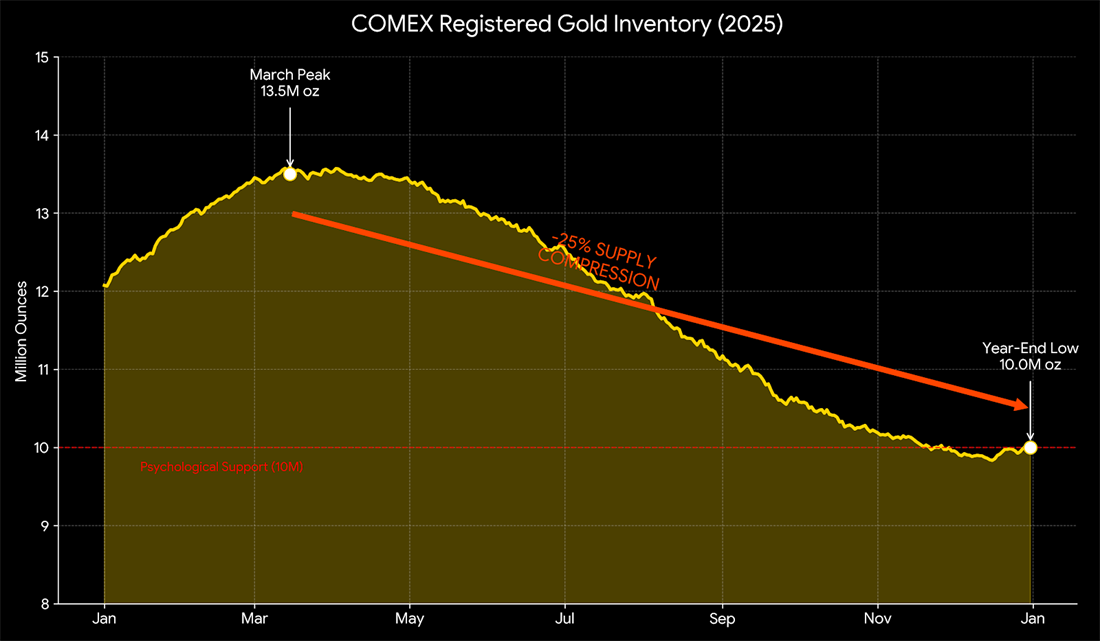

1. The Raw Materials Layer: You can print money, but you can’t print copper — and you can’t code lithium. The physical inputs required for this buildout are in short supply. We face a 10-million-ton copper deficit over the next decade.

The Play: Own Western copper, lithium, and uranium. The ground itself is now a strategic asset.

2. The Power Layer: AI is an energy vampire. Big Tech is being forced to build its own power generation, bypassing the public grid entirely. The only solution for 24/7, carbon-free, massive-scale power is nuclear.

The Play: Own the existing nuclear fleet and the fuel cycle. They hold the keys to the energy source that fits the mission profile.

3. The Infrastructure Layer: A rack of Nvidia Blackwell chips runs so hot it would melt a standard server room. We have to retrofit the entire internet with liquid-cooling plumbing. We need new switchgear, new transformers, and massive new physical shells.

The Play: Own the companies that manage heat and physical power distribution. The “plumbers” of the AI age are about to become kings.

4. The Compute Layer: It’s no longer just about getting a raw GPU. It’s about “packaging” – the incredibly complex process of stitching the GPU and memory together on silicon. Further, the U.S. government is actively pushing American-designed custom silicon to reduce reliance on generic chips.

The Play: Own the packaging monopoly and the leaders in U.S.-designed custom silicon.

5. The Memory Layer: An AI chip without memory is useless. The new HBM (high bandwidth memory) chips are stacked vertically like skyscrapers on a microscopic scale. The manufacturing yield is terrible, and the entire global supply is sold out until 2027.

The Play: Own the domestic memory producers that have cornered the market on the high-end supply.

6. The Networking Layer: When you connect 100,000 GPUs together, copper wires are too slow. You need light. The insides of datacenters are switching from electrical cables to fiber optics and lasers.

The Play: Own the masters of optical interconnects and low-latency switching.

The Train Is Leaving

Look, I understand why this feels unsettling…

But if we lose the AI race to China, nothing else matters.

That’s why we’ve begun moving trillions of dollars – from both private coffers and the public purse – to the six bottlenecks listed above. The government is using a firehose to blast away regulatory hurdles and using its military to secure the supply lines.

In moments like this, the market rewards those who understand what’s happening and position themselves before execution begins.

Which is why I hope you’ll check out my new free broadcast.

During that event, I dig much deeper into this shift… breaking down what’s really happening behind the scenes, why this moment mirrors past mobilizations like Manhattan Project and Apollo Program, and how investors should be positioning as the next phase unfolds.

History shows where the real wealth is created.

The countdown has already begun.

Check out my new free broadcast here.

Sincerely,

Luke Lango

Editor, Early Stage Investor

Senior Investment Analyst, InvestorPlace

.png)