Category Archives: Uncategorized

Score the best of Black Friday with Xbox!

Wrap up your holiday shopping now and save time to playGAMESGAME PASSACCESSORIESDEALS

![]() 0WRAP UP THE JOY

0WRAP UP THE JOY

OF GAMINGSHOP NOW ❯

The wait is over! Light up the holidays with Xbox and save on your favorite ways to play with the best deals of the season.

Unwrap savings on Xbox accessories

Save now on select Xbox accessories. Add color, style, and immersive gaming to any setup now.SHOP NOW ❯

Make it personal with free engraving

Make it yours or theirs. Get free engraving and save on select components and top cases with Xbox Design Lab.DESIGN YOURS ❯

The gift for any Xbox gamer

Start your shopping with an easy win! With an Xbox Gift Card, you can give the freedom of choice, whether they’re looking for games, add-ons, consoles, accessories, or more.GET A GIFT CARD NOW ❯

Xbox Mastercard

Apply now and for a limited time only, enjoy a bonus of 10,000 card points (a $100 value!) after qualifying account activity. Terms apply.APPLY NOW ❯

Save on select Xbox games

Get up to 75% off when you shop these games and bring a smile to yourself or someone special.SHOP NOW ❯

Call of Duty®: Black Ops 7

Don’t miss out! Save 15% on the biggest Black Ops ever for a limited time.GET IT NOW ❯

Enjoy Xbox Game Pass

This season, stream and play hundreds of games on any device, including more day-one games than ever before!2 Plus, in-game benefits, faster rewards, and much more.1,3JOIN GAME PASS ❯

Earn more with Rewards

As you play the games you love and shop the Store for everyone on your list, earn Rewards points you can turn into Xbox Gift Cards for more fun and games.3EARN WITH XBOX ON MOBILE ❯ EARN WITH XBOX ON PC ❯

The best deals of the year

Discover more Black Friday deals to shop and save with Xbox for the holidays.SHOP DEALS ❯ FOLLOW XBOXMY ACCOUNTMY GAMER PROFILEXBOX PC APPXBOX MOBILE APPSUPPORT

1. Benefits vary by Xbox Game Pass plan. Game library varies over time, by region, device, and Xbox Game Pass plan. xbox.com/gamepass. https://www.ea.com/ea-play/.

2. Xbox Cloud Gaming: Xbox Cloud Gaming requires an Xbox Game Pass subscription and supported device (both sold separately). Cloud playable games not included with Xbox Game Pass are sold separately, and may be made available with Xbox Game Pass in the future. Game library varies. Stream directly on Xbox consoles, or with the Xbox app or at xbox.com/play on supported devices. Select regions (xbox.com/regions) and devices at xbox.com/cloud-devices. See cloud gaming library (xbox.com/play).

3. Rewards: Terms apply. Microsoft Account required. Select markets only. Rewards vary by Game Pass Plan and Rewards level. Point values vary by local market currency, Rewards level, and the number of points redeemed. Point multipliers compared to Game Pass Essential earning potential. Gameplay rewards for 18+. Exclusive quests with Premium and Ultimate plans only, for titles in the Game Pass library. Excludes PC Games that require 3rd party launchers or are played on Battle.net. Playtime required for all quests. Qualifying purchases at Microsoft Store (online, or on Windows or console) at Rewards with Xbox.Unsubscribe | Privacy Statement

Microsoft Corporation

One Microsoft Way

Redmond, WA 98052

© 2025 Microsoft Corporation. All Rights Reserved. All trademarks are the property of their respective owners.

Amazon Enters Correction Zone—Time to Panic, or to Load Up?

Arizona-made nanochips the new millionaire maker? (From Banyan Hill Publishing)

Amazon Enters Correction Zone—Time to Panic, or to Load Up?

Written by Sam Quirke on November 27, 2025

Key Points

- Amazon has fallen into correction territory after dropping more than 15% from its all-time high earlier this month.

- Yet buyers are already stepping back in, with shares up more than 6% from last week’s lows.

- Analysts remain almost universally confident, calling the move a reset rather than the start of a reversal.

Shares of Amazon.com Inc. (NASDAQ: AMZN)have spent the past two weeks under pressure, sliding from record highs near $260 at the start of the month to almost $215 last week. The good news for investors is that despite that sharp move, the stock hasn’t broken any key technical levels, and momentum is already improving.

It appears that much of the selling was driven by a broader souring of sentiment, especially in tech stocks. However, giving up more than 15% of gains without much defense from the bulls is never a good look. The big question now as we head into Thanksgiving weekend is whether this pullback marks the start of something deeper or a rare opportunity to buy one of 2025’s best-performing mega-caps at a discount.

Lock In 7%–9% Yields Before Everyone Else Does (Ad)

Here’s what income-focused investors are discovering fast:

The biggest payouts in are NOT coming from trendy tech…

But from a powerful wave of high-yield dividend stocks quietly dominating the market.

Our newest research reveals three of the strongest cash machines in today’s income landscape[Download Your Free Report Before It Goes Public]

A Healthy Correction

Before the selloff, Amazon had rallied as much as 60% from April, a run that was bound to attract profit-taking, especially after the earnings inspired a gap-up in late October.

The current drop officially puts the stock in correction territory, but it hasn’t come close to testing, let alone breaking any lows.

Technically, the setup looks more like a cooling phase than a collapse, and all the major moving averages and trend lines are intact.

Notably, trading volume during the decline has stayed moderate, with the most volume in recent weeks on green days, and no signs of panic selling.

The Fundamentals Remain Strong

Much of this strength stems from Amazon’s latest earnings report at the end of October, which confirmed that its growth story is alive and kicking. As MarketBeat highlighted at the time, all of the company’s major revenue engines are firing on all cylinders, and the outlook is bright heading into 2026.

Margins are trending higher, helped by cost discipline and automation, and cash flow continues to grow. The broader narrative hasn’t changed: Amazon is still a $2.5 trillion growth story that dominates every market it operates in and has ample room to grow. From a valuation standpoint, the recent pullback also made it more attractive to investors on the sidelines, and it’s perhaps no surprise that shares have been snapped up quickly so far this week.

My research tells me this gold stock will rise 400% in Q1 2026 (Ad)

“Like buying gold for $1,000/oz”

If you could go back in time to 10+ years ago and buy gold for $1,000 an ounce, it would be one of the biggest no-brainer decisions and an easy 4X gain. But you can’t go back…

Gold analyst Garrett Goggin believes there’s a similar opportunity right now in his #1 favorite gold stock.Own Garrett’s #1 Gold Stock Now: Click here to see the details

Analysts Back the Rebound

It’s also no surprise that Wall Street is treating this correction as a buying opportunity as well.

Rosenblatt Securities, for example, reiterated its Buy rating on Tuesday along with its $305 price target, implying more than 30% upside from current levels.

This echoed the move by BNP Paribas on Monday, which upgraded the stock to Outperform, and dozens of other analysts who’ve been calling the stock a red-hot buy for months.

With a street-high analyst price target of $360, the consensus on Amazon underscores widespread confidence that this is a temporary pause, not the beginning of a breakdown.

Technical Setup Looks Constructive

Recent selling has also improved the technical setup. Having been in overbought territory earlier in November, Amazon’s Relative Strength Index (RSI) has cooled nicely towards the low 40s, helping to reset momentum without causing cracks in the broader trend.

Support around the $210-215 mark has been tested multiple times in recent months without breaking, suggesting a firm base has formed. A close above $240 in the coming sessions would confirm that buyers are back in control and could pave the way for a retest of $260 highs before year-end.

Broader macro sentiment will play a big part in that happening, and for now, at least, it’s looking good. The S&P 500 has been rallying hard since Monday morning, risk appetite is opening up once again, and rate-cut expectations are growing.

Even if volatility persists in the near term, it’s hard to bet against Amazon’s long-term trajectory. Few companies have such a combination of scale, innovation, and operational discipline. This correction may look sharp on paper, but it seems likely that future investors will look back on it as a golden entry opportunity ahead of fresh highs into 2026.

Featured Stories:

- SanDisk Joins the S&P 500: Inside the Index Effect Rally

- Buffett, Gates and Bezos Dumping Stocks (From Banyan Hill Publishing)

- Tesla Just Got Called a “Must Own” Stock—Here’s Why

- Larry’s Unexpected Black Friday Move(From Brownstone Research)

- Why Gold Loves Trump as Much as Trump Loves Gold

- Google’s Gemini 3 Sends Broadcom Soaring: TPUs Take Center Stage

- Palantir Isn’t Just Riding the AI Boom—It’s Orchestrating It

Did you like this article?

Thank you for subscribing to MarketBeat!

MarketBeat empowers investors to make better financial decisions by delivering up-to-the-minute financial information and unbiased market analysis.

If you have questions about your account, please don’t hesitate to email our South Dakota based support team at contact@marketbeat.com.

If you would like to unsubscribe or change which emails you receive, you can manage your mailing preferences or unsubscribefrom these emails.

© 2006-2025 MarketBeat Media, LLC. All rights protected.

345 N Reid Pl. #620, Sioux Falls, SD 57103-7078. USA..

TSee Also: Claim Your Share of $5.39 BILLION in AI Equity Checks(From Angel Publishing)

Former CIA to Trump – Will you shut down this secret lab?

![]()

AN OXFORD CLUB PUBLICATION

Loyal reader since August 2025

Editor’s Note: Did you miss this?

Jim Rickards at Paradigm Press says he recently visited a lab that’s even more secretive than Area 51…

He shares some of his findings here.

– James Ogletree, Senior Managing Editor

Former CIA to Trump – Will You Shut Down This Secret Lab?

Dear Reader,

Deep in the sands of New Mexico lies a government lab so secret it makes Area 51 look like a tourist spot…

The scientists here aren’t toying with viruses or weather manipulation technology…

No, they’re into something far more alien…

A technology with the power to completely flip how wars are waged — on soldiers and civilians.

And nothing will keep them from unleashing their creation on America.

I know, because I recently visited this lab.

And the dangerous thing I saw could be released as soon as January 13th…

In my gut, I know there’s no stopping it.

That’s why I’ve already prepared my finances…

So that instead of losing money when this thing is unleashed…

My money will be backed by a strategy with an 88% win rate over 10 years straight.

Click here for my full analysis before it’s taken offline.

Sincerely,

You are receiving this email because you subscribed to Wealthy Retirement.

Wealthy Retirement is published by The Oxford Club.

To stop receiving special invitations and offers from Wealthy Retirement, please click here.

Please note: This will not impact the fulfillment of your subscription in any way.

Questions? Check out our FAQs. Trying to reach us? Contact us here.

Please do not reply to this email as it goes to an unmonitored inbox.

Privacy Policy | Whitelist Wealthy Retirement

© 2025 The Oxford Club, LLC All Rights Reserved

The Oxford Club | 105 West Monument Street | Baltimore, MD 21201

North America: 866.237.0436 | International: 443.353.4540

Oxfordclub.com

Nothing published by The Oxford Club should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by The Oxford Club should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of The Oxford Club, LLC, 105 West Monument Street, Baltimore, MD 21201.

REF: 000142349377

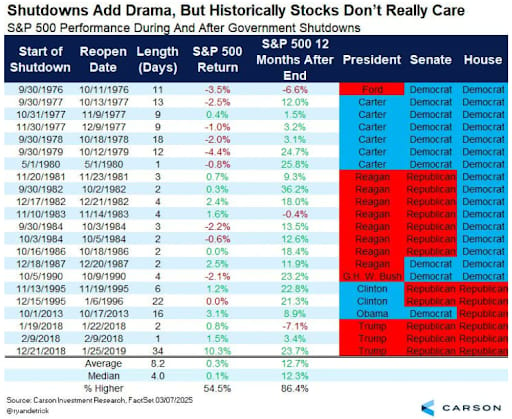

Another Reason Why You Shouldn’t Trade On The Mainstream News

November 28, 2025

Contrary to the mainstream’s talking points…

The government shutdown didn’t shake the market.

In fact, it went on to set new all-time highs.

And here’s the part no one on TV will admit…

Markets have done the same thing during past shutdowns, too.

And that’s why I don’t get distracted by the headlines. Because there will always be noise…

The only thing that matters is the data.

If you can focus on the right information… you’ll be way ahead of most traders.

The good news is…

You don’t have to dig through endless tickers. I’ve already done the heavy lifting.

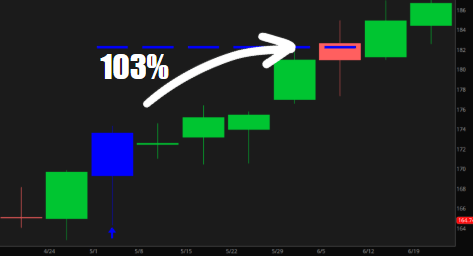

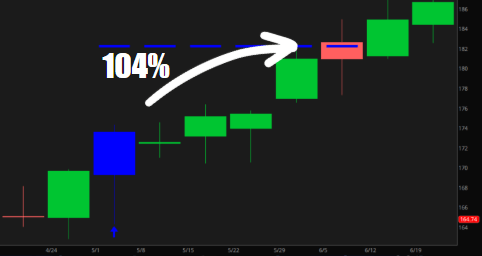

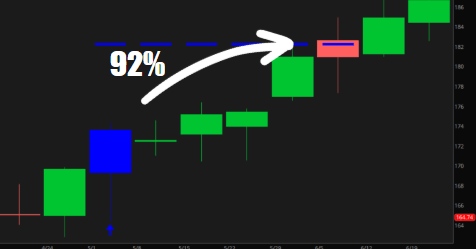

And right now, the chart data I’m tracking has already highlighted 10 trades with the highest probability of surging.

I’m talking about the same data that caught winners like 103% on TSLA…

104% on GM…

And 92% on MU…

Now, there were smaller wins and those that didn’t work out. There are bound to be winners and losers in trading.

But if you want to tune out the mainstream and focus on what’s actually moving the market…

I recently held a session where I gave the full details…

With the important charts backing each setup…

You’ll find the full breakdown in the replay here.

-Investimonials

We develop tools and strategies to the best of our ability, but no one can guarantee the future. There is always a risk of loss when trading. Past performance is not indicative of future results. From 11/30/23 to 9/26/25, the win rate on live published alerts was 58.1%, and the average return was 16.28% over an 18-day hold time

Update your email preferences or unsubscribe here

© 2025 Millionaire Publishing

66 W Flagler St. Ste. 900

Miami, FL 33130, United States of AmericaTerms of Service

$1 Deal: Closest thing to a ‘win/win’ trade plan

In 2026, Big Tech is set to pay $900 billion in what I call ‘AI Tolls.’

Every tech company that wants access to AI has no choice but to pay them.

That’s why I’m convinced AI Tolls is the closest thing to a ‘win/win’ trade plan I have seen in this hypergrowth sector. But you don’t need to be rich or connected to get in on it…

For the first time ever, you can unlock my entire trade plan for only $1. Previously, you would’ve had to pay many times this amount to access it.

But the moment the Black Friday–Cyber Monday window closes, this offer disappears — and won’t return until next year.

Here’s everything you’ll get for just $1.

Sincerely,

Tim Bohen

P.S. Every major tech company racing to scale AI must buy the same key technology at the center of my trade plan. You can unlock its ticker and analysis for just $1 — but only during this Black Friday/Cyber Monday deal.

Today’s Featured Story

If You Wait for the Dip, Micron Technology Could Leave You Behind

Written by Thomas Hughes. Published 11/14/2025.

Key Points

- Micron Technology is on the brink of a major demand ramp that will last for years as AI demand and data center growth fuel the business.

- As DRAM prices surge, Analysts are lifting their targets—but not fast enough.

- While MU stock is poised to correct in mid-November, robust trends and forecasts pointing to the $300 level might prevent it.

While concerns that the AI demand outlook is overblown and that players like OpenAI may struggle to meet GPU commitments are valid, these are bricks in a Wall of Worry built on a robust demand spike and the foundations of a multi-year memory chip supercycle.

Evidence of that supercycle appears in moves by DRAM chipmakers — notably Samsung (OTCMKTS: SSNLF) — to raise prices, and in Morgan Stanley’s decision to lift its price target. More upward revisions are likely in the coming quarters.

Market uncertainty is high — but this memecoin is gaining momentum (Ad)

Something with massive upside potential is still flying under the radar…

Discover the brand-new memecoin that is poised to soar next.Discover the #1 Memecoin to Own Right Now

Those macro signals underscore a rising tide that directly benefits Micron (NASDAQ: MU), one of the few companies positioned to capitalize on surging DRAM demand. Micron’s price action peaked in November and could see a pullback — but for long-term investors that pullback would be a bullish buying opportunity.

Analysts Can’t Keep Up With Micron’s Rapidly Rising Growth Trajectory

Morgan Stanley analyst Joseph Moore and his team raised their price target for MU to $325, roughly 50% above their prior target.

The new target implies about 40% upside from mid-November highs and is likely conservative.

In Morgan Stanley’s view, the demand-driven price surge supports an earnings outlook that takes Micron into “uncharted territory” from a profit standpoint. “We think the stock has yet to fully price in the upside that’s coming,” they said. Their model assumes DRAM prices could rise by as much as 50% in some scenarios — and even that projection has shown signs of being cautious.

That thesis was reinforced almost immediately when Samsung raised prices by about 60%, citing a global shortage of AI-capable HBM3E (or better) memory units that are critical to the AI industry. Each GPU — whether from NVIDIA (NASDAQ: NVDA) or Advanced Micro Devices (NASDAQ: AMD) — is built with clusters of HBM stacks, each containing up to 12 DRAM dies. That architecture has driven an exponential increase in demand for Micron’s products relative to what we’ve seen so far from NVIDIA and what we expect when AMD launches the MI450 line.

The takeaway for investors is straightforward: Micron is experiencing an unprecedented surge in revenue and earnings potential that the stock price has not yet fully reflected.

Micron Is a Deep Value, But the Market Isn’t Sure How Deep

Analysts will need to raise near- and long-term estimates to reflect the strength in demand and pricing. Consensus forecasts currently show some strength for 2026–2028, but they do not yet capture the surge implied by recent trends, nor have many forecasters extended their targets further out.

As of mid-November 2025, Micron was trading at roughly 14x trailing earnings and about 12x on its 2028 forecast. If the valuation multiple expands materially — for example, by 50% over the coming years — the stock could appreciate significantly even without dramatic additional earnings outperformance.

With those factors in play, Micron’s share price could plausibly reach triple-digit gains relative to November highs over the next few years.

Analyst coverage has increased to 38 firms, sentiment has firmed (with a Buy bias around 88%), and price targets are trending higher.

The consensus lagged the market in November, which helped create a short-term correction outlook, but Micron is still up more than 45% over the prior 12 months. Morgan Stanley’s high-end target of $325 and the series of recent upward revisions are all above the prior consensus.

Micron Is at a Peak and Poised to Pull Back… But It Might Not

Micron’s stock price reached a peak in November and could see limited gains over the next few weeks to months. Headwinds include elevated short interest, which is near long-term highs, and institutional activity: many institutions reduced their holdings in the first half of Q4.

If a correction occurs, the stock could fall into the $185–$200 range before finding support. The caveat is that positive analyst sentiment and steady retail interest may provide enough backing to hold prices near current highs. In that case, Micron could consolidate at or near these levels and potentially move to new highs later this year or in early 2026.

Thank you for subscribing to Insider Trades Daily, which covers the most recent insider buying and selling activity from Wall Street CEO’s, CFO’s, COO’s and other insiders.

This message is a sponsored email for Timothy Sykes, a third-party advertiser of InsiderTrades.com and MarketBeat.

If you need assistance with your account, feel free to email our South Dakota based support team at contact@marketbeat.com.

If you no longer wish to receive email from InsiderTrades.com, you can unsubscribe.

© 2006-2025 MarketBeat Media, LLC. All rights reserved.

345 N Reid Place, Suite 620, Sioux Falls, S.D. 57103-7078. United States of America..

Link of the Day: AI Continues to Surge—Here Are 2 Stocks Still Under $15 (Click to Opt-In)

Bitcoin is dead?

Dear Reader,

There’s been no better investment on the planet this past decade than Bitcoin.

Not gold …

Not bonds …

Nothing.

Over the last ten years …

Bitcoin’s returns have more than doubled that of gold, real estate and stocks …

A simple $1 investment in Bitcoin when it first traded seventeen years ago …

Would be worth more than $100 million dollars.

That’s enough to make your head spin.

It might give you a serious case of FOMO.

But …

Before you rush to move your retirement plan into Bitcoin …

Hoping for these types of gains …

I’ve got news for you.

It’s not going to happen.

Because as we speak …

A seismic shift is reshaping the crypto landscape.

Money is flowing out of Bitcoin …

And into a handful of exceptional cryptos.

Coins that have the potential for their gains to blow past Bitcoin.

And it’s all happening at a rapid pace.

Presenting investors with an amazing opportunity.

To find out more about this huge development, click here

Regards,

Chris Hurt, Weiss Ratings

P.S. Juan Villaverde has called every bull and bear market in crypto since 2012.

Including the top and bottom of Bitcoin in 2018 …

To within days.

As a matter of fact …

He’s sitting on four different gains of more than 1,100% on Bitcoin.

But now …

He’s saying it’s time to invest in another crypto.

To find out what it is, click here.

Today’s Bonus News

Why GRAIL Stock Could Be Biotech’s Next Big Breakout

Written by Bridget Bennett. Published 11/19/2025.

Key Points

- Insider buying is a reliable signal in market pullbacks, offering long-term confidence amid short-term volatility.

- Biotech stock GRAIL is one to watch, with its breakthrough cancer detection technology nearing FDA approval.

- Despite economic concerns, the American Dream is still attainable through long-term investing, saving, and strategic financial choices.

Retail investors are understandably on edge after several sessions of market volatility. But bestselling author and Oxford Club strategist Alexander Green, in his new book The American Dream, says we’re still in one of the best times in history to build wealth—especially if you think long term and stick to time-tested principles.

According to Green, this pullback isn’t as severe as it may feel. “Just last Wednesday, the Dow hit an all-time high,” he noted, explaining that recent selling pressure has more to do with valuation concerns and interest-rate doubts than any fundamental breakdown.

Why the Market Pulled Back

The $650 Million Bet on AI’s Future (Ad)

In 1999, Sutter Hill Ventures made a bold bet on Nvidia before anyone had heard of it. Now, they’re going all-in on Nvidia’s hush-hush partner that’s powering their new Blackwell chip. Discover the little-known company that’s attracting massive investments from the visionaries behind Nvidia’s 100,000% rise.Unlock the hidden key to AI’s future.

Green attributes the dip to two core concerns. First, investors are starting to question elevated tech and AI valuations, especially as earnings season begins to test those expectations.

Second, inflation data and slower hiring have tempered hopes that the Fed will cut rates in December. With the central bank emphasizing a “data-dependent” posture, markets are less certain that relief is coming this year.

Why Selling Now Might Be the Wrong Move

Rather than trying to predict what will happen next week, Green urges investors to zoom out. He calls himself “a long-term optimist,” and points out that historically the market’s trend has been upward.

For traders, a little short-term caution might be warranted. But for long-term investors, these dips are often opportunities to buy high-quality stocks at more attractive prices.

Insider Buying Can Point the Way

One of the most reliable indicators in times like these is insider buying. Green suggests that when officers and directors—people with access to nonpublic financial information—are putting money into their own companies, that’s worth noting.

He recommends tracking insider trading activityto see which stocks corporate executives are buying, not just selling. While insiders aren’t always right, their actions can provide a useful signal when markets are in flux.

A Biotech Breakout to Watch: GRAIL

One sector Green is focused on is biotech, where artificial intelligence is helping accelerate drug development and reduce costs. He highlighted one company in particular: GRAIL (NASDAQ: GRAL).

GRAIL, spun off from Illumina, has developed the Galleri Test, which can detect more than 50 types of cancer from a simple blood draw. Green has even used the test himself and calls it “a good feeling” to know you’re clear of so many deadly diseases—especially cancers like pancreatic that often go undetected until late stages.

With fast-track status with the FDA and potential insurance reimbursement ahead, Green sees GRAIL’s roughly $3 billion market cap as just a starting point.

The Biotech Risk—and Big Pharma’s Appetite

Of course, biotech carries risk. Most drug candidates never make it through all phases of clinical trials. Still, larger pharmaceutical companies like Merck (NYSE: MRK), Pfizer (NYSE: PFE), and Bristol Myers (NYSE: BMY) are actively acquiring promising small caps to replace expiring patents.

Green cited Johnson & Johnson (NYSE: JNJ) as a recent example. The company invested in a private prostate-cancer drug before it received FDA approval—underscoring how aggressive Big Pharma can be when clinical trials look promising.

Green believes biotech is especially compelling now because healthcare is largely recession-proof. Whether the economy is growing or shrinking, people still seek treatment. For investors looking to weather volatility, sectors like healthcare, utilities, consumer staples, and food companies tend to offer steady demand and less drama than high-flying AI names.

The American Dream Is Still Possible—But Mindset Matters

Despite economic challenges, Green argues the American Dream is far from dead. He wrote The American Dream to counter the narrative that it’s out of reach, and says he was surprised by polls showing nearly 70% of Americans believe it’s no longer attainable.

The reality, he says, is that with access to low-cost investment tools, no-commission trading, and widely available information, building wealth has never been more accessible. The challenge is knowing what to do—and having the discipline to do it.

He breaks it down simply: if a 25-year-old invests $190/month in an S&P 500 index fund, they could have $1 million by age 65—tax-free in a Roth IRA.

No extreme frugality required. “You could eat out, take trips, and still build wealth,” Green says—as long as you save and let that money compound.

Creative Solutions for Today’s Housing Market

Housing may feel out of reach, but Green says it doesn’t have to be. Mortgage rates have doubled and prices are up about 50% since the pandemic—but there are still ways in.

He shares his personal story of buying two houses with no money down by working directly with motivated sellers and assuming their mortgages—a method sometimes called a “contract for deed.” It might not get you the perfect house right away, but it can help you start building equity sooner than you think.

Stay Focused on the Long Game

Volatile markets come and go. What matters is how you respond. Whether it’s tracking insider moves, exploring high-upside sectors like biotech, or simply believing in your ability to build a financial future, Green’s message is clear: the American Dream is still within reach.

You just have to keep your eyes on it—and take the next right step.

This email message is a sponsored email sent on behalf of Weiss Ratings, a third-party advertiser of MarketBeat. Why did I get this email content?.

11780 US Highway 1,

Palm Beach Gardens, FL 33408-3080

Would you like to edit your e-mail notification preferences or unsubscribe[/link] from our mailing list?Copyright © 2025 Weiss Ratings. All rights reserved.

If you need help with your newsletter, please email our South Dakota based support team at contact@marketbeat.com.

If you would no longer like to receive promotional emails from MarketBeat advertisers, you can unsubscribe or manage your mailing preferences here.

© 2006-2025 MarketBeat Media, LLC. All rights protected.

345 N Reid Pl., Sixth Floor, Sioux Falls, S.D. 57103-7078. USA..

Check This Out: Deplorable, but insanely profitable? (From Timothy Sykes)

Nvidia’s 3 New “Unauthorized” Silent Partners

Dear Reader,

Nvidia just became the world’s first $5 trillion company.

They’re bigger than the stock markets of Canada, the UK, France, Germany and Italy.

Nvidia’s value has skyrocketed since ChatGPT made AI daily front-page news three years ago.

That’s because, without Nvidia, AI stops.

But here’s the thing …

AI’s undisputed leader can’t do it all by themselves.

Nvidia depends on companies who help make their revolutionary tech possible.

Many of these companies …

Nearly 1,100 in all …

Are part of Nvidia’s official Partner Network …

But that’s not who I’m talking about.

The companies I’m revealing work with Nvidia behind the scenes.

You won’t find them on any official Nvidia list.

That’s why I call them Nvidia’s “Unauthorized” Silent Partners.

Companies fitting this description have done very well since they first partnered with Nvidia.

In fact, some exceptional firms have stocks that have gone up as much as 1,938% …

4,501% …

9,793% …

And even 22,713% …

And now, I’ve just uncovered three new “Unauthorized” Nvidia Silent Partners.

They’re each playing vital roles …

As Nvidia pivots to two breakthrough technologies …

Projected to be worth $24 trillion.

These technologies need Nvidia …

And Nvidia needs these Silent Partners.

Click here to find out more about these “Unauthorized” Silent Partners.

Michael Robinson, Editor

Disruptors & Dominators

Featured Content from MarketBeat

Why These 3 Tech Stocks Could Be the Best Opportunities You’re Overlooking

Written by Nathan Reiff. Published 11/17/2025.

Key Points

- Outside of the largest names in the space, the tech sector has a number of often-overlooked firms poised to thrive.

- Investors eager to look beyond the Magnificent Seven might look to semiconductor firm Marvell or software and digital platform engineering company EPAM Systems.

- Those considering a tech-adjacent play outside of the sector might find reason to be optimistic about Align Technology’s potential.

The Magnificent Seven—the tech-focused firms among the largest and most influential companies in the world—dominate the broader market, accounting for a full one-third of the S&P 500. The Roundhill Magnificent Seven ETF (BATS: MAGS) provides equal-weight exposure to these seven stocks and has returned nearly 20% year-to-date (YTD). This performance outpaces the broader market despite the volatility the Magnificent Seven experienced earlier in 2025.

Investors often lump the entire tech sector together when thinking about the Magnificent Seven. While this group can serve as a bellwether for the broader sector, limiting a portfolio to these names may cause investors to miss promising opportunities among tech-adjacent companies that combine solid fundamentals with distinctive market niches.

5 Stocks That Could Double in 2026 (Ad)

While everyone’s making predictions about what might happen in 2026, we’ve identified 5 stocks with catalysts that are already locked and loaded.

These aren’t hopes or projections. These are scheduled events, signed contracts, and approved projects that will play out over the next 12 months.

The difference between 100% gains and missing out completely? Positioning before 2026 arrives.Click here to get your free copy of this report

Align Technology Inc. (NASDAQ: ALGN), Marvell Technology Inc. (NASDAQ: MRVL), and EPAM Systems Inc. (NYSE: EPAM) are three under-the-radar companies with notable upside potential.

Align Technology Leverages AI to Support Recovery in Orthodontic Market

Align Technology, the maker of the digital platform behind the Invisalign orthodontic system, is not a pure-play tech stock but is heavily dependent on technology, making it an option for investors looking for tech exposure in a different sector.

In the third quarter, Align topped analyst predictions across multiple metrics: revenue rose about 2% year-over-year (YOY) to nearly $1 billion, earnings per share (EPS) beat analyst expectations by $0.23, and non‑GAAP operating margin came in above forecasts at 23.9%. Growth has been supported by higher adoption rates among teens and children, helped in part by AI-driven treatment planning that improves efficiency.

That said, Align has faced headwinds: sales growth has slowed and shares are down by about one-third YTD. If adoption rates continue to climb, the company could return to stronger earnings performance.

Analysts are split. They forecast more than 12% earnings growth in the year ahead, which would represent an acceleration, but only seven of 16 ratings for ALGN shares are Buys. Still, a consensus price target above $175 implies roughly 28% upside, making Align a possibility for investors with a higher risk tolerance.

Marvell Technology Capitalizes on AI and Amazon Cloud Demand

A smaller player in the semiconductor space, Marvell has carved out an important niche by providing system-on-chip (SoC) solutions and products that are critical to data infrastructure.

For Marvell’s second quarter of fiscal 2026 (its fiscal year ends in early February), revenue topped $2 billion, up 58% year-over-year, driven largely by a strong data center business.

It’s no surprise given that a substantial portion of Amazon’s (NASDAQ: AMZN) AWS cloud service runs on Marvell chips.

Marvell is also streamlining its operations. The company sold its automotive Ethernet operations for $2.5 billion earlier this year, which has freed cash to focus on expanding AI and data-center product lines, repurchasing shares and boosting R&D investment.

About two-thirds of the 36 analysts covering Marvell rate it a Buy, and consensus forecasts call for earnings to surge by nearly 120% in the year ahead.

EPAM Systems Rises on AI and Global Talent Diversification

EPAM provides software engineering and digital platform services across multiple industries.

Shares of EPAM have struggled this year, falling more than 21% YTD. However, a recent earnings beat—including 19% year-over-year revenue growth, record free cash flow and a robust share-repurchase program—has sparked a rally in recent weeks.

A major factor in EPAM’s earlier decline was its historically heavy reliance on talent based in Russia, Ukraine and nearby regions. As the company diversifies its geographic footprint, it should be less vulnerable to disruptions from regional turmoil.

EPAM is also pivoting toward AI engineering and related services. Analysts appear optimistic: 13 of 18 analysts rate EPAM shares a Moderate Buy, and the consensus implies roughly 19% upside to nearly $214 per share.

This message is a sponsored message provided by Weiss Ratings, a third-party advertiser of MarketBeat. Why did I get this message?.

11780 US Highway 1,

Palm Beach Gardens, FL 33408-3080

Would you like to edit your e-mail notification preferences or unsubscribe[/link] from our mailing list?Copyright © 2025 Weiss Ratings. All rights reserved.

If you have questions or concerns about your subscription, please contact our South Dakota based support team at contact@marketbeat.com.

If you would no longer like to receive promotional emails from MarketBeat advertisers, you can unsubscribe or manage your mailing preferences here.

© 2006-2025 MarketBeat Media, LLC. All rights protected.

345 North Reid Place #620, Sioux Falls, South Dakota 57103-7078. USA..

Link of the Day: AI Continues to Surge—Here Are 2 Stocks Still Under $15 (Click to Opt-In)

An issue with your MarketBeat account we need to resolve.

Good evening,

As you prepare for the week ahead, I wanted to bring to your attention an important matter that could significantly impact your investment success.

Upon reviewing our subscriber accounts, I noticed that your name is currently missing from our exclusive stock alert distribution list. This means that you may be missing out on valuable information and the opportunity to make well-timed investment decisions.

Our next stock alert is scheduled to be sent out tomorrow, and I want to ensure that you don’t miss out on this potentially profitable opportunity.

Joining our alert distribution list is quick and straightforward. Simply click on the link below to sign up and guarantee that you receive our future alerts:

Add your name to the alert distribution list here

By becoming part of our alert list, you’ll gain access to crucial insights, expert analysis, and real-time updates that can significantly influence your investment strategy.

Staying well-informed, making informed choices, and positioning yourself for financial success will become easier than ever.

Thank you for your attention, and we look forward to keeping you informed with our stock alerts!

Rebecca McKeever

MarketBeat.com

Thank you for subscribing to MarketBeat!

We empower investors to make better financial decisions by delivering up-to-the-minute financial information and objective market analysis.

This email is a sponsored message from MarketBeat Alerts, a third-party advertiser of MarketBeat. Why was I sent this message?.

If you need help with your subscription, please contact MarketBeat’s U.S. based support team at contact@marketbeat.com.

If you would like to unsubscribe or change which emails you receive, you can manage your mailing preferences or unsubscribe from these emails.

© 2006-2025 MarketBeat Media, LLC. All rights reserved.

345 N Reid Place, Sixth Floor, Sioux Falls, SD 57103. U.S.A..

Today’s Featured Content: AI in Baltimore Lab Learns to Forecast Stock Prices (See its Live Calls Now) (From TradeSmith)

This weeks Specials

THIS WEEK’S SPECIALS

Come out and enjoy the following specials across Encanterra’s restaurants this week, good through Sunday, November 30th!

These specials are available in addition to our Signature Menu.

Note that Palma is open to the general public, and the rest of the restaurants are Members only.

And Encanterra Members, be sure to check out the new menu at The Algarve, now available!

Palma Kitchen & Tap

Lunch Special

- Smoked Brisket Sandwich | $19

Slow Smoked Brisket, Onion Rings, Tangy BBQ, Coleslaw, Choice of Side

Market Fish

- Shrimp Bahn Mi Bowl | $28

Crispy Shrimp, Brown Rice, Mint, Carrots, Cilantro, Peppers, Cucumbers, Sweet Chili Vinaigrette

Dinner Special

- Bleu Cheese Crusted Petite Sirloin | $28

Peppercorn Rubbed Steak, Bleu Cheese Crust, Garlic Whipped Potatoes, Roasted Broccoli and Cauliflower, Red Wine Demi

Cocktail Special

- Spiced Timber Sour | $14

Cinnamon Chili Liqueur, Bourbon, Spiced Apple Syrup, Fee Foam, Lemon, Cinnamon Sugar Rim

Solaz & Beverage Cart(Encanterra Members Only)

Beverage Special

- Stormy Weather | $12

Empress Gin, Lemonade, Tonic

The Algarve (Encanterra Members Only)

Come find new favorite items on our new menu, now available!

Beverage Special

- Vanilla Cranberry Moscow Mule | $13

Vanilla Vodka, Cranberry Juice, Ginger Beer, Fresh Lime

Food Special

- Pretzel Board | $20

Giant Pretzel, Charcuterie, Stone Ground Mustard, Dried Fruits, Pumpkin Seeds

Bodega

The following menu is available Wednesday through Saturday from 3:00pm to 8:00pm for the afternoon service in Bodega:

- Dry Rub Wings | $18

- Hummus | $9

With Olive Relish, Flatbread, Sweet Peppers, English Breakfast Radishes - Flatbread | $12

Margherita, Pepperoni, Chicken Bacon Ranch - Spinach Artichoke Dip | $8

With Ciabatta - Classic Bruschetta | $7

Roma Tomatoes, Basil, Olive Oil, Garlic

——————————–

Bodega is open 7:00am-1:00pm every day, and 3:00pm-8:00pm Wednesday through Saturday. Flatbreads are available 3:00pm-8:00pm Wednesday through Saturday.

- Breakfast Special

Ham, Egg, and Cheese Croissant | $6