![]()

AN OXFORD CLUB PUBLICATION

Loyal reader since August 2025

SPONSORED

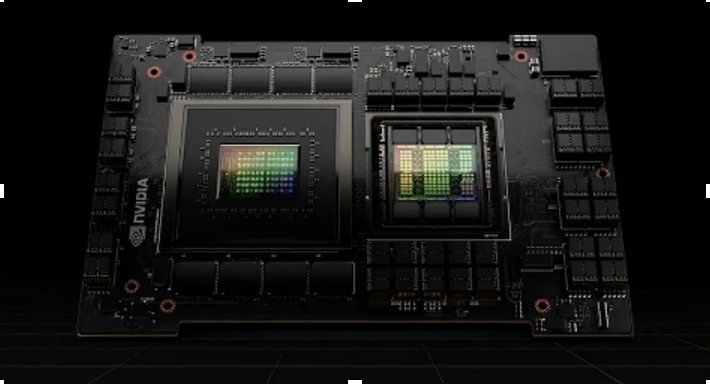

Stop chasing NVIDIA

If you’re chasing Nvidia, Amazon, or Palantir right now, I’ve got one word for you: Stop. Because according to legendary investor Whitney Tilson, AI mania is about to leave millions of investors holding the bag.

Whitney just went public with one of his most controversial predictions in years:

“The AI boom is real… but the next wave of gains won’t come from where everyone expects.”

Instead, he believes a stealthy, little-known stock is about to blow past Nvidia in a way few investors see coming.

THE SHORTEST WAY TO A RICH LIFE

How Capitalism Makes Things Better… and Cheaper

Alexander Green, Chief Investment Strategist, The Oxford Club

Many investors earn lower returns than they should because they are far too pessimistic about the future.

That may sound surprising to those who read Monday’s column, where I detailed how government policies make things like houses, cars, groceries, and utilities increasingly unaffordable.

Yet the private sector makes things better and… increasingly affordable.

That sounds like a contradiction. But it’s not.

It is possible for goods to simultaneously become more expensive and more affordable.

To measure affordability, we need to compare the price of goods and services to hourly compensation (wages and benefits).

The resulting ratio is called the time price.

A time price is the length of time the average worker labors to afford something.

Prices are expressed in dollars and cents. But time prices are expressed in hours and minutes.

It’s possible for things to become more expensive in dollars, but cheaper in time.

Which is more meaningful? In our daily lives, time is our most limited and nonrenewable resource.

That’s why time prices matter.

And they reveal something stunning: most things have become dramatically more affordable over time.

Understand this key point: the CPI tells us if something has become more expensive.

But the time price tells us if it has become more affordable.

Time prices are an excellent way to measure increases or decreases in our abundance over time for three reasons:

- Time prices cannot understate or overstate inflation since prevailing prices and wages are used at every point on the timeline.

- Time prices are independent of currency fluctuations. (They can be measured in euros, yen, or any other currency.)

- Time prices provide a standardized way of measuring changes in wellbeing.

In their eye-opening book, Superabundance, authors Marian L. Tupy and Gale L. Pooley measured the costs of 50 commodities between 1980 and 2020.

They didn’t just find that the time prices of some of them went down.

The time prices of all of them went down.

In fact, the average time price decline of those 50 commodities – including oil, natural gas, wheat, cotton, soybeans, beef, corn, pork, and sugar – was a whopping 75.2%.

Put differently, a blue-collar worker had to work 75% less to afford the same amount of these things.

Unless we’re at the gas pump or the grocery store, however, we don’t usually buy commodities. We buy finished goods.

Yet the time price decline in these was just as dramatic. And in many cases, more so.

Over the same 40-year period, the time price of a utensil set declined 51%, a dishwasher declined 62%, a washer declined 65%, men’s clothing declined 72%, a bicycle declined 74%, a vacuum declined 83%, and a food processor declined 86%.

This isn’t cherry-picking. It’s across the board.

And that’s just for blue-collar workers.

White-collar workers – especially those with a college degree – saw time prices drop even more dramatically because their incomes are higher and rose faster.

It’s impossible, of course, to measure the 40-year time price decline in things like laptops, smartphones, and flat-panel TVs because none of these were even imagined in 1980.

SPONSORED

Famous Georgia Trader Reveals #1 Trade On

Monday, December 15

The man who once turned $37k into $2.7 Million in just 4 years and recently closed a 1,129% win after just TWO days on a livestream..

Just revealed the #1 trade to make onMonday, December 15...

All using a strategy that has produced an 81% win-rate over the past year.

Other price declines are hard to measure as well.

For example, how do you compare the average cost of a book in 1980 to the more than 10 million that are free to download today from Google’s digital library?

Nobody thinks about the cost of a long-distance phone call today. But growing up, I did.

In college, I could only afford to call from my school in South Carolina to my home in Virginia at night when AT&T offered lower rates.

Today, I routinely have FaceTime calls with friends overseas at no cost.

Over the last 50 years, music listeners have gone from vinyl records to 8-track tapes to cassettes to CDs to MP3 files to streaming.

Today you can listen to almost any song, anywhere, at any time for next to free.

Other products are not free but considerably more affordable when measured in hours worked.

In 1971, a pair of soft contact lenses cost $65, and a fitting by an eye doctor ran about $550, putting the total cost at $615. Unskilled workers earned about $2 an hour.

Today an eye exam is around $120, and lenses start at $200, putting the cost at $320. Unskilled workers earn around $16.51.

In other words, the time price has declined 84%.

In 1970, the price for a roundtrip airline ticket from New York to London was $550.

Blue-collar workers earned $3.93 an hour at the time. (In my family, the folks who spent so lavishly were viewed as members of the “jet set.”)

Today, the same flight has dropped to about $467 and blue-collar workers earn about $36.15. The time price has decreased 91%.

In 1972, you could book a seven-day cruise from Miami to the Caribbean for $240.

Blue-collar workers earned about $4.59 an hour at the time.

Today, you can book a seven-day cruise out of Port Canaveral for $549. For blue-collar workers who earn $36.15 an hour, the price has dropped more than 70%.

Apple introduced the Macintosh in 1984 at a retail price of $2,495.

Unskilled workers earned about $5 an hour at the time.

Today a new iMac sells for $1,299 and unskilled workers earn about $16.51 an hour.

The time price has decreased by 84.2%.

And the difference between a 2025 Mac and the 1984 Mac is like comparing a Lamborghini with a skateboard.

That’s time price abundance.

Not all categories saw time price declines. Healthcare, college tuition, and childcare – heavily regulated, heavily subsidized, and labor-intensive – have outpaced inflation.

These markets don’t benefit from the “economics of knowledge,” where producing multiple copies of a prototype costs less and less.

But even in those areas, alternatives are emerging:

- Online education is dramatically cheaper and more flexible than traditional degrees.

- AI in healthcare is improving diagnostics, streamlining care, and lowering costs.

- Many elective procedures (Lasik, cosmetic surgery, dental implants) have dropped in price significantly – because they’re outside the insurance system and thus more exposed to market forces.

In my new book, I detail how things are likely to become even more affordable in the years ahead, as I’ll discuss in my next column.

Get ready to adjust your investment plan accordingly.

Good investing,

Alex

P.S. Many of you have written to say that my new book is the perfect gift for someone who needs a bit of Christmas cheer. To learn more about The American Dream: Why It’s Still Alive… and How to Achieve It, click here.Leave a Comment

BUILD AND PROTECT YOUR WEALTH

Donald Trump’s Second Term Could Create 20,000,000 Millionaires

Is Cal-Maine’s 10% Yield About to Go Splat?

Proof: New “One Ticker Payouts” (You Can Do This Weekly!)

From Tariff Hoarding to Chart Collapse: Why Best Buy’s About to Fall 15%

MORE FROM LIBERTY THROUGH WEALTH

Bringing Your Best to Your Future

Why “Boring” Dividend Stocks Build Extraordinary Wealth

Why American Life Has Become Less Affordable

The Most Subversive Book in America

JOIN THE CONVERSATION

SPONSORED

New IPO Stock Creates Massive Controversy Online

After giant Apple deal, some say it will be the next trillion-dollar company. Decide Who’s Right Here.

You are receiving this email because you subscribed to Liberty Through Wealth.

Liberty Through Wealth is published by The Oxford Club.

Questions? Check out our FAQs. Trying to reach us? Contact us here.

Please do not reply to this email as it goes to an unmonitored inbox.

Privacy Policy | Whitelist Liberty Through Wealth | Unsubscribe

© 2025 The Oxford Club, LLC All Rights Reserved

The Oxford Club | 105 West Monument Street | Baltimore, MD 21201

North America: 866.237.0436 | International: +1.443.353.4540

Oxfordclub.com

Nothing published by The Oxford Club should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by The Oxford Club should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of The Oxford Club, LLC, 105 West Monument Street, Baltimore, MD 21201.

Ref: 000142349377