Dear valued professional,Are you ready to stay ahead of the curve in Artificial Intelligence Management Systems? Join us for a special event on Thursday, January 8th to learn about the latest requirements according to the upcoming ISO/IEC 42001:2023 standard.This is a unique opportunity to stay informed and ensure your organization is prepared for the future of AI management. Don’t miss out on this valuable learning experience!Sincerely, Dear valued professional,Are you ready to stay ahead of the curve in Artificial Intelligence Management Systems? Join us for a special event on Thursday, January 8th to learn about the latest requirements according to the upcoming ISO/IEC 42001:2023 standard.This is a unique opportunity to stay informed and ensure your organization is prepared for the future of AI management. Don’t miss out on this valuable learning experience!Sincerely,CPD Training  Thursday, January 8, 2026 9:00 PMArtificial Intelligence Management System Requirements – ISO/IEC 42001:2023Register Thursday, January 8, 2026 9:00 PMArtificial Intelligence Management System Requirements – ISO/IEC 42001:2023Register CPD Training @ The QHSE groupUG01-F4 RAKEZ Amenity Center Al Hamra Industrial Zone-FZ – Ras Al Khaimah, Ras Al Khaimah, RAK AEUnsubscribe | Privacy Policy CPD Training @ The QHSE groupUG01-F4 RAKEZ Amenity Center Al Hamra Industrial Zone-FZ – Ras Al Khaimah, Ras Al Khaimah, RAK AEUnsubscribe | Privacy Policy |

Category Archives: Uncategorized

Event Horizon Ahead as S&P Targets 8000 Peak

Sponsored content from Porter & Company

You’ve seen this movie…

A spaceship drifts too close to a black hole. Light bends. Time warps. Weird things happen. Then it crosses the event horizon (the point of no return)… and vanishes.

That’s where I believe we are in this bull market, right now.

16 years of easy money, insane gains and tech billionaires richer than God have created a gaping black hole of risk.

Now we’re past the safe zone, approaching the event horizon… the last wild rush before the immutable laws of the universe rip the whole thing apart. Don’t just take my word for it.

MarketWatch says the rally’s “moving more toward melt-up mode.”

Contrarian macrostrategist David Hunter believes the S&P could be headed for a parabolic 8000, before a brutal 80% drop.

Even Ray Dalio (a man who’s tracked 500 years of debt cycles) warns the U.S. is heading into “very, very dark times.”

Is your portfolio equipped to survive such a wild ride?

Honestly, probably not. There’s a good chance you’ll get dragged into the abyss, just like millions of others.

And don’t look to Washington to ride to your rescue. It’s too late for that. We were promised a big fix, but it never arrived.

Instead, the debts are bigger, the deficit is fatter, and core inflation is ever higher.

This market’s like a house with fresh paint and termites chewing through the foundations… it looks strong from the street with stocks at all-time highs, but beneath the surface it’s been hollowed out.

Analyst Michael Lebowitz sees “striking similarities to the dot-com melt-up of 1999” and so do I.

Back then, rate cuts acted like fuel on an already raging fire… predictably, the market got too hot and flamed out:

It’s happening all over again. President Trump and Scott Bessent have pressured the Fed into cutting rates, with more to come.

But history tells us that by the time desperate cuts arrive, the damage is already done. The bubble is too big. Too unstoppable. And the outcome, in my view, is inevitable.

I don’t say that as a casual observer.

For nearly 30 years I’ve built a career helping regular investors prepare for dramatic shifts in the financial system… calling Fannie and Freddie’s implosion, America’s lost AAA credit rating and the Covid inflation shock long before the headlines.

And now, I’m doing everything I can to prepare you for the coming breaking point. Most folks will be left holding the bag, loaded up on the wrong stocks at the wrong time.

That doesn’t have to be your story.

In this recent broadcast, I’ll show you:

- Why the most dangerous flaw in America’s financial system has reached a point of no return

- How Trump’s recent actions are accelerating the coming crisis

- And what I believe you must do now to avoid the worst of it – and potentially even profit from the shift

I also name three investments you can make today… assets that could see a huge influx of capital when this situation escalates.

This might be your final chance to prepare before we cross the event horizon.

Let me show you exactly what to do.

Good investing,

Porter Stansberry

Thank you for subscribing to The Early Bird, MarketBeat’s 7:00 AMnewsletter that covers stories that will impact the stock market each day.

This email communication is a sponsored message from Porter & Company, a third-party advertiser of The Early Bird and MarketBeat.

If you need help with your subscription, don’t hesitate to contact MarketBeat’s South Dakota based support team at contact@marketbeat.com.

If you no longer wish to receive email from The Early Bird, you can unsubscribe.

Copyright 2006-2026 MarketBeat Media, LLC.

345 N Reid Pl., Suite 620, Sioux Falls, South Dakota 57103. United States..

Today’s Featured Link: 5 Stocks That Could Double in 2026(Click to Opt-In)

AI Without Robots Is Just ChatGPT

AI Without Robots Is Just ChatGPT

In 1961, John F. Kennedy declared that America would go to the Moon.

This audacious goal wasn’t just about space or research but supremacy; and the Soviets weren’t allowed to reach it.

Now, six decades later, the United States is working toward another ‘moonshot.’

The Genesis Mission – a push to fuse America’s top supercomputers, scientific data, and research labs into a unified AI platform – is all about domination. And this time, instead of regulating capitalism, the federal government is commanding it.

The signal is unmistakable. We’ve seen five strategic investments in five months:

- Intel (INTC): Revitalizing America’s semiconductor backbone

- MP Materials (MP): A bid for rare-earth magnet control, essential for motors, missiles, and robots

- Trilogy Metals (TMQ): Copper, cobalt, nickel – the nervous system of electrification

- Lithium Americas (LAC): Battery sovereignty

- xLight: Strategic optics play to break foreign supply chain choke points

Industrial policy has become industrial warfare. And it’s shining a spotlight on an industry set to dominate Wall Street in 2026.

Because here’s what they’re not saying out loud…

AI without robots is just ChatGPT.

Control of supply chains, physical production, and the technologies that turn software intelligence into real-world power – that’s the actual endgame. When you map these investments onto the Genesis Mission’s strategic pillars, the government’s grand plan becomes undeniable.

The Genesis Mission: Why Robotics Is the Real Endgame

Here’s the brutal truth the White House has now internalized: AI without robots doesn’t reshuffle global power.

Robots without AI are just basic machines. But AI + robots = production dominance.

Every major Washington priority is tied to robotics. If it hopes to:

- Reshore manufacturing

- Compete with China’s labor scale.

- Offset labor shortages without igniting wage inflation

- Optimize defense logistics, infrastructure security, port automation, warehouse throughput

- And turn America’s AI lead into physical output…

Robots are essential.

And according to recent reporting from Politico, the administration is actively discussing a stand-alone executive orderto support the U.S. robotics industry in 2026.

Robotics is being elevated from ‘footnote’ to ‘pillar.’

Robotics as a Core Pillar in the Genesis Mission’s Six Strategic Industries

The Genesis Mission centers on six core industries:

- Semiconductors

- Energy (nuclear + grid + storage)

- Critical minerals

- Advanced manufacturing

- AI

- Robotics / physical automation

And if you’ll notice, robotics is the only one that physically integrates the other five.

Robots need chips, energy, magnets, copper, lithium. They automate manufacturing. They’re AI embodied – the connective tissue of the entire Genesis strategy…

Which is why the idea of a robotics-specific executive order in 2026 matters so much. It’s a declaration that Washington wants a domestic robotics champion class – and is willing to help create one.

And it’s acting with urgency because it’s acutely aware that political time is dwindling. Midterms are looming. Control of committees, budgets, and investigations shifts fast. So, the administration’s incentive is simple: Do as much as possible as quickly as possible.

Lock in programs. Commit capital. Anchor private investment to public support.

Genesis is about irreversibility.

Once factories are built, robots are deployed, contracts are signed, and ecosystems are funded, even a hostile Congress has a hard time unwinding them.

That’s why the pace has accelerated – and why robotics is taking center stage right now

Recommended Link

Buy Alert: $8 AI Stock

This building contains one of the most innovative AI-powered companies in Silicon Valley. In this video, famous tech analyst Luke Lango goes on location to share the name, ticker symbol, and full analysis what he believes will be his next big AI winner. Not too many people are paying attention to this company (you’ll see why here)… Today, you can grab a stake for just under $8 — and potentially rake in a 1,000% return. Join Luke on location in Silicon Valley for the name and ticker symbol of his #1 AI stock right now.

The Robotics Companies Best Positioned to Benefit

If Washington is serious – and the signs say it is – here’s where the upside consolidates.

The Flagship Narrative Name

- Tesla (TSLA): Like it or not, Tesla sits at the intersection of AI, manufacturing, robotics, and American optics. More than just a humanoid demo, Optimus is a political symbol. It’s a robot designed to work in U.S. factories, built by a company already reshoring aggressively.

If the administration wants a visible win – a ‘this is what an American automation looks like’ story – Tesla fits the script perfectly.

Warehouse & Logistics Automation

- Symbotic (SYM): Symbotic is one of the most important robotics companies in America: AI-driven warehouse automation, already scaled, already deployed, already saving labor.

If Washington wants to harden domestic supply chains without blowing up inflation, this is exactly the type of technology that gets subsidized, accelerated, or quietly favored in federal logistics contracts. - Teradyne (TER): Through Universal Robots, Teradyne dominates collaborative robots (‘cobots’): the kind of small- and mid-sized bots American manufacturers can deploy without rebuilding entire factories. If the goal is broad-based adoption, cobots are the fastest way there.

Service & Labor-Substitution Robots

- Serve Robotics (SERV): Serve creates last-mile delivery robots solving real economic problems: labor shortages, urban congestion, service-sector inefficiency. Practical automation.

- Richtech Robotics (RR): Hospitality and service robots to deploy in hotels, restaurants, casinos, and senior living facilities. We see this as the politically palatable version of automation: ‘robots doing the jobs nobody wants.’

Security & Infrastructure Robots

- Knightscope (KSCP): This company builds autonomous security for malls, warehouses, transit hubs, infrastructure, etc. If robotics starts flowing through DOT, DHS, or infrastructure budgets, this category could benefit fast.

The Picks-and-Shovels Layer

Now, here’s where ‘smart money’ often hides: within the critical supplies and materials that a technology needs to function.

Robots need components, like sensors, cameras, actuators, control and safety systems…

Companies like Cognex (CGNX), Keyence(KYCCF), and industrial automation backbone providers such as Rockwell Automation (ROK) quietly ride the wave when robot counts rise – regardless of which brand names win the headlines.

Why 2026 Marks the Inflection Point for America’s Robotics Industry

For years, robotics have been too early. Too expensive. Too clunky. Too slow.

But the world is different now.

AI is powerful and widespread. Hardware costs are falling. Labor is scarce and expensive. And importantly, Washington is done waiting for markets to self-correct. It’s realized that if the state doesn’t shape the next industrial era, someone else will.

So, yes – 2026 looks like the year robotics breaks out of niche status and into a national priority asset class…

Because power, productivity, and geopolitical leverage demand it.

And when Washington decides something is too important to leave to chance, markets don’t drift higher. They break out.

The smart money doesn’t wait for the official announcement. It positions before the market reprices the entire sector…

Because by then, the easy gains are gone.

Sincerely,

Luke Lango

Editor, Hypergrowth Investing

P.S. Questions or comments about this issue? Drop us a line at langofeedback@investorplace.com.

A smartphone trick to potentially grow your wallet

Dear Reader,

A market insider just revealed a remarkable new way to potentially double your money using just your smartphone.

Forget stocks. Forget crypto. And forget spending hours analyzing charts.

With Jeff Clark’s “Crossfire” method, all you need to do is make some moves on your phone, and you’re done.

With this exact strategy, you could have recently turned $1,000 into $3,200, in just seven days.

He’s now sharing exactly how you can replicate this strategy starting right now, for free.

You don’t need any trading experience.

All you need is a regular brokerage app, and Jeff’s three-step process.

Sounds too easy? That’s exactly why most people miss it.

Tap here to learn this powerful strategy now.

Regards,

Rachel Bodden

Senior Managing Editor, TradeSmith

To ensure that you continue to receive marketing emails from TradeSmith, please add info@exct.tradesmith.com to your address book.

If you no longer want to receive marketing emails from TradeSmith, please click here to unsubscribe.

If you have any questions, please don’t hesitate to contact Customer Service at support@tradesmith.com or by calling 1-866-385-2076.

© 2026 TradeSmith, LLC. All Rights Reserved. 1125 N. Charles Street, Baltimore, MD 21201

Must Read: How to Survive the AI Labor Crash That’s Already Accelerating

.png)

How to Survive the AI Labor Crash That’s Already Accelerating

Editor’s Note: The best investment opportunities often come out of big changes – especially when most people aren’t paying attention yet.

My friend and colleague Luke Langopoints to one of the biggest changes we’ve seen – AI. Most of the attention from it focuses on what it means for tech stocks, but Luke is looking at something bigger – how it’s reshaping the economy and the job market, and what it means for all of us.

To do that, he put together a special presentation explaining what makes this opportunity different, why it matters for investors and the steps you can take now to stay ahead.

You can watch his special briefing right here, where he breaks down the specific companies he believes are best positioned to benefit – including one he names for free.

Here’s Luke with more…

In 1811, as England’s Industrial Revolution was gaining momentum, a group of textile workers decided to fight back.

Led by the mythical “General Ludd” of Sherwood Forest, what began as a concentrated movement in central England quickly spread across the nation. Traditional workers took hammers to the stocking frames and power looms – the machines erasing their jobs, their wages, and centuries of hard-won craft.

They weren’t irrational or anti-progress. They were simply watching their livelihoods evaporate in real time, and they understood that no one was coming to help them.

And it took generations of political struggle to rebuild something resembling dignity for working people.

Right now, a similar story is unfolding. This time, AI is the existential threat.

While investors are worrying about if Big Tech is spending too much on AI, the ground beneath our feet – the very foundation of how we earn a living – is turning into quicksand.

The biggest risk we face isn’t a bear market or even a crash in the Nasdaq.

It’s the permanent devaluation of human labor…

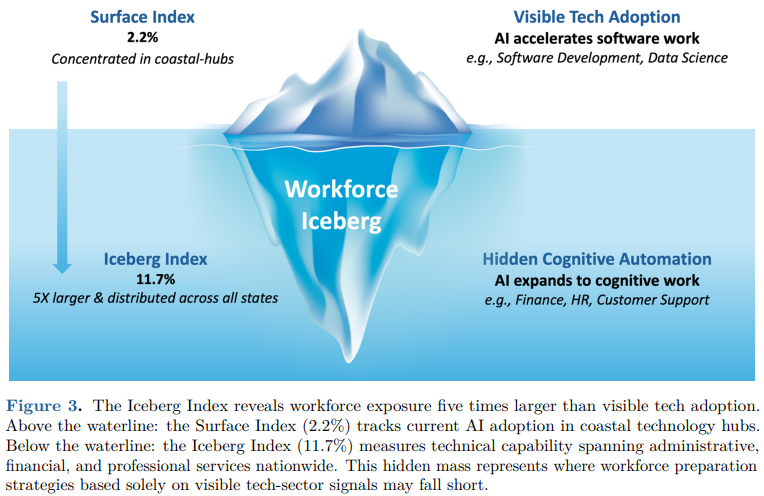

The Iceberg Index: The Truth About AI Job Loss in America

The latest research shows just how far this displacement has already advanced beneath the surface.

The Massachusetts Institute of Technology, partnering with Oak Ridge National Laboratory, recently released what it calls the “Iceberg Index” – and it’s terrifyingly blunt.

The study’s models suggest that roughly 12% of existing U.S. jobs could be replaced by AI right now.

That’s 1 in 9 people whose economic output can be matched by a software subscription that doesn’t need health insurance and doesn’t take bathroom breaks.

We aren’t even talking about what happens when the AI further matures.

When an AI agent can not only write the email but also plan the project and execute the code migration without human intervention, the need for human “managers” in the middle evaporates.

We are already seeing the results…

- HP Inc.(HPQ) just announced it is cutting up to 6,000 jobs by 2028 to “fund AI investment.”

- United Parcel Service Inc. (UPS) cut 12,000 corporate roles earlier this year, explicitly stating that automation means those jobs aren’t coming back.

- Amazon.com Inc. (AMZN) is undergoing its biggest corporate layoff ever.

This isn’t recessionary. This is a capital pivot. Companies are trading variable-cost, high-maintenance human workers for fixed-cost, exponentially improving silicon ones.

AI Is Breaking the Link Between Productivity and Wages

For the last century, as technology improved, productivity went up. As productivity went up, wages did, too. A rising tide lifted all boats, even if some boats were lifted higher than others.

But AI is breaking that link.

When a company deploys an AI system that allows it to double its output without hiring a single new employee, where does that extra value go?

It does not go to the remaining workers. It goes to the company’s bottom line, and then to dividends, buybacks, and a higher share price.

And that doesn’t even take an economic downturn into account.

Right now, we have historically low unemployment (around 4%). The economy is showing cracks but is still fairly stable. And yet, companies are aggressively automating.

Imagine what happens in a recession.

Economists call it the “cleansing effect.” When revenue dips, companies are forced to cut costs and jobs mercilessly.

The recession will be the accelerant. The recovery will be jobless.

Recommended Link

Wall St Legend: AGI Arrives Q1 2026. The Power Grab Started Months Ago.

While retail buys Nvidia at all-time highs, institutions position into something else. Why? AI needs POWER. Louis Navellier, who spent 46 yrs Wall St. and called Nvidia at $1, reveals that his grading system shows where the money is REALLY flowing. Companies you’ve never heard of. Stocks the media never covers. Before Stage 3 begins… click here for the full story.

Workers Must Shift From Labor to Capital to Survive the AI Era

So, if the value of labor is crashing and the value of capital is skyrocketing, the solution is uncomfortably simple.

You need to stop thinking like a laborer and start thinking like a capitalist.

This brings us to the “stock bubble.” You might be worried that Nvidia Corp. (NVDA) is overpriced at its current valuation. Fair enough.

But if you have zero exposure to the companies building the infrastructure of the future, you are betting your entire financial existence on your ability to outwork software that doubles in ability every 18 months.

That is a terrible bet.

The only true hedge against the devaluation of your labor is to own stock in the companies that are benefiting from labor devaluation. You need to be on the receiving end of that wealth transfer.

If the AI boom continues, these companies will generate unprecedented cash flows. If the “AI bubble” pops, the tech doesn’t go away. It just gets cheaper for companies to deploy, accelerating the labor displacement even faster.

In either scenario, capital wins.

How to Protect Yourself From AI Job Loss: A Two-Part Strategy

Now, I know what you’re thinking. “Great advice. I’ll just take this spare $3 million and buy a diversified portfolio of AI infrastructure stocks so I can live off the dividends when my job is automated.”

Indeed, replacing an entire salary with capital returns requires a massive amount of money that most of us simply don’t have.

So, you need a two-part “barbell strategy” for survival.

Immediate Financial Exposure: You cannot afford to sit this market out because it’s “frothy.” You need exposure to the picks and shovels of this gold rush – the chip designers, hyperscale cloud providers, foundational model companies, etc.

Become ‘Human Capital’: Until you have enough capital to retire, your labor is still your primary asset. You have to upgrade it.

The labor market is bifurcating into two categories: commodity labor versus agency labor.

You need to be the latter. Stop writing copy. Start orchestrating the brand voice that AI brings to life.

The people who will thrive in the transition period aren’t just the ones owning Nvidia stock. They are the ones who can walk into a panicked C-suite and say: “I can replace your inefficient 20-person department with myself, three sharp lieutenants, and a fleet of AI agents – and save you 40%.”

Wield AI as a weapon for your own advancement.

The Labor Market Is Approaching a Breaking Point

Exponential curves look flat for a long time … and then, suddenly, they go vertical.

We are right at the knee of that curve. The window to prepare is closing faster than most think.

It’s best to stop agonizing about whether we are in a 2000s-style stock bubble. A stock market crash hurts your portfolio temporarily. A structural shift in the value of human labor hurts your family permanently.

As automation accelerates and data centers explode in size, the U.S. is quietly executing what many insiders are calling a modern “Manhattan Project for AI.”

And Washington isn’t just funding this initiative. It’s partnering directly with select American companies it views as essential to winning the AI race – and those stocks are erupting.

This year alone, several smaller U.S. firms surged 200%… 300%… even 400% in a matter of days after government investment or contract news broke.

These aren’t hype-driven rallies. They’re the early winners of America’s AI buildout – the companies being positioned at the center of a multiyear national transformation.

And while millions of workers brace for AI-driven disruption, investors who understand where Washington is placing its strategic bets could be on the receiving end of one of the last great wealth transfers of our lifetime.

That’s why I’ve been working on something urgent, which you can now see for yourself.

I’ve identified a handful of overlooked American companies that I believe are next in line for government backing – and each has the potential to soar 10X as this new AI buildout accelerates.

I reveal the first one – 100% free – in my new briefing.

Click here to learn how to position yourself before the next government-backed breakout.

Consider it the first plate on your barbell.

Regards,

Luke Lango

Editor, Early Stage Investor

Don’t Miss Out: Secure Your $10 Bitcoin Reward Today

Hey Crypto Enthusiast,

Yesterday, several members jumped at the chance to receive free Bitcoin from our special guest. Have you claimed yours yet?

He’s generously offering $10 in Bitcoin (BTC) just for attending and engaging in one of this week’s exclusive workshops.

>> Secure Your Spot Now!

There’s absolutely no catch and no purchase necessary.

Simply watch, absorb the knowledge, and ace a brief quiz afterward. He’ll transfer $10 in BTC to your wallet as a reward for your commitment.

Remember, he once received $5 in Bitcoin, now valued at $550. Imagine what your $10 could grow into!

Why this incredible offer? He’s passionate about guiding as many individuals as possible towards profitable crypto investments, cutting through the misinformation out there. Plus, he hopes you’ll consider becoming part of our thriving program.

He’s confident that the value you’ll gain is worth far more than the $10 in Bitcoin he’s offering. Don’t miss this unique opportunity!

>> Claim Your Bitcoin & Learn Today!

Today’s Exclusive Content

Nike Beats on Earnings But Struggles in China and Faces Tariffs

By Leo Miller. Originally Published: 12/19/2025.

Key Takeaways

- Nike beat revenue and EPS estimates in its latest earnings report but still showed underlying operational weaknesses.

- The company’s DTC strategy faces challenges, especially in China, while wholesale and running product lines are performing well.

- Nike’s long-term recovery hinges on its Sport Offense strategy and managing tariff impacts, but investor confidence remains shaky.

The last three years have not been kind to U.S. apparel giant Nike (NYSE: NKE). As of the Dec. 18 close, shares had dropped approximately 34%, with sales, margins and profits all down significantly over the same period.

A series of strategic missteps contributed to this, including weaker product innovation compared with emerging competitors like ON (NYSE: ONON). Nike’s push toward direct-to-consumer (DTC) sales also had unintended consequences: as the company focused on its own channels, competitors gained visibility through retailers such as Foot Locker, which filled shelves with alternative products.

BlackRock’s $20B secret (they earn in ANY market) (Ad)

BlackRock’s $20B secret (they earn in ANY market)

While retail panics, you could be collecting fees like BlackRock does.Click here to learn how.

Excess inventory and tariff pressures have also squeezed margins.

Still, analyst price targets continue to point to upside potential for Nike shares. Below, we look at the company’s Dec. 18 earnings release to assess its path to recovery.

Nike Beats on Top and Bottom Lines

In its latest quarter, Nike reported revenue of $12.4 billion, a 1% increase (flat on a currency-neutral basis). That topped Wall Street expectations of just under $12.2 billion.

Nike’s diluted earnings per share (EPS) were $0.53, down 32% from the prior year but well above consensus of $0.38, which implied a decline of nearly 53%.

For the next quarter, the company expects revenue to decrease by low-single digits and anticipates gross margin to decline roughly 200 basis points at the midpoint, driven largely by tariff headwinds.

Mixed Operational Metrics Highlight Strengths and Weaknesses

Gross margin fell 300 basis points to 40.6%, largely because of tariff-related pressures. Nike expects tariffs to continue weighing on results but is taking steps to reduce the drag to about 120 basis points in FY2026.

North American sales were a bright spot, rising 9%, while every other region posted negative currency-adjusted growth. Greater China was especially weak, with sales down 16%.

Wholesale revenue improved, rising 8% as Nike’s partner ecosystem stabilized. By contrast, Nike Direct Digital — the DTC e-commerce channel — saw sales fall 14%, including a 36% decline in China.

CEO Elliott Hill has pointed out that Chinese consumers tend to take an e-commerce-first approach to purchasing.

That makes Nike’s poor performance in China particularly concerning. The company plans to “reset its approach to the China marketplace” as part of its broader recovery strategy.

A notable positive: Nike’s running product line posted 20% sales growth for the second consecutive quarter, with double-digit increases in both wholesale and DTC. This is an early sign the company’s Sport Offense strategy may be working.

Under Sport Offense, Nike is reorganizing into teams focused on specific sports to produce products that consistently resonate with particular consumer groups. As a multi-sport brand, this approach could help Nike regain relevance — though implementation is still in the early stages.

Nike Shares Drop After Earnings as Recovery Remains Slow

Despite topping estimates on both the top and bottom lines, markets reacted negatively. In after-hours trading on Dec. 18, Nike shares fell nearly 10% after management guided to negative growth next quarter and highlighted ongoing operational challenges.

Trading near $59 after hours, Nike needs a substantial rebound in long-term free cash flow to justify a higher valuation. Management remains committed to long-term investment, but progress appears slower than markets had hoped.

Nike is still one of the most recognizable sports apparel brands in the world, a brand advantage that provides a solid foundation for recovery. If the company can reverse weakness in China, mitigate tariff headwinds and rebuild its DTC business, it could stage a meaningful rebound.

Thank you for subscribing to The Early Bird, MarketBeat’s 7:00 AMnewsletter that covers stories that will impact the stock market each day.

This email message is a sponsored message sent on behalf of Crypto Swap Profits, a third-party advertiser of The Early Bird and MarketBeat.

If you have questions about your subscription, please email MarketBeat’s U.S. based support team at contact@marketbeat.com.

If you no longer wish to receive email from The Early Bird, you can unsubscribe.

Copyright 2006-2026 MarketBeat Media, LLC.

345 N Reid Pl. #620, Sioux Falls, S.D. 57103. USA..

Read More: Could things escalate with China? (From Monument Traders Alliance)

Adapt or get left behind. The market’s already decided.

You’ve seen what’s coming.

The market in 2026 isn’t going to play by the same rules as 2025.

The “buy every dip” playbook is broken. The Fed’s confused.

Valuations are stretched. Volatility is creeping back in.

We’ve shifted from a market of easy money… to a market that punishes the unprepared.

So what are you going to do about it?

You can keep hoping things settle down. Keep waiting for “clarity” that never comes. Keep trading the same way you always have and pray it works out.

Or you can adapt.

But you don’t have to figure it out alone.

You can trade alongside Mike Rykse (who’s already adapted) inside Weekly Gems.

He’s not guessing or hoping for smoother waters. He’s placing short-term, risk-defined trades that are built to win in this exact environment.

And you can learn to do the same.

But think of it like learning an instrument…

Nobody picks up a guitar and writes their own songs on day one.

You first copy the greats. You learn their techniques. You follow their lead.

And once your confidence grows, you find your own rhythm.

Trading is no different.

You can try to master it solo, stumbling through trial and error…

Or you can follow someone who’s already playing at the level you want to reach.

One way or another, you’ll be trading in 2026.

The only question is: will you be guessing… or following a proven system?

To your success,

Coach Brian

NetPicks

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT ADVICE. NetPicks Services are offered for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation or be relied upon as personalized financial advice. We are not financial advisors and cannot give personalized advice. There is a risk of loss in all trading, and you may lose some or all of your original investment. Results presented are not typical. Please review the full risk disclaimer: https://www.netpicks.com/risk-disclosure This email was sent to pahovis@aol.com by info@netpicks.com

16211 N Scottsdale Rd, Suite A6A #295, Scottsdale, AZ 85254

Exodus 20:12 – How Dishonoring Parents Leads to Societal Decay and Personal Immaturity

Having trouble reading this email? View it in your browser.

Exodus 20:12

(12) “Honor your father and your mother, that your days may be long upon the land which the LORD your God is giving you.

New King James Version Change email Bible version

Taken to an extreme, dishonoring of parents leads to anarchy, first in the family and then in society, as the decay of this basic component spreads. Eventually, a person will expend much, if not most, of his energies just surviving, effectively destroying the development of spiritual, creative, and intellectual qualities essential to his and society’s well-being.

Not honoring parents also causes immaturity. Because children do not respect their parents’ advice, they grow up missing the significance of much they encounter, and so wisdom comes to them very slowly. In some cases, they may never learn wisdom. Lack of honor manifests itself in self-willed and self-indulgent people who seem to simmer just beneath the point of rebellion. Their motto in life becomes, “Just do it.” So they condemn themselves to learning the lessons of life through hard experience, which may be a good teacher, but a painful one.

— John W. Ritenbaugh

To learn more, see:

The Fifth Commandment (1997)

Topics:

Commentary copyright © 1992-2026 Church of the Great God

New King James Version copyright © 1982 by Thomas Nelson, Inc.

Subscription Information

This daily newsletter was sent to you at peter.hovis@gmail.com because you subscribed at www.theberean.org on Apr 16, 2019.

Email Preferences | Unsubscribe

Church of the Great God

P.O. Box 471846

Charlotte, NC 28247

803-802-7075

Data Center Demand Powers Undervalued Utilities in 2026

Get our next stock pick on Monday (for free) (From MarketBeat Alerts)

2026 Sector Playbook: 3 Sectors Trading Below Fair Value

Written by Chris Markoch on January 1, 2026

What You Need to Know

- Sector rotation into financials, industrials, and utilities could continue in early 2026 if crowded growth trades cool off.

- Sector ETFs can work, but stock selection may offer better value where forward valuations sit below sector norms.

- Rate expectations, capex trends, and data center power demand are three practical catalysts to watch across these sectors.

As we kick off 2026, it’s likely the sector rotation that began in December 2025 will continue. Some investors believe that many of the best-performing stocks of 2025, notably artificial intelligence (AI) stocks, are simply overvalued.

This belief extends beyond concerns about an AI bubble and falls into the category of value for the price. Many growth-oriented technology stocks simply feel overvalued and may require a correction before their valuations become attractive again.

As investors rotate out of the tech sector, they’ll look for stocks in sectors that may be trading below fair value. Three of the key sectors to consider are financials, industrials, and utilities.

This has been a stock picker’s market, so there have been some names in these sectors that have performed well. Many investors may choose to keep riding the hot hand into 2026.

But there are other names that are still trading at attractive valuations to their sector and the broader market. By focusing on individual names, investors have the opportunity to outperform some of the leading ETFs in the sector.

Next Monday’s stock idea (Ad)

A couple of years ago, we started playing with the massive amounts of data that MarketBeat takes in everyday trying to figure out if there was a way to identify short term trading wins. By analyzing earnings data, news sentiment, analyst recommendations, insider transactions and dozens of other data points, we think we’ve found an algorithm that finds interesting short-term stock ideas. We call that algorithm the IdeaEngine and its stock ideas are published on MarketBeat All Access every Monday morning. We make one IdeaEngine idea available free every Monday as an SMS alert. We’ll be releasing the next IdeaEngine alert on Monday morning, so make sure you are signed up before then.Get MarketBeat IdeaEngine Alerts (Free)

Financials: Lower Rates Could Unlock Undervalued Bank Stocks in 2026

Finance stocks are expected to do well in 2026, no matter which direction interest rates go. However, with the scale heavily tilting to at least one rate cut in the first half of 2026, this could be an attractive sector. The overarching theme is that lower interest rates will stimulate the economy, which is more supportive of bank earnings.

One option is to buy the Financial Select Sector SPDR Fund (NYSEARCA: XLF). The fund was up approximately 13% in 2025, lagging the S&P 500. The fund provides exposure to some best-in-class stocks like JPMorgan Chase & Co. (NYSE: JPM) and Berkshire Hathaway (NYSE: BRK.B).

However, these stocks are trading at or slightly above the sector’s forward price-to-earnings (P/E) ratio of 16.5. A different option may be to invest in undervalued sector stocks, including Bank of America (NYSE: BAC), Capital One Financial Corp. (NYSE: COF), and PNC Financial Group Inc. (NYSE: PNC).

Industrials: Capex Revival and Infrastructure Demand Point to Upside

Industrial stocks were one of the hottest sectors in the first half of the year. But the sector has leveled off in the back half, and that’s observed in the stock chart for the Industrial Select Sector SPDR Fund (NYSEARCA: XLI).

Industrials are expected to have another strong year in 2026 as infrastructure demand of all types is likely to get a boost if lower rates spur capital expenditures.

The XLI ETF is up about 18%, which closely approximates the performance of the S&P 500. Many of the top holdings in the fund are overvalued compared to the sector P/E average of around 24x, which is above the S&P average.

However, there is still some value to be found with names like Boeing Co. (NYSE: BA), Union Pacific Corp. (NYSE: UNP), and Honeywell Intl. (NASDAQ: HON) that all trade at a forward P/E ratio below the sector average.

Your stock is up 25%. What just happened?! (Ad)

Your account is not currently signed up for MarketBeat’s free Monday morning stock ideas. Our team is going to be releasing an important pick on Monday morning and we want to make sure that you are able to see it.Add your name to the distribution list here

Utilities: A Quiet Value Play Powered by Data Center Energy Needs

The utilities sector is another place to unlock value in 2026. That could lead you to the Utilities Select Sector SPDR Fund (NYSEARCA: XLU). The ETF finished 2025 up around 13%, below the broader market. However, that was largely due to a 5.5% pullback in the last month of the year.

Utilities stocks are expected to benefit from increased demand from data centers, as well as the need to update aging electric infrastructure.

The sector has an average P/E ratio of around 18x. Some names currently trade at a value to that number, including Exelon Corp. (NASDAQ: EXC), Pacific Gas & Electric (NYSE: PCG), and Algonquin Power & Utilities Corp. (NYSE: AQN).

Further Reading

- The Last Time This Happened, Qualcomm Fell 10%

- The McDonald’s Secret (From The Oxford Club)

- From Rust to Riches: 2 Auto Parts Names Built for 2026

- You Weren’t Supposed to See This(From The Oxford Club)

- Bullseye Bounce: Toms Capital Takes a Stake in Target

- Insider Buying: Smart Money Just Spent +$100M on These 3 Stocks

- The Power Bill, the AI Dip, and the Date That Could Flip 2026 Stocks

Did you enjoy this article?

Thank you for subscribing to TickerReport, where we work around-the-clock

to bring you the latest market-moving news.

Contact Us | Unsubscribe

© 2006-2026 MarketBeat Media, LLC dba TickerReport.

345 North Reid Place #620, Sioux Falls, South Dakota 57103. USA..

President Trump Just Privatized the U.S. Dollar

Stay ahead by tracking smart money moves, strategic insights, and timely market signals.President Trump Just Privatized the U.S. Dollar – Ad

Stay ahead by tracking smart money moves, strategic insights, and timely market signals.President Trump Just Privatized the U.S. Dollar – Ad

A controversial new law (S.1582) just gave a small group of private companies legal authority to create a new form of government-authorized money. Today, I reveal how to use this new money, why it’s set to make early investors fortunes, and what to do before the wealth transfer begins just weeks from now if you want to profit. Go here for details now.Bill Gates, Marjorie Taylor Greene Bet On The Same 5 Stocks: Some Might Surprise You

A trust founded by Bill Gates and the investment portfolio of Congresswoman Marjorie Taylor Greene share five stocks in common. More Info ➔Why Is Wall Street Moving Their Money Overnight? – Ad

Something far more consequential for your money than tariffs is unfolding behind the scenes… Tucked inside this overlooked directive is a plan set to be executed for the first time in in U.S. history. One Stansberry Research’s Senior Partner says it’s set to trigger a rare window for potentially explosive gains in ONE asset immediately. (Not AI or crypto). Wall Street insiders are already positioning themselves… and he insists you should, too, before it’s too late. Get the full story here.5 Stocks Investors Couldn’t Stop Buzzing About This Week: TGT, TSM, GOOG And More

Retail investors talked up five hot stocks this week (Dec. 29 to Jan. 2) on X and Reddit’s r/WallStreetBets, driven by retail hype, AI buzz, and corporate news flow. More Info ➔If You Invested $5000 In Tesla Around Christmas 2020, Here’s How Much It Would Be Worth Today

Have you wondered what Investing $5,000 in TSLA during Christmas 2020 would now yield you? Here’s your answer. More Info ➔Media Humiliated: Demo of Elon’s Tech Proves They’re Wrong – Ad

It’s smaller than a quarter, but it could power Elon Musk’s next AI revolution… A revolution he believes will be worth more than $9 trillion. Believe it or not, this device could even help put an extra $30k in your pocket every year outside of the markets. A lot of people could get rich.Latest deep-sea search for missing Malaysia Airlines Flight 370 gets underway

HANOI, Vietnam (AP) — A deep-sea search for began in the Indian Ocean on Wednesday, reviving efforts to solve one of aviation’s greatest mysteries more than a decade after the jet vanished with 239 people on board. More Info ➔Donald Trump’s Cryptic Message: ‘Savor What Might Be Your Final Merry Christmas!’

President Trump delivered a cryptic message to Democrats on Truth Social on Christmas Day. More Info ➔8 Stocks Wall Street Analysts Love Most – Ad

When in doubt over picking which stocks to own it’s wise to look at what the experts are saying. Here are the 8 stocks with the highest percentage of buy ratings among analysts on Wall Street today.

Get Top Stocks NowBy clicking the link above you will automatically opt-in to receive emails from SystemTrading and agree to Privacy PolicyKevin O’Leary Praises NYC Mayor Zohran Mamdani’s ‘New Rules Of Politics’

Kevin O’Leary praised New York City Mayor Zohran Mamdani for using data and social media to reshape political leadership. More Info ➔Trump’s Net Worth Skyrockets, Pelosi’s Stock Picks, Russia’s Claims And More: This Week In Politics

Donald Trump’s net worth surged by $500 million in one day due to a rise in shares of Trump Media & Tech Group. More Info ➔Wall St Legend: AGI Arrives Q1 2026. The Power Grab Started Months Ago. – Ad

While retail buys Nvidia at all-time highs, institutions position into something else. Why? AI needs POWER. Louis Navellier, who spent 46 yrs Wall St. and called Nvidia at $1, reveals that his grading system shows where the money is REALLY flowing. Companies you’ve never heard of. Stocks the media never covers. Before Stage 3 begins… Click here for the full story.Tesla Rival Nio Caps 2025 With Record Deliveries

Nio reports record deliveries in Dec 2025, surpassing 40,000 total deliveries of its flagship SUV. Q4 deliveries reach 124,807. More Info ➔Banks Are Unanimously Bearish On Oil – Is It The Contrarian Opportunity For 2026?

Oil is closing 2025 as one of the negative-performing assets. More Info ➔Walmart Founder Sam Walton’s Genius Move: Why He Never Gave His 5 Kids Company Stock

Sam Walton’s estate planning kept his Walmart stock in a trust, protecting it from divorce courts. This strategy was key to preserving family wealth. More Info ➔What to Stream: Kid Laroi, ‘The Pitt’ and ‘Tron: Ares’

Returns to “The Pitt,” the Grid and music of Kid Laroi are some of the new television, films and music near you. More Info ➔Santa Claus Rally Favors These 5 Stocks, History Says

Santa Claus Rally season is here. Historical data shows strong year-end gains for the S&P 500 and Dow, with five stocks standing out as the most consistent seasonal winners. More Info ➔Maduro’s capture disrupts Caribbean holiday travel, hundreds of flights canceled

The U.S. military operation that captured Venezuelan President Nicolás Maduro and flew him out of the country early Saturday has also disrupted Caribbean travel at a busy travel time for the region. More Info ➔

Information, charts, or examples contained in this email are for illustration and educational purposes only and not for individualized investment management. This message contains commercial elements, such as advertising and partner offers for which we may receive affiliate compensation. We only send these offers to those who have opted into our newsletter.

If you wish to no longer receive these offers, click on the unsubscribe link at the bottom of this email. Past performance is not indicative of future results. For these reasons, we strongly suggest trading in a DEMO/Simulated account.

The information provided by us is for educational and informational purposes only. We make no representations or warranties concerning the products, practices, or procedures of any company or entity mentioned or recommended in this email and have not determined if the statements and opinions of the advertiser are accurate, correct, or truthful.

If you use, act upon, or make decisions in reliance on information contained in this email or any external source linked within it, you do so at your own peril and agree to hold us, our officers, directors, shareholders, affiliates, and agents without fault.

2967 Dundas St. W. #990, Toronto, ON M6P 1Z2 | Phone Number: 917.672.7040

© 2026 Musth | SmartMoneyTrading | All rights reserved.

UNSUBSCRIBE