Unsubscribe![]() The IPO Market Is Quiet… But Not for Long (From Darwin)

The IPO Market Is Quiet… But Not for Long (From Darwin)

Pelosi’s Bullish 2026 Buy List: AI, Power & Dividends

Written by Jeffrey Neal Johnson

Few market signals are watched as closely as the trading activity of Representative Nancy Pelosi. Over the years, the portfolio attributed to her and her husband, Paul Pelosi, has developed a near-mythical status among investors. Dubbed the Queen of Capitol Hill by traders, her disclosures are often treated as a roadmap for where smart money believes the market is heading.

A new Periodic Transaction Report, filed with the House of Representatives on Jan. 23, 2026, has just provided the first major roadmap for the new year. At first glance, the headlines might look bearish: the report shows sales of millions of dollars’ worth of major technology stocks. However, savvy investors know that headlines often obscure the truth. A detailed analysis of the filing reveals that the Pelosi portfolio is not exiting the tech market. Instead, it is executing a sophisticated reloading strategy.

The data, covering trades from late December 2025 through mid-January 2026, outlines a clear, three-part playbook. The strategy involves taking profits for tax purposes, establishing a massive defensive position in the financial sector, and using high-level leverage to double down on the artificial intelligence (AI) revolution.

The Yield Shield: A Multi-Million Dollar Bet

The most surprising twist in the 2026 portfolio update is a heavy rotation into the financial sector. On Jan. 16, 2026, the filing reveals the purchase of 25,000 shares of AllianceBernstein Holding L.P. (NYSE: AB). The value of this transaction is listed between $1 million and $5 million.

For years, the Pelosi portfolio has been defined by high-growth, high-volatility technology stocks. AllianceBernstein is the opposite. It is a global asset management firm, a traditional business model focused on managing money for others. So, why the sudden shift?

The answer likely lies in yield. AllianceBernstein is a favorite among income investors because it pays a massive dividend, historically ranging from 8% to 9%. By parking millions of dollars in this specific stock, the portfolio creates a yield shield.

In a market year that could see volatility or sideways trading, growth stocks might stall.

However, a position like AllianceBernstein pays the investor to wait. The quarterly dividend payments provide a steady, reliable stream of cash flow that cushions the portfolio against losses in riskier sectors. This purchase signals a prudent, defensive mindset: hoping for growth, but ensuring that the portfolio gets paid regardless of what the stock market does next.

The Infrastructure Play: Why She Kept the Shares

While the portfolio added defensive armor with AllianceBernstein, it simultaneously went on the offensive in the AI sector. The filing shows that the investor exercised call options on two specific companies: Vistra Corp (NYSE: VST) and Tempus AI (NASDAQ: TEM).

To understand the significance of this, investors must understand the mechanics. When you own a call option, you have the right to buy a stock at a certain price. Often, traders will simply sell the option to pocket the cash profit. Exercising the option is different. It means the investor is choosing to pay cash to acquire the actual shares. On Jan. 16, 2026, the Pelosi portfolio took delivery of 5,000 shares of Vistra and 5,000 shares of Tempus AI.

- Vistra Corp – The Power Play:This trade confirms a high-conviction belief in the AI Energy narrative. Data centers running AI models are power-hungry beasts, consuming exponential amounts of electricity. Vistra, with its robust fleet of nuclear and natural gas power plants, is a key supplier for this demand. By taking ownership of the stock, the portfolio is betting that the energy crunch is a long-term reality that will drive Vistra’s value for years to come.

- Tempus AI – The Healthcare Play: This position sits at the cutting edge of science. Tempus uses artificial intelligence to analyze clinical and molecular data to help doctors make real-time decisions. The decision to hold these shares suggests confidence in the company’s recent performance. With analysts pointing to improved earnings and revenue growth, the portfolio views Tempus as a company graduating from a speculative startup to a foundational AI healthcare leader.

The Tech Roll: Selling Stock to Buy Leverage

The most misunderstood part of the recent filing involves the Big Four tech stocks: NVIDIA (NASDAQ: NVDA), Apple (NASDAQ: AAPL), Amazon (NASDAQ: AMZN), and Alphabet (NASDAQ: GOOGL). The report shows the sale of common shares for all four companies. A casual observer might think, “Pelosi is dumping tech!”

That observer would be wrong.

Immediately after selling the shares, likely a move to harvest old profits and pay tax bills, the portfolio re-entered these same positions using a financial instrument called LEAPS (Long-Term Equity AnticiPation Securities). Specifically, the portfolio bought call options expiring in January 2027.

This strategy acts as a leveraged roll. Here is the logic:

- Capital Efficiency: Owning 20,000 shares of a tech giant requires millions of dollars of upfront cash. By switching to Deep-In-The-Money options, the investor can control the same number of shares for a fraction of the cost.

- The Bullish Signal: You do not buy options expiring a year from now if you think the market is crashing. By purchasing contracts that run through 2027, the portfolio is effectively betting that the AI super-cycle is far from over.

Whether it is NVIDIA’s next-generation Blackwell chips, the upcoming iPhone super-cycle, or Amazon’s cloud dominance, the Pelosi portfolio has positioned itself to capture all the upside of 2026 without tying up as much cash as before.

Pelosi Portfolio Management: Don’t Exit, Optimize

The latest disclosures from the Queen of Capitol Hill provide a masterclass in portfolio construction. The 2026 Pelosi portfolio is not retreating; it is evolving. It is leaner, using options to control tech exposure efficiently, but it is also broader, diversifying into critical infrastructure and high-yield finance.

For the everyday investor, the lesson is clear. In a maturing bull market, you do not need to sell everything and go to cash. Instead, look for opportunities to optimize. Consider taking some profits from high-flying tech stocks and redeploying that capital into defensive assets like AllianceBernstein that pay dividends. At the same time, keep your exposure to the themes that matter, specifically the power and data infrastructure, building the future of artificial intelligence. READ THIS STORY ONLINE

5 Stocks That Could Double in 2026 (Ad)

While everyone’s making predictions about what might happen in 2026, we’ve identified 5 stocks with catalysts that are already locked and loaded.

These aren’t hopes or projections. These are scheduled events, signed contracts, and approved projects that will play out over the next 12 months.

The difference between 100% gains and missing out completely? Positioning before 2026 arrives.CLICK HERE TO GET YOUR FREE COPY OF THIS REPORT

Did BlackRock Build A New Floor for Archer’s Stock Price?

Written by Jeffrey Neal Johnson

For the electric aviation sector, 2026 has ushered in a defining market theme: the flight to quality. In the early years of the industry, investors spread capital across dozens of startups, treating the sector like a venture-capital lottery ticket. Today, that speculative phase has largely ended. The market is now ruthlessly separating winners from losers based on a single criterion: who has the resources to survive the valley of death.

For eVTOL organizations, the valley of death will be the perilous period between building a functional prototype and receiving final government certification to carry passengers. It is a phase of high cash burn and zero revenue. As this separation occurs, retail investors are looking to the smart money for clues. Institutional investors (think pension funds, sovereign wealth funds, and massive asset managers) do not typically gamble on hype. They rely on rigorous auditing, risk analysis, and deep-dive due diligence. When these giants take a significant position in a pre-revenue company, it signals that the company has passed the most stringent financial and technical tests that Wall Street offers.

The 8.1% Stake: BlackRock’s Vote of Confidence

At the end of January, this institutional signal of acceptance flashed for Archer Aviation (NYSE: ACHR). According to a recently amended Schedule 13G filing with the Securities and Exchange Commission (SEC), BlackRock Inc. (NYSE: BLK) has increased its position in the company. The world’s largest asset manager now holds an 8.1% passive stake in Archer, equating to approximately 53 million shares.

For the eVTOL investor, the specific type of filing matters. Passive investors, those who believe the company is being run well and simply want to own a piece of its future growth, file a Schedule 13G. This is distinct from activist investors, who buy shares to pressure management to make changes. BlackRock’s purchase is a tacit endorsement of Archer’s current leadership and roadmap.

Owning nearly 10% of a company creates a level of stability that Archer’s press releases cannot manufacture. But why is BlackRock buying now? The answer likely lies in Archer’s resilience. In the aerospace industry, companies don’t usually fail because their technology doesn’t work; they fail because they run out of money before they can prove it works.

The Financial Fortress: $2 Billion in Protection

Archer Aviation enters 2026 with a financial profile that is arguably best-in-class for the sector. The company boasts a total liquidity position hovering near $2 billion. However, the most telling metric for risk-averse investors like BlackRock is the current ratio.

Archer reports a current ratio of 18.19. For context, a ratio of 1.0 is considered safe, meaning a company has one dollar in assets for every dollar of bills due within a year. A ratio of 18.19 is exceptional. It implies that for every dollar of short-term debt, Archer holds over $18 in liquid assets. This effectively removes the near-term risk of emergency fundraising, which often destroys shareholder value.

This financial fortress is heavily fortified by Archer’s strategic partnership with automotive giant Stellantis (NYSE: STLA).

In a typical aerospace startup, the company must burn hundreds of millions of dollars building a factory. In Archer’s case, Stellantis is absorbing the bulk of the capital costs and providing the manufacturing expertise for the high-volume facility in Covington, Georgia. This allows Archer to direct its cash almost exclusively toward research, flight testing, and certification, resulting in highly efficient capital allocation that appeals to institutional analysts.

Archer And Joby: Why Money Is Moving

The significance of the BlackRock purchase is amplified when viewed against the broader sector. A clear divergence has formed between Archer and its primary competitor, Joby Aviation (NYSE: JOBY). For years, these two companies have traded in lockstep, but 2026 has brought a decoupling.

While Archer is attracting institutional inflows, Joby has faced headwinds regarding its stock valuation. In December 2025, analysts at Goldman Sachs initiated coverage on Joby Aviation with a Sell rating. This was followed in late January 2026 by a reiteration of a sell rating from Weiss Ratings. The analysts cited concerns that Joby’s valuation was too high relative to its near-term growth prospects.

This contrast has created a classic pair trade scenario. In financial markets, a pair trade involves selling a stock that appears overvalued while buying a direct competitor that appears undervalued. The recent market data suggests a rotation of capital is underway, moving out of the premium-priced Joby and into Archer, which is increasingly viewed as a value play in the eVTOL sector. BlackRock’s timing aligns perfectly with this broader rotation, suggesting they see Archer as an undervalued asset in the space.

Friction in the Float: Bears vs. Bulls

The heavy institutional accumulation by BlackRock and Stellantis creates an interesting friction in the stock’s market mechanics, specifically regarding short sellers. Currently, short interest in Archer Aviation is high, with approximately 15% of the available shares (the float) sold short. This equates to roughly 90.4 million shares that must eventually be repurchased.

This setup creates the potential for short squeeze mechanics to play out. Here is how the mechanism would work:

- Locked Supply: When long-term giants like BlackRock and Stellantis buy shares, they typically hold them for years. This removes those shares from the daily trading supply.

- The Trap: If positive news drives Archer’s stock price up, short sellers start losing money. To stop the losses, they must buy shares to close their positions.

- The Squeeze: Because institutions are not selling, fewer shares are available to buy. This scarcity forces short sellers to bid the price higher and higher to exit their trades, creating a feedback loop of buying pressure.

With 15% of the float shorted and supply tightening due to the BlackRock purchase, the stock is coiled like a spring.

A Convergence of Catalysts

Market reaction to these developments has already begun. Archer’s stock has shown upward mobility over the past 30 days, gaining approximately 8% before a late January sector-wide slump. Despite the sector’s downward trend in the last days of January, Archer has demonstrated resilience. This sustained strength suggests a firm price floor is being established through institutional buying.

From a technical perspective, the momentum is confirmed. The TradeSmith Health Indicator recently placed Archer in the Green Zone, a technical signal indicating that the stock has stabilized and entered a healthy, positive trend.

The investment thesis for Archer Aviation in 2026 is becoming clear. The company has secured the technology throughNVIDIA (NASDAQ: NVDA), the manufacturing capacity through Stellantis, and the financial runway through a massive liquidity pile.

Now, with BlackRock’s 8.1% stake providing the ultimate institutional seal of approval, the risks associated with the valley of death appear significantly lower.

For investors, the combination of smart money validation, comparative value against competitors, and potential short-squeeze mechanics makes Archer a standout candidate in the race for the skies. READ THIS STORY ONLINE

The IPO Market Is Quiet… But Not for Long (Ad)

We’re entering a rare quiet stretch before what many expect to be a much more active IPO cycle in 2026, and this is often when early investors position themselves long before Wall Street turns its attention back to private companies. We’ve put together a straightforward guide showing how the early-stage landscape works, where opportunities are typically found, what to look for long before an IPO is announced, and which risks actually matter so you can approach this space with realistic expectations.GET INSTANT ACCESS TO THE FULL REPORT HERE

3 Dividend-Backed Consumer Staples to Reinforce Your Portfolio

Written by Dan Schmidt

The best offense is sometimes a good defense, and that’s especially true in markets when stocks turn volatile. Defensive stocks can preserve capital in a declining market by limiting losses and supplementing portfolios with dividend income. Some market sectors offer better protection than others, and today we’ll look at one of the common defensive sectors: consumer staples.

Consumer Staples Stocks Can Protect Capital in Volatile Markets

Most investors think of gold or U.S. Treasuries (at least for now!) when the discussion turns to safe haven assets, but capital doesn’t necessarily need to exit the stock market to be protected. Some sectors are less volatile than others, while others offer income through dividends in addition to equity appreciation. And then some offer a combination of both, such as consumer staples.

Consumer staples are considered a ‘safe’ sector because they comprise companies that sell necessities rather than discretionary goods. Consumers purchase items like groceries and toiletries in a consistent, timely manner, which limits upside but offers predictable, reliable revenue. Other factors that make staples a popular investment during volatile markets include:

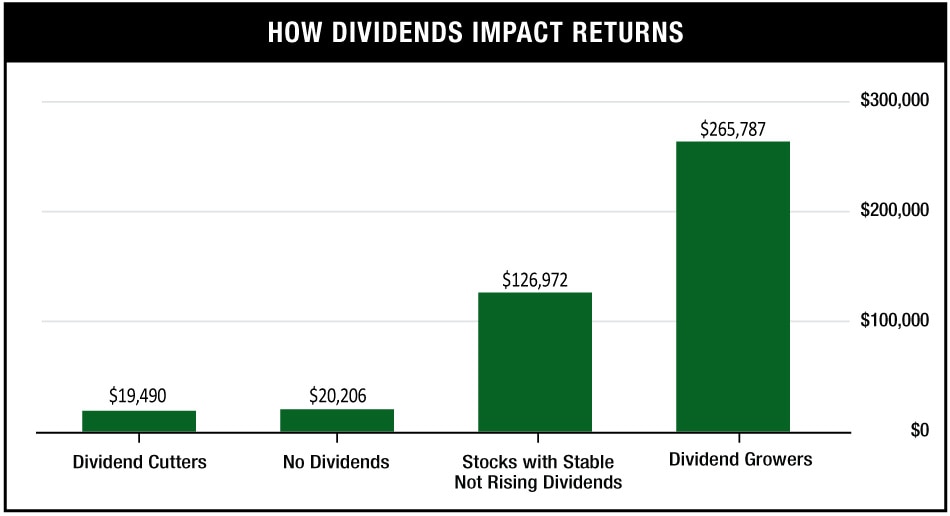

- Steady Dividend Income – Predictable revenue leads to reliable profits, and these companies often return these profits to shareholders as dividends. Reliable earnings are key to dividend safety, and consumer staples stocks are rarely at risk of dividend cuts.

- Pricing Power – The ability to pass rising costs onto consumers is crucial in the age of tariffs and inflation. Consumer staples possess a unique ability to pass on costs since there’s no substitute or ‘trade down’ for life’s necessities. A family can choose to get takeout instead of eating at a steakhouse, but they can’t forgo or substitute toilet paper, toothpaste, or soap.

- Low Beta – Beta is a useful heuristic for measuring a stock’s volatility relative to a broader index or market. Low beta stocks are less volatile than the broader market, and these are the types of stocks institutional investors look for when markets get turbulent. Consumer staples often offer relief from market volatility, preserving investor capital during steep drawdowns.

3 Consumer Staples With Inelastic Product Demand

The following three stocks all have inelastic demand for their products and services, though they aren’t the traditional grocery-store items you might expect. Each company has a foothold in its niche market, offering steady income and strong dividends.

Waste Management: Strong Dividend and Irreplaceable Infrastructure

Whoever coined the phrase “one man’s trash is another man’s treasure” probably didn’t have actual trash in mind, but Waste Management Inc. (NYSE: WM)depends on American households and businesses throwing away tons of stuff every week. But Waste Management’s moat doesn’t come from trash removal as an essential service; it’s the company’s vast network of landfills that gives it a near-monopoly in many of the locations it operates.

Environmental regulations make landfill permitting extremely difficult and time-consuming to obtain, so Waste Management’s hold on market share is as safe as its dividend, which has a 52% dividend payout rate (DPR) and a 22-year history of annual payout increases.

WM shares are also in the midst of a breakout, with the price eclipsing the 200-day simple moving average (SMA) for the first time since last September. The bullish trend actually began in November when the Moving Average Convergence Divergence (MACD) initiated a bullish cross, and now a second cross has confirmed the next leg up in the rally.

British American Tobacco: Deep Value With Premium Dividend

Cigarette smoking may be in secular decline, but British American Tobacco plc (NYSE: BTI)’s pivot to smokeless products like e-cigs, vapes, and nicotine pouches has reinvigorated the company’s revenue in the U.S. But, as with most tobacco companies, the appeal lies in the dividend, and BTI currently yields more than 5% with a 63% DPR. The company has raised payouts for 19 straight years, but the low growth rate means the stock often functions like a bond in bull markets.

In this current bull market, BTI shares have returned nearly 60% in the last 12 months, and the stock could be ready for its next move up after a period of consolidation. A bullish wedge has formed on the chart, with the upper bound forming resistance at the previous all-time high and the lower bound making higher lows.

Traditionally, a new uptrend begins when the stock price breaks above this upper level, and the MACD and Relative Strength Index (RSI) signal that bullish momentum is gathering strength.

Service Corporation International: A Necessary Service That Can’t Be Outsourced

Here’s a company where the clients never actually know when they’re using the service. Service Corporation International Inc. (NYSE: SCI) is the largest provider of funeral and cemetery services in North America, where an aging population faces some unfortunate demographic inevitabilities. If you’re lucky enough to be unfamiliar with this business model, Service Corp accepts payment upfront for future funeral and burial arrangements, as most clients want to offload the burden of ‘deathcare’ from their loved ones before they pass. Pre-payment allows the company to build a large pool of capital that can be deployed in interest-earning vehicles.

SCI’s cash position allows it to sustain a healthy dividend, currently yielding 1.68% with a 36.7% DPR. The dividend has grown at a 10.57% annualized rate over the last five years, and the company has raised the payout for 15 consecutive years. The company also raised its 2025 cash flow guidance to the $915 million to $950 million range during its Q3 earnings report, which should help support another year of payout increases.

Companies like SCI usually don’t offer outsized stock returns. Still, a little capital appreciation on top of a steady dividend is ideal in volatile markets, and the chart here shows some promise. The RSI bounced off the Oversold level in December and has been trending higher ever since, and the share price has now broken through the 50-day and 200-day SMAs for the first time since late October.

7 High-Yield Dividend Stocks You Need to See (Ad)

7 High Yield Dividend Stocks to Buy Now 💰

Love steady payouts? This free report reveals 7 high-yield dividend stocks you need to know about. From Company #3, a tobacco giant innovating with smokeless products, to Company #4, famously known as “The Monthly Dividend Company,” these picks deliver steady income you can count on. PERFECT FOR INCOME-FOCUSED INVESTORS.

More Stories

- Which Semiconductor Equipment Stock Has More Upside in 2026?

- 3 Rare Earth Stocks to Watch Following Washington’s Latest Trade Moves

- Refund From 1933: Trump’s Reset May Create Instant Wealth (Ad)

- Kinder Morgan’s Natural Gas/Dividend Growth Cycle Still in Play

- What to Watch for in Meta’s Earnings: 2026 CapEx and AI Updates

- D-Wave Files $330 Million Shelf: Growth Fuel or Dilution Risk?

- ALHC Stock Surges 400%—Here’s Why the Bulls Aren’t Done

The Night Owl is a financial newsletter that provides in-depth market analysis on stocks of interest to individual investors. Published by MarketBeat and Early Bird Publishing, The Night Owl is delivered around 9:00 PM Eastern Sunday through Thursday. If you give a hoot about the market, The Night Owl is the newsletter for you.

If you need assistance with your account, don’t hesitate to email our U.S. based support team at contact@marketbeat.com.

Unsubscribe

Copyright 2006-2026 MarketBeat Media, LLC. All rights reserved.

345 North Reid Place #620, Sioux Falls, South Dakota 57103. United States..

Today’s Bonus Content: The Top 10 AI Stocks You Need to Know (Click to Opt-In)